TP-1568.6 2013-2026 free printable template

Show details

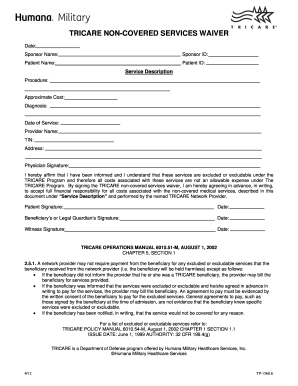

TRI CARE UNCOVERED SERVICES WAIVER Date: Sponsor Name: Sponsor ID: Patient Name: Patient ID: Service Description Procedure: Approximate Cost: Diagnosis: Date of Service: Provider Name: TIN: Address:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TP-15686

Edit your TP-15686 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TP-15686 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TP-15686 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit TP-15686. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TP-1568.6 Form Versions

Version

Form Popularity

Fillable & printabley

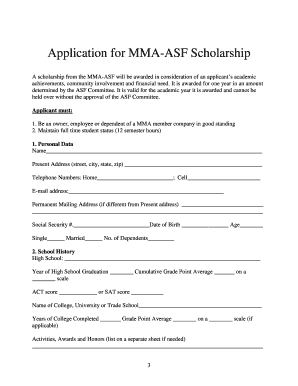

How to fill out TP-15686

How to fill out TP-1568.6

01

Obtain the TP-1568.6 form from the official tax website or local tax office.

02

Fill out your name and address at the top of the form.

03

Enter your Social Security Number or Employer Identification Number.

04

Complete the sections regarding your income and deductions.

05

Review the instructions for any specific requirements related to your situation.

06

Double-check all entries for accuracy before signing.

07

Submit the completed form by the specified deadline.

Who needs TP-1568.6?

01

Individuals or businesses seeking tax credits or deductions in their jurisdiction.

02

Taxpayers who have specific income types or expenses that qualify for reporting on TP-1568.6.

Fill

form

: Try Risk Free

People Also Ask about

What is a notice of non coverage with TRICARE?

The notice of noncoverage will state whether your doctor or the RRA agrees with the hospital's decision that TRICARE should no longer pay for your hospital care. review your case before a notice of noncoverage is issued.

What are non covered services for TRICARE?

In general, TRICARE excludes services and supplies that are not medically or psychologically necessary for the diagnosis or treatment of a covered illness (including mental disorder), injury, or for the diagnosis and treatment of pregnancy or well-child care.

What is a TRICARE waiver?

This Waiver allows a network (contracted) provider to collect billed charges for services denied as “non-covered” from a USFHP member when the beneficiary has agreed, in writing, to waive his or her balance-billing protection.

Can you lose TRICARE benefits?

You may lose TRICARE coverage for a number of reasons. For instance: Separating from the service. Loss of eligibility due to age.

What does TRICARE non-network mean?

A non-network provider is one who is authorized to provide care to TRICARE beneficiaries, but hasn't signed an agreement with TRICARE. For non-network providers, keep the following in mind: They have no formal agreement with your TRICARE contractor. They have an option to file claims with TRICARE for you.

What is a non covered service waiver for TRICARE?

This Waiver allows a network (contracted) provider to collect billed charges for services denied as “non-covered” from a USFHP member when the beneficiary has agreed, in writing, to waive his or her balance-billing protection.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send TP-15686 to be eSigned by others?

To distribute your TP-15686, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for the TP-15686 in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your TP-15686.

How do I fill out the TP-15686 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign TP-15686 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is TP-1568.6?

TP-1568.6 is a specific tax form used in certain jurisdictions to report information regarding tax credits.

Who is required to file TP-1568.6?

Taxpayers who are eligible for specific tax credits and deductions that need to be reported are required to file TP-1568.6.

How to fill out TP-1568.6?

To fill out TP-1568.6, taxpayers must provide their personal information, report their income, claim any available credits, and follow the instructions provided with the form.

What is the purpose of TP-1568.6?

The purpose of TP-1568.6 is to collect necessary information from taxpayers to ensure compliance with tax regulations and to assess eligibility for tax credits.

What information must be reported on TP-1568.6?

Information that must be reported on TP-1568.6 includes personal identification details, income amounts, and specific tax credit claims.

Fill out your TP-15686 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TP-15686 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.