MO MO-PTC 2015 free printable template

Show details

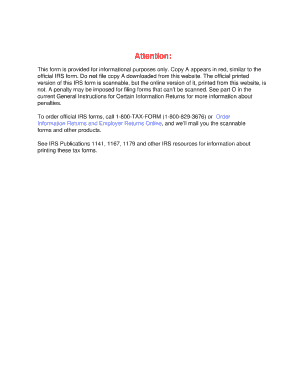

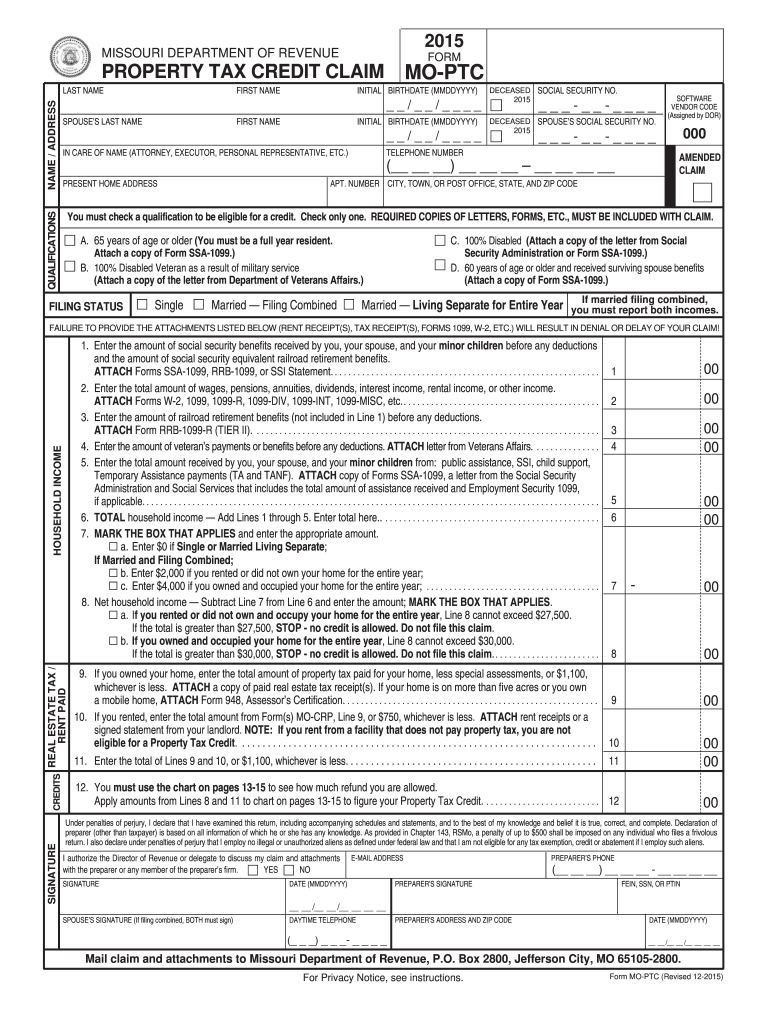

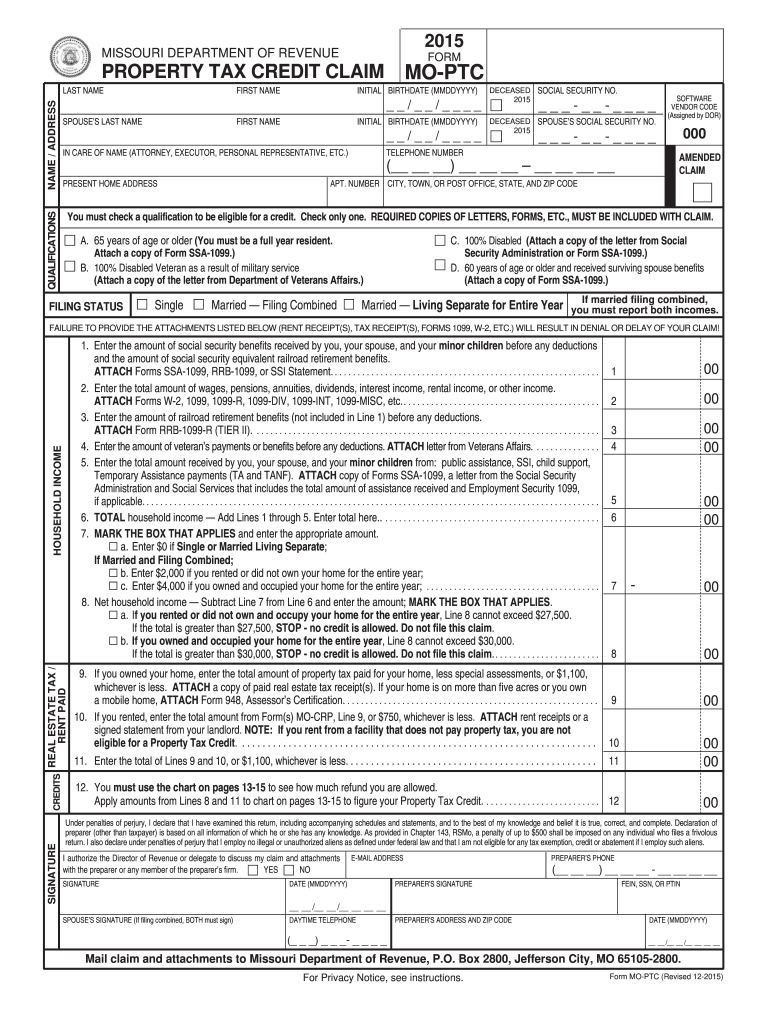

O. Box 2800 Jefferson City MO 65105-2800. For Privacy Notice see instructions. Form MO-PTC Revised 12-2015 Missouri Department of Revenue Certification of Rent Paid for 2015 Form MO-CRP Failure to provide landlord information will result in denial or delay of your claim. 1. MISSOURI DEPARTMENT OF REVENUE FORM PROPERTY TAX CREDIT CLAIM FIRST NAME MO-PTC INITIAL BIRTHDATE MMDDYYYY // SPOUSE S LAST NAME IN CARE OF NAME ATTORNEY EXECUTOR PERSONAL REPRESENTATIVE ETC. DECEASED SOCIAL SECURITY NO....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO MO-PTC

Edit your MO MO-PTC form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO MO-PTC form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MO MO-PTC online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MO MO-PTC. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO MO-PTC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO MO-PTC

How to fill out MO MO-PTC

01

Gather all necessary personal information, including your full name, address, and social security number.

02

Obtain records of your income, including W-2 forms, 1099 forms, or any other relevant documentation.

03

Visit the official Missouri Department of Revenue website or obtain a physical copy of the MO MO-PTC form.

04

Carefully read the instructions provided with the form to understand eligibility criteria.

05

Complete the form by entering all required information in the designated fields.

06

Double-check the accuracy of your entries to avoid errors.

07

Sign and date the form as required.

08

Submit the completed form to the appropriate address provided on the form or electronically as allowed.

Who needs MO MO-PTC?

01

Individuals who have paid property taxes on their primary residence in Missouri.

02

Homeowners who meet specific income qualifications.

03

Residents seeking to claim a property tax credit or reimbursement.

Fill

form

: Try Risk Free

People Also Ask about

Can I file Mo-PTC online?

If you are eligible for a Property Tax Credit and required to file federal and Missouri (Form MO-1040) income tax forms, you are eligible to e-file.

What is a mo-ptc form?

