WI F-82064 2014 free printable template

Show details

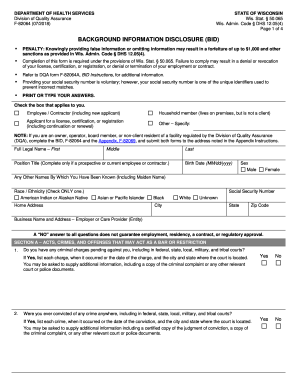

DEPARTMENT OF HEALTH SERVICES Division of Enterprise Services F-82064 (02/2014) STATE OF WISCONSIN Chapters 48.685 and 50.065, Wis. Stats. DHS 12.05(4), Wis. Admin. Code BACKGROUND INFORMATION DISCLOSURE

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI F-82064

Edit your WI F-82064 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI F-82064 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI F-82064 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit WI F-82064. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI F-82064 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI F-82064

How to fill out WI F-82064

01

Start by downloading the WI F-82064 form from the official website or obtain a physical copy.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill out your personal information at the top of the form, including your name, address, and contact details.

04

Provide the necessary details regarding your income and the source of that income as instructed.

05

List any dependents you are claiming and provide their information as required.

06

Review any additional questions or sections related to specific eligibility requirements.

07

Sign and date the form at the designated area to affirm your information is accurate.

08

Submit the completed form either electronically or by mailing it to the appropriate address as indicated in the instructions.

Who needs WI F-82064?

01

Individuals seeking assistance with their financial situation or needing to verify their eligibility for certain programs.

02

People applying for state benefits in Wisconsin that require proof of income or household composition.

Fill

form

: Try Risk Free

People Also Ask about

What is the monthly income limit for food stamps in Wisconsin?

Who is eligible for FoodShare Wisconsin? Household Size*Maximum Income Level (Per Year)1$29,1602$39,4403$49,7204$60,0004 more rows

What is forward health in Wisconsin?

Its purpose is to encourage people to make plans for how they will meet their future long-term care needs.

What is the highest income to qualify for SNAP?

Your net income is your gross income minus any allowable deductions. And assets are "countable resources" like cash, money in a bank account, and certain vehicles. For fiscal year 2023 (Oct. 1, 2022 – Sept. 30, 2023), a two-member household with a net monthly income of $1,526 (100% of poverty) might qualify for SNAP.

Is ForwardHealth and BadgerCare the same thing?

ForwardHealth supports BadgerCare Plus HMO and Medicaid SSI HMO enrollee rights regarding the confidentiality of health care records. ForwardHealth has specific standards regarding the release of an HMO or SSI HMO enrollee's billing information or medical claim records.

How is food stamps calculated in Wisconsin?

Net Income Limits SNAP benefit amounts are based on a household's net income: in general $100 more in net income = $30 less in benefits. Households with an elderly or disabled member only have to meet this test if they did not pass the Gross Income test above. All other households do not have to meet this test.

How much will I get in food stamps in Wisconsin?

Effective October 1, 2022, through September 30, 2023: Household size*200% FPL Gross Income LimitMaximum Allotment1$2,266$2812$3,052$5163$3,840$7404$4,626$9397 more rows • Nov 22, 2022

What does DHS mean in medical terms?

About the Department of Health Services (DHS)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my WI F-82064 in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your WI F-82064 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send WI F-82064 to be eSigned by others?

When you're ready to share your WI F-82064, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit WI F-82064 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as WI F-82064. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is WI F-82064?

WI F-82064 is a tax form used in Wisconsin for reporting certain financial information related to income and withholding.

Who is required to file WI F-82064?

Individuals or businesses that have specific tax obligations in Wisconsin, such as employers withholding income tax from employees, are required to file WI F-82064.

How to fill out WI F-82064?

To fill out WI F-82064, gather the necessary financial documentation, provide accurate information on income and withholding amounts, and follow the instructions provided with the form carefully before submitting it.

What is the purpose of WI F-82064?

The purpose of WI F-82064 is to facilitate the reporting of income and withholding taxes to ensure compliance with Wisconsin tax laws.

What information must be reported on WI F-82064?

WI F-82064 requires reporting information such as the total income earned, the amount of taxes withheld, the names and identification numbers of employees, and other relevant financial details.

Fill out your WI F-82064 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI F-82064 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.