Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

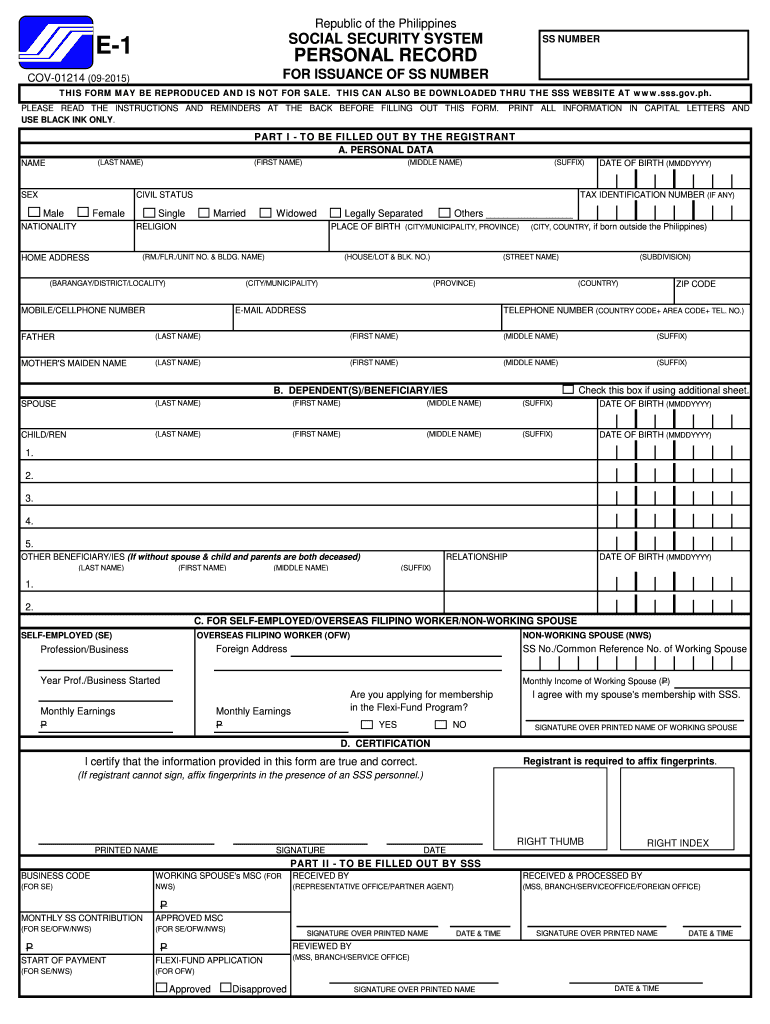

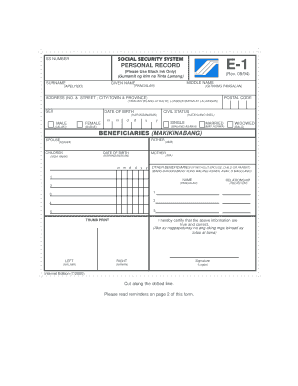

What is sss e1 form?

The SSS E1 form is an application form used to register as a self-employed individual in the Philippines. The form is used to register for Social Security System (SSS) membership and to apply for SSS benefits, such as sickness, maternity, disability, and death benefits.

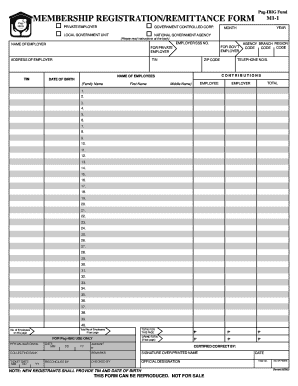

Who is required to file sss e1 form?

The SSS E1 Form is an Employer Report of Employee Information and Contributions that needs to be submitted by employers to the Social Security System (SSS). This form is used to report the basic information of newly-hired employees and their monthly contributions to the SSS.

How to fill out sss e1 form?

1. On the first page of the SSS E1 form, fill out your name, address, date of birth, and SSS number.

2. On the second page, fill out your employer's name and address, your tax identification number, the date you began working, and your monthly salary.

3. On the third page, fill out your bank details, including the bank name, branch code, account number, and other required information.

4. On the fourth page, indicate your choice of contribution rate, and the amount you wish to contribute.

5. On the fifth page, sign and date the form, and submit it to the Social Security System.

What is the purpose of sss e1 form?

The SSS E1 Form, also known as the Member's Data Change Request Form, is used to update the member's personal information in the database of the Social Security System (SSS). It is used to update information such as name, address, civil status, date of birth, gender, email address, and other pertinent information.

What information must be reported on sss e1 form?

The information required to be reported on an SSS Form E1 includes: employer's name and address, employer's SSS number, employer's type of business, name and address of each employee, employee's SSS number, employee's date of birth, employee's sex, employee's monthly salary and other compensation, employee's status as a regular or voluntary member, employee's date of coverage, and employee's total contributions for the month.

How can I send form e1 sss to be eSigned by others?

Once your sss e 1 fill is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I get sss e1 pdf?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific sss e 1 fillable and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I sign the sss e1 personal form electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your sss e 1 form get in seconds.

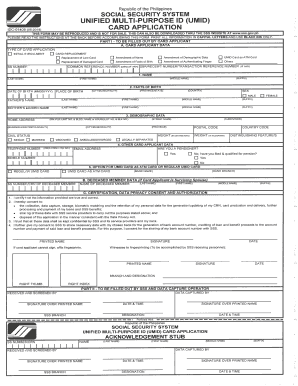

What is PH SSS E-1?

PH SSS E-1 is a form used by employees and employers in the Philippines for the registration of employees in the Social Security System (SSS).

Who is required to file PH SSS E-1?

Employers who hire new employees and individuals who wish to register themselves for social security benefits are required to file PH SSS E-1.

How to fill out PH SSS E-1?

To fill out PH SSS E-1, you must provide the necessary personal information of the employee, including their name, date of birth, address, and other relevant details, and submit it to the SSS office.

What is the purpose of PH SSS E-1?

The purpose of PH SSS E-1 is to facilitate the registration of employees under the SSS, ensuring they have access to various social security benefits.

What information must be reported on PH SSS E-1?

The PH SSS E-1 form must report information such as the employee's full name, date of birth, address, contact details, and other personal identifiers for accurate registration.