OH IT 1040 2015 free printable template

Show details

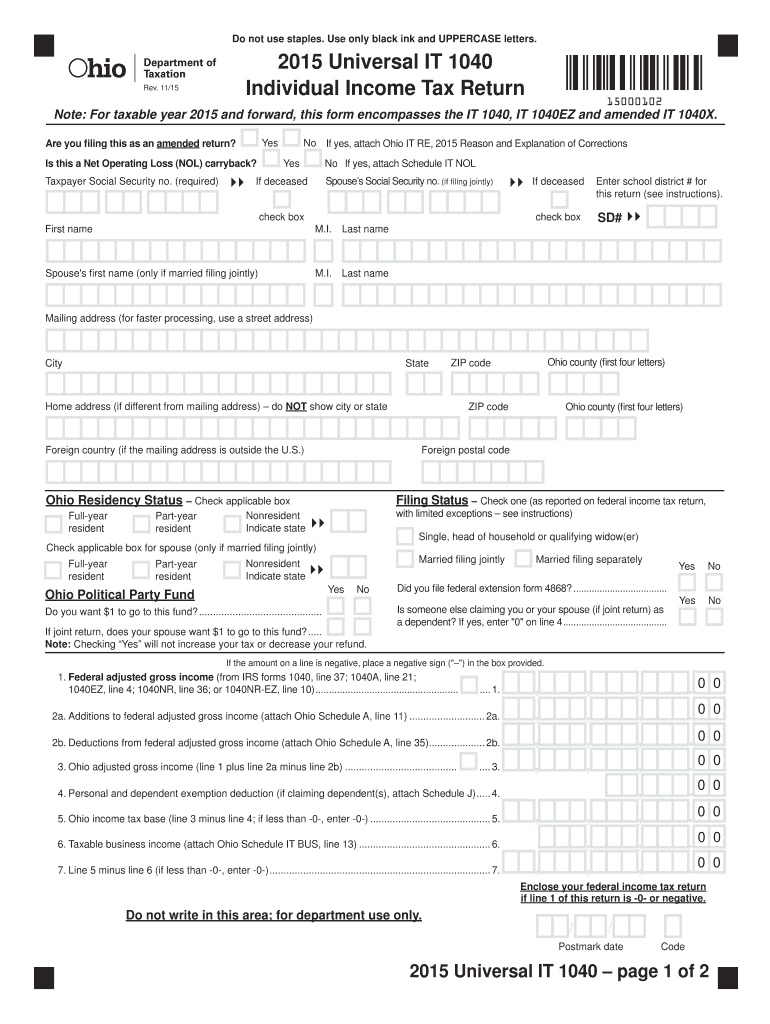

38. 39. Motion picture production credit. 39. 40. Financial Institutions Tax FIT credit. 40. 41. Total refundable credits add lines 36 through 40 enter here and on Ohio IT 1040 line 16. 41. 2015 Schedule J Dependents Claimed on the Universal IT 1040 Return Do not list below the primary filer and/or spouse reported on Ohio IT 1040. 41. 2015 Schedule J Dependents Claimed on the Universal IT 1040 Return Do not list below the primary filer and/or spouse reported on Ohio IT 1040. Use this schedule...to claim dependents. If you have more than 15 dependents complete additional copies of this schedule and include them with your income tax return. Abbreviate the Dependent s relationship to you below if there are not enough boxes to spell it out completely. Do not use staples. Use only black ink and UPPERCASE letters. 2015 Universal IT 1040 Individual Income Tax Return Rev. 11/15 Note For taxable year 2015 and forward this form encompasses the IT 1040 IT 1040EZ and amended IT 1040X. Yes Are...you filing this as an amended return Is this a Net Operating Loss NOL carryback Taxpayer Social Security no. required No If yes attach Ohio IT RE 2015 Reason and Explanation of Corrections Spouse s Social Security no. Taxable Year Use the IT 40XP payment voucher if you are submitting a payment for an amended IT 1040 income tax return. for an original IT 1040 income tax return. for Amended Returns IT RE 15270102 2015 Ohio IT RE Reason and Explanation of Corrections Note For amended individual...return only Please complete the Universal IT 1040 checking the amended return box and attach this form with documentation to support any adjustments to line items on the return. Reason s Net operating loss carryback IMPORTANT Be sure to complete and attach Ohio IT NOL Net Operating Loss Carryback Schedule available at tax. Do not use staples. Use only black ink and UPPERCASE letters. 2015 Universal IT 1040 Individual Income Tax Return Rev* 11/15 Note For taxable year 2015 and forward this...form encompasses the IT 1040 IT 1040EZ and amended IT 1040X. Yes Are you filing this as an amended return Is this a Net Operating Loss NOL carryback Taxpayer Social Security no. required No If yes attach Ohio IT RE 2015 Reason and Explanation of Corrections Spouse s Social Security no. if filing jointly If deceased check box Enter school district for this return see instructions. SD First name M. I. Last name Spouse s first name only if married filing jointly M. I. Last name Mailing address for...faster processing use a street address City State Home address if different from mailing address do NOT show city or state Foreign country if the mailing address is outside the U*S* Part-year resident ZIP code Ohio county first four letters Foreign postal code Ohio Residency Status Check applicable box Full-year Filing Status Check one as reported on federal income tax return with limited exceptions see instructions Indicate state Single head of household or qualifying widow er Check...applicable box for spouse only if married filing jointly Married filing jointly Ohio Political Party Fund No Do you want 1 to go to this fund.

