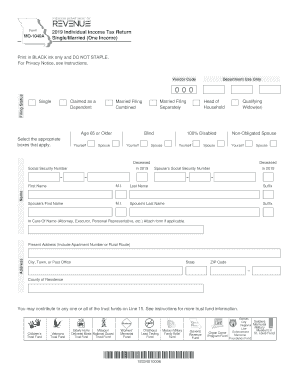

MO Form MO-1040A 2015 free printable template

Show details

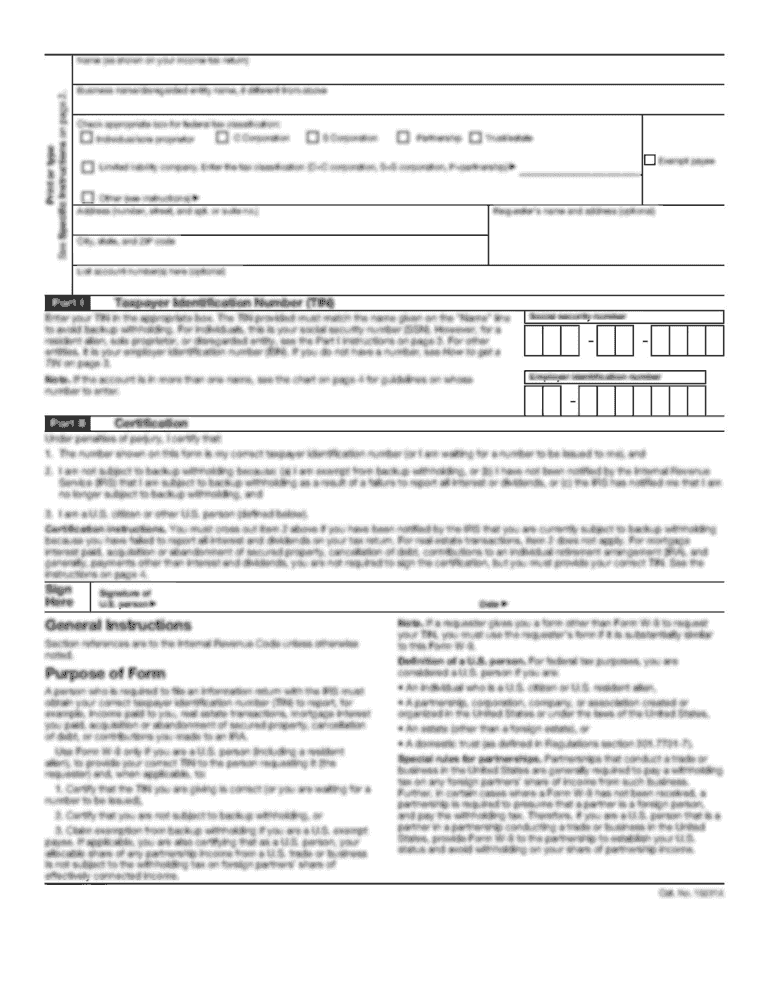

MISSOURI INDIVIDUAL INCOME TAX RETURN SINGLE/MARRIED (INCOME FROM?ONE?SPOUSE) SHORT FORM LAST NAME FIRST NAME 2015 FORM MO-1040A MIDDLE INITIAL DECEASED SOCIAL SECURITY NUMBER 2015 — SPOUSE S LAST

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO Form MO-1040A

Edit your MO Form MO-1040A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO Form MO-1040A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MO Form MO-1040A online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MO Form MO-1040A. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO Form MO-1040A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO Form MO-1040A

How to fill out MO Form MO-1040A

01

Gather your financial documents, including W-2s, 1099s, and any other income statements.

02

Start with the personal information section. Fill out your name, address, and Social Security number.

03

Indicate your filing status by checking the appropriate box.

04

Report your total income by adding up all sources of income from your documents.

05

Enter any deductions you qualify for and subtract them from your total income to calculate your taxable income.

06

Calculate your state tax owed based on your taxable income using the provided tax tables.

07

Fill out any additional credits you may qualify for to reduce your tax liability.

08

Include any payments made, such as withheld taxes, and determine if you owe additional taxes or are due a refund.

09

Sign and date the form before submitting it.

Who needs MO Form MO-1040A?

01

Individuals who have earned income and are residents of Missouri.

02

Taxpayers who are eligible for a short form to report their income and claim deductions.

03

People who do not need to file the longer MO Form 1040 and prefer a simplified tax return process.

Fill

form

: Try Risk Free

People Also Ask about

Is there a mo 1040 short form?

The Individual Income Tax Return (Form MO-1040) is Missouri's long form. It is a universal form that can be used by any individual taxpayer. If you do not have any of the special filing situations described below and you choose to file a paper tax return, try filing a short form (Form MO-1040A).

Who should use 1040A?

Form 1040-A: U.S. Individual Tax Return For instance, if you couldn't use Form 1040-EZ because you had dependents to claim, you would have been able to use 1040A if: You file as single, married filing jointly or separately, qualifying surviving spouse, or head of household. Your taxable income was less than $100,000.

Is a 1040A and 1040 the same thing?

The IRS Form 1040A is one of three forms you can use to file your federal income tax return. Form 1040A is a shorter version of the more detailed Form 1040, but is more complex than the simple 1040EZ form.

What is the difference between 1040 and 1040A?

The simplest IRS form is the Form 1040EZ. The 1040A covers several additional items not addressed by the EZ. And finally, the IRS Form 1040 should be used when itemizing deductions and reporting more complex investments and other income. Here are a few general guidelines on which form to use.

Does Missouri use 1040 or 1040A?

The Missouri income tax form is pretty easy to fill out once you have calculated your federal taxes, because the Missouri form uses numbers from the federal 1040. In Missouri, both U.S. residents and nonresidents use the same forms. If you are single or married with one income, you can probably use the MO-1040A.

What is a 1040A tax form?

Reporting tax, credits and payments on Form 1040A Once you calculate your tax, Form 1040A allows you to claim a limited number of tax credits such as for child and dependent care expenses, child tax credit, the credit for the elderly or disabled and education tax credits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my MO Form MO-1040A directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your MO Form MO-1040A and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I modify MO Form MO-1040A without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including MO Form MO-1040A, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I sign the MO Form MO-1040A electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your MO Form MO-1040A in minutes.

What is MO Form MO-1040A?

MO Form MO-1040A is a Missouri state tax form used for filing individual income taxes for residents who meet specific criteria, allowing for a simplified reporting of income and deductions.

Who is required to file MO Form MO-1040A?

Individuals who are residents of Missouri and have a taxable income below a certain threshold are required to file MO Form MO-1040A, along with those who wish to claim specific credits or deductions available on this form.

How to fill out MO Form MO-1040A?

To fill out MO Form MO-1040A, taxpayers should gather their income information, complete personal identification sections, report their income on the appropriate lines, and claim any deductions or credits as applicable before signing and submitting the form.

What is the purpose of MO Form MO-1040A?

The purpose of MO Form MO-1040A is to facilitate the filing of state income taxes for eligible Missouri residents in a simplified manner, ensuring that taxpayers can report their income and claim allowable deductions easily.

What information must be reported on MO Form MO-1040A?

MO Form MO-1040A requires taxpayers to report personal information, total income, adjustments to income, standard deductions or itemized deductions, and any tax credits they are eligible for.

Fill out your MO Form MO-1040A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO Form MO-1040a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.