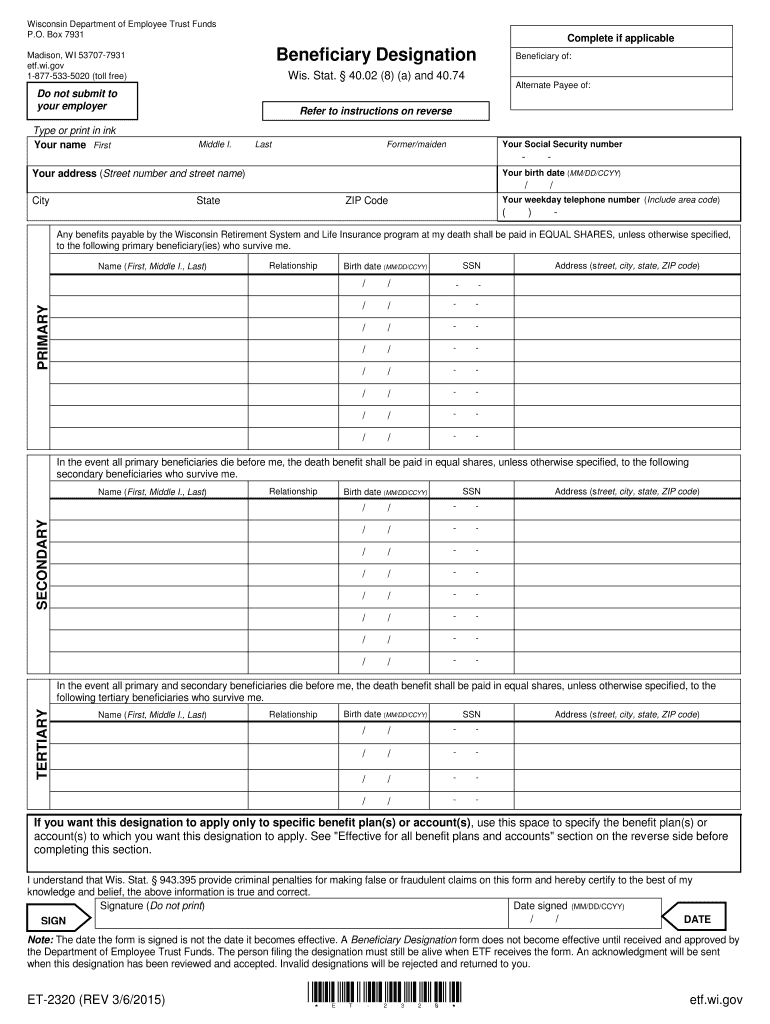

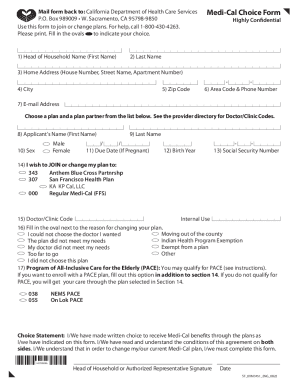

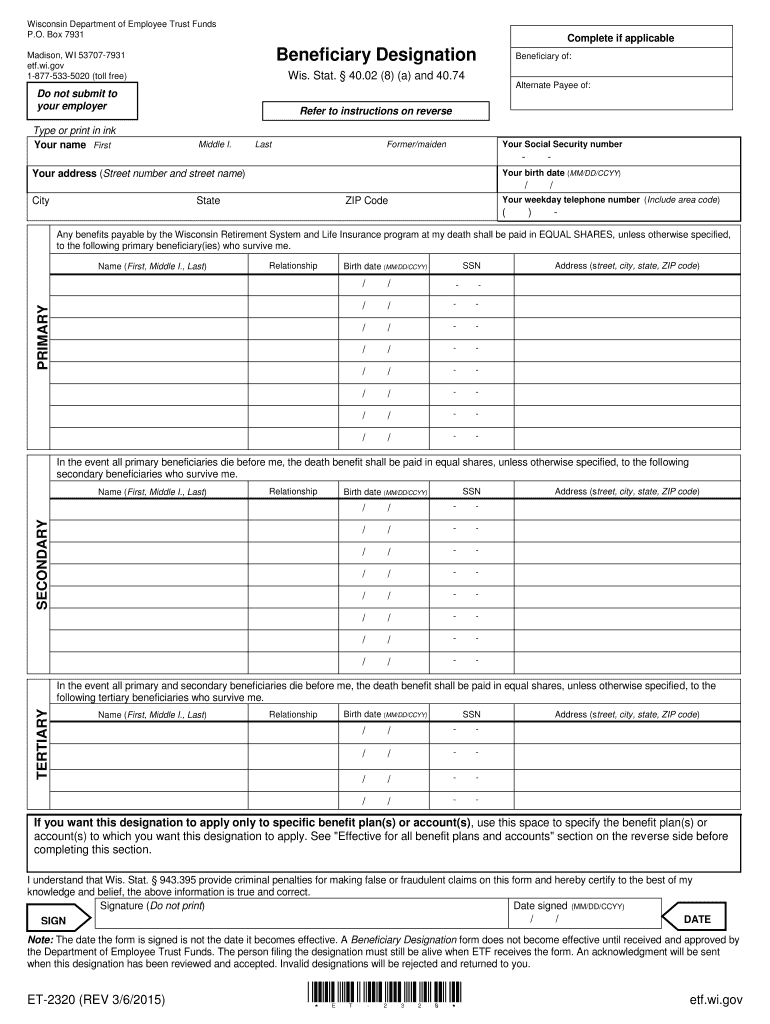

WI ET-2320 2015 free printable template

Get, Create, Make and Sign WI ET-2320

Editing WI ET-2320 online

Uncompromising security for your PDF editing and eSignature needs

WI ET-2320 Form Versions

How to fill out WI ET-2320

How to fill out WI ET-2320

Who needs WI ET-2320?

Instructions and Help about WI ET-2320

Hey folks it's me again I wanted to show you the little laser technology that I bought off of eBay we got a recommendation from some people on in the sphere that said oh you can find one for like 15 20 bucks so have to lose, so I wanted to show you the little laser technology there it is bus came in put the battery, and already it's a little 9-volt doohickey you'll notice it's got a little laser here you can tease your dog with it when you're done measuring your motor but you basically you hold down the test 0 RPM you take one of these little reflective strips cut it off and attach it to whatever spinning you want to measure, and then I'm going to wave it around I think it needs a little while to pick up the speed but yeah kind of cool little thing good for measuring the RPM of a motor in order to find out what kind of gearing you need or revolt what speed you're going to get so good times you know 15 bucks not such a bad deal I hope you turn I've turned you on to something cool, and I'll continue to make little videos show it off this cheap fun electric stuff

People Also Ask about

Are beneficiary forms required?

How do I set up a beneficiary?

How do I fill out a beneficiary form?

What is the purpose of a beneficiary form?

Do you need to fill out a beneficiary form?

What form do I need to name a beneficiary?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit WI ET-2320 on a smartphone?

Can I edit WI ET-2320 on an iOS device?

How do I complete WI ET-2320 on an Android device?

What is WI ET-2320?

Who is required to file WI ET-2320?

How to fill out WI ET-2320?

What is the purpose of WI ET-2320?

What information must be reported on WI ET-2320?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.