Get the free Charitable Organization Permit Application Form - dcp utah

Show details

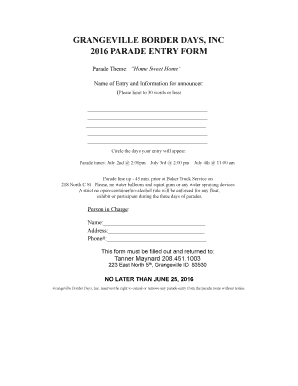

This form is used to apply for a permit allowing charitable organizations to solicit contributions in the state of Utah, including the required identification, financial disclosures, and the organization’s

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable organization permit application

Edit your charitable organization permit application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable organization permit application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charitable organization permit application online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit charitable organization permit application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable organization permit application

How to fill out Charitable Organization Permit Application Form

01

Obtain the Charitable Organization Permit Application Form from the relevant government agency or their website.

02

Read the instructions carefully to ensure you understand the requirements.

03

Fill out the applicant's details including the organization's name, address, and contact information.

04

Provide information about the organization’s mission and the specific charitable activities it will undertake.

05

Attach necessary documentation such as proof of nonprofit status, bylaws, and financial statements.

06

Provide details of any affiliations with other organizations, if applicable.

07

Complete any required background checks or registrations as specified.

08

Review the application for completeness and accuracy.

09

Submit the application along with any required fees to the appropriate agency.

10

Wait for confirmation and follow up if necessary to check the status of the application.

Who needs Charitable Organization Permit Application Form?

01

Any nonprofit organization or charity that wishes to solicit donations or operate as a charity in their jurisdiction.

02

Organizations planning to hold fundraising events or campaigns.

03

Groups seeking tax-exempt status for donations received.

Fill

form

: Try Risk Free

People Also Ask about

How much is the family tax rebate in Arizona?

For eligible taxpayers, the rebate is $250 per dependent under age 17 and $100 per dependent over age 17 as claimed on their 2021 returns. A taxpayer cannot claim more than three dependents, regardless of age.

What is AZ form 321?

How do I start my own charitable foundation? Define your mission statement. Determine whether you want your organization to be a trust or nonprofit corporation. Hire a lawyer and appoint a board of directors. Apply for an Employer Identification Number (EIN). File for tax-exempt status with the IRS.

What is the difference between a nonprofit and a charitable organization?

AZ form 321 Credit for Contributions to Qualifying Charitable Organizations. The maximum QCO credit donation amount for 2023: $421 single, married filing separate or head of household; $841 married filing joint.

What is the working poor tax credit in Arizona?

The Arizona Charitable Tax Credit (formerly known as the Working Poor Tax Credit) is a wonderful way to impact the lives of the many people we help, plus receive a dollar for dollar tax credit, up to $470 for filing single or head of household, or up to $938 for married filing jointly.

What qualifies for Arizona charitable tax credit?

In order to qualify for the Arizona Charitable Tax Credit program and be designated as a Qualified Charitable Organization, an organization must: “provide immediate basic needs to residents of Arizona who receive Temporary Assistance for Needy Families (TANF) benefits, are low income residents of Arizona, or are

What is Arizona form 321?

Complete the appropriate tax form to claim your credit for your gift(s): Arizona Form 321 for gifts to a Qualified Charitable Organization, like A New Leaf.

How do I register a charity foundation in USA?

A party, committee, association, fund or other organization organized and operated primarily for the purpose of directly or indirectly accepting contributions or making expenditures, or both, for an exempt function.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

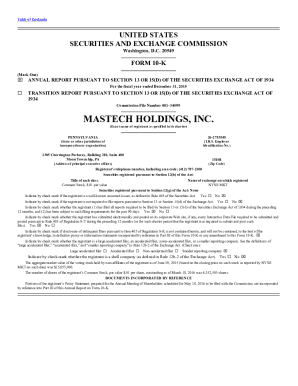

What is Charitable Organization Permit Application Form?

The Charitable Organization Permit Application Form is a document that organizations must submit to the relevant regulatory authority to obtain permission to solicit donations and operate as a charitable entity.

Who is required to file Charitable Organization Permit Application Form?

Any organization that intends to operate as a charitable entity and engage in fundraising activities is required to file the Charitable Organization Permit Application Form.

How to fill out Charitable Organization Permit Application Form?

To fill out the Charitable Organization Permit Application Form, provide accurate information including the organization's name, purpose, address, and details about its fundraising activities, along with any required supporting documentation.

What is the purpose of Charitable Organization Permit Application Form?

The purpose of the Charitable Organization Permit Application Form is to ensure that organizations comply with state regulations governing charitable activities and to protect the public from fraudulent fundraising practices.

What information must be reported on Charitable Organization Permit Application Form?

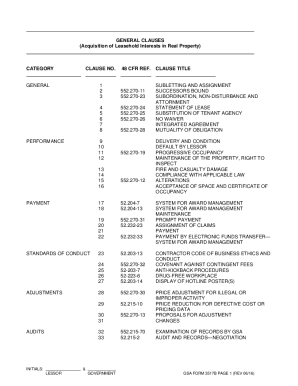

The Charitable Organization Permit Application Form typically requires the reporting of information such as the organization's legal structure, mission statement, planned fundraising activities, estimated budget, and contact details.

Fill out your charitable organization permit application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Organization Permit Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.