pdfFiller is not affiliated with any government organization

Instructions and Help about OH IT 1040

How to edit OH IT 1040

How to fill out OH IT 1040

Instructions and Help about OH IT 1040

How to edit OH IT 1040

To edit the OH IT 1040 tax form, first download the latest version of the form from authorized state resources. Use a PDF editing tool, such as pdfFiller, to make necessary changes. Ensure all data complies with state regulations. Save the edited form securely for your records.

How to fill out OH IT 1040

Filling out the OH IT 1040 tax form requires attention to detail and accurate financial records. Follow these steps to complete the form:

01

Gather all necessary documentation, including taxpayer identification and income records.

02

Enter your personal information in the designated sections, such as name, address, and Social Security Number.

03

Report all sources of income accurately following the provided guidelines.

04

Calculate tax liability based on instructions included with the form.

05

Review the form thoroughly to prevent errors before submission.

About OH IT previous version

What is OH IT 1040?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About OH IT previous version

What is OH IT 1040?

OH IT 1040 is the State of Ohio's individual income tax return form. Taxpayers in Ohio use this form to report their income and calculate their state tax obligations. This form is specifically designed for individual filers and must be filed annually to comply with state tax laws.

What is the purpose of this form?

The purpose of the OH IT 1040 tax form is to facilitate the reporting of individual income to the Ohio Department of Taxation. It allows the state to assess the taxpayer’s liability and collect the appropriate taxes based on income earned during the tax year.

Who needs the form?

Any resident or non-resident individual who earns income in Ohio must file the OH IT 1040. This includes employees, self-employed individuals, and anyone receiving income from Ohio sources. Certain exemptions exist, depending on income thresholds and other criteria.

When am I exempt from filling out this form?

You may be exempt from filing the OH IT 1040 if your income is below the threshold set by the Ohio Department of Taxation. Additionally, certain retirees and individuals with specific sources of income might qualify for exemptions. Always verify with current state guidelines or consult a tax professional.

Components of the form

The OH IT 1040 consists of several key components, including personal information fields, income categories, tax calculation sections, and signature lines. Each section is crucial for accurate reporting and must be filled out completely. Ensure you review each component for completeness and accuracy.

Due date

The OH IT 1040 must typically be submitted by April 15 following the end of the tax year, with extensions available upon request. Adhering to this timeline is essential to avoid late fees or penalties.

What payments and purchases are reported?

The OH IT 1040 requires the reporting of all sources of income, including wages, interest, dividends, and business income. Certain deductible expenses can also be reported to potentially reduce taxable income. All items must align with applicable Ohio tax laws.

How many copies of the form should I complete?

You typically only need to complete one copy of the OH IT 1040. However, it is advisable to retain a personal copy for your records after submission. If submitting through various methods, ensure compliance with specific requirements.

What are the penalties for not issuing the form?

Failure to file the OH IT 1040 by the due date can result in significant penalties. Late fees may apply, and interest will accrue on any unpaid taxes. Additionally, continued non-compliance may lead to further legal action from the Ohio Department of Taxation.

What information do you need when you file the form?

When filing the OH IT 1040, you will need personal identification information, all forms of income documentation, and records of any deductions or credits you plan to claim. Ensure all information is accurate to avoid issues with the Ohio Department of Taxation.

Is the form accompanied by other forms?

The OH IT 1040 may require accompanying schedules or specific forms, such as schedules detailing income sources or deductions. Always refer to the official guidelines provided with the form for proper documentation accompanying the filing.

Where do I send the form?

The completed OH IT 1040 form should be mailed to the Ohio Department of Taxation at the address specified in the form instructions. If filing electronically, ensure compliance with provided e-filing guidelines for successful submission.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

love learning everything. Problem with sending multiple pages in one email to have signed. Problems with getting the signature from the recepient because the codes don't work consistently.

I am selling my own piece of real estate and this has been awesome for the necessary forms.

See what our users say