Form MO-PTC - 2022 Property Tax Credit Claim.

How to file Missouri property tax credit?

How do I file for the credit? If you are required to file a Missouri Individual Income Tax Return, you must use Form MO-1040 with a Property Tax Schedule (MO-PTS) attached. If you are not required to file a Missouri Individual Income Tax Return, then you may file the Missouri Property Tax Credit Claim (MO-PTC).

How far back can I file a Mo-PTC?

$29,200 if rented or owned less than full year; $34,000 if owned & occupied full year. The MO-PTC is generally filed with the income tax return, but may be filed at any time during the year for up to three years back. Example: In 2022 you may file for 2019, 2020 & 2021.

What is the Missouri PTC refund?

The Missouri Property Tax Credit Claim gives back a portion of the rent or real estate tax paid for that year by persons 65 and older, or persons 18-64 that receive SSI, SSD, or Veterans Disability. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MO MO-PTC to be eSigned by others?

Once your MO MO-PTC is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete MO MO-PTC online?

pdfFiller has made it simple to fill out and eSign MO MO-PTC. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I complete MO MO-PTC on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your MO MO-PTC. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is MO MO-PTC?

MO MO-PTC is a tax form used in Missouri for reporting and remitting the prepaid tuition contributions.

Who is required to file MO MO-PTC?

Individuals or entities making prepaid tuition contributions in Missouri are required to file the MO MO-PTC.

How to fill out MO MO-PTC?

To fill out MO MO-PTC, you need to provide personal information, report the amount of contributions, and certify that the information is accurate.

What is the purpose of MO MO-PTC?

The purpose of MO MO-PTC is to facilitate the reporting of prepaid tuition contributions and ensure compliance with Missouri tax laws.

What information must be reported on MO MO-PTC?

MO MO-PTC requires reporting of the contributor's name, Social Security number, the amount of contributions made, and the beneficiary's details.

Fill out your MO MO-PTC online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO MO-PTC is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.