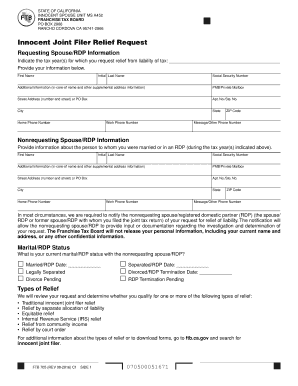

CA FTB 705 2015 free printable template

Show details

Please make a copy of your completed FTB 705 application and Privacy Notice for your records. FTB 705 Request for Innocent Joint Filer Relief is located on the back cover of this booklet. We may ask for additional information. To get forms and more information go to ftb. ca.gov and search for innocent joint filer or call 916. Ca.gov and search for innocent joint filer. For assistance call 916. 845. 7072. Read the Franchise Tax Board FTB privacy notice on PAGE 3. Mail the application and...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 705

Edit your CA FTB 705 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 705 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 705 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 705

How to fill out CA FTB 705

01

Obtain the CA FTB 705 form from the California Franchise Tax Board website.

02

Begin filling out the taxpayer information section with your name, address, and identification number.

03

Provide information about the estate or trust, including its name and tax identification number.

04

Report the income, deductions, and credits according to the instructions provided on the form.

05

Include details of the beneficiaries of the estate or trust.

06

Calculate the total tax due, if applicable.

07

Review all information for completeness and accuracy.

08

Sign and date the form before submission.

09

Submit the completed form by the required deadline, either electronically or by mail.

Who needs CA FTB 705?

01

CA FTB 705 is needed by the fiduciaries of estates or trusts that are required to file California state income tax returns.

02

It is relevant for individuals who are managing an estate or trust with taxable income.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for the California state tax rebate?

Like the federal Earned Income Tax Credit, the California Earned Income Tax Credit (CalEITC) is a tax credit, but available exclusively to Californians — including Individual Tax Identification Number (ITIN) holders. An estimated 3 million California families and individuals qualified for the credit in 2021.

What is FTB on tax return?

The Franchise Tax Board (FTB) is the agency responsible for collecting state personal income taxes in California.

How much is the FTB refund?

Background Married Filling Joint$150,000 or less$700$350$150,001 to $250,000$500$250$250,001 to $500,000$400$200All other individual10 more rows

Who qualifies for FTB refund?

Determine your eligibility You are eligible if you: Filed your 2020 tax return by October 15, 2021 [i] Meet the California adjusted gross income (CA AGI) limits described in the What you may receive section. Were not eligible to be claimed as a dependent in the 2020 tax year.

How do I claim my FTB refund?

Provide us a written statement with supporting documents listing the facts to support your claim. Use one of the following forms to file a reasonable cause claim for refund: Reasonable Cause - Individual and Fiduciary Claim for Refund (FTB 2917) Reasonable Cause - Business Entity Claim for Refund (FTB 2924)

Who qualifies for FTB stimulus?

You may receive this payment if you receive the California Earned Income Tax Credit (CalEITC) or file with an Individual Taxpayer Identification Number (ITIN). The Golden State Stimulus aims to: Support low-income Californians. Help those facing a hardship due to COVID-19.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CA FTB 705?

CA FTB 705 is a form used by the California Franchise Tax Board to report the sale, exchange, or other disposition of California real property.

Who is required to file CA FTB 705?

Individuals, partnerships, corporations, or any other entities that have sold or exchanged California real property are required to file CA FTB 705.

How to fill out CA FTB 705?

Filling out CA FTB 705 involves providing details such as the name and address of the taxpayer, tax identification number, the property description, sale date, amount received, and other relevant details.

What is the purpose of CA FTB 705?

The purpose of CA FTB 705 is to report capital gains or losses from the sale of California real property and to ensure correct state tax computation.

What information must be reported on CA FTB 705?

Information that must be reported on CA FTB 705 includes property details, sales price, cost basis, date of acquisition, date of sale, and any applicable deductions or adjustments.

Fill out your CA FTB 705 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 705 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.