Get the free Subchapter V Small Business Debtor's Plan of Reorganization or Liquidation 2-19-20 f...

Show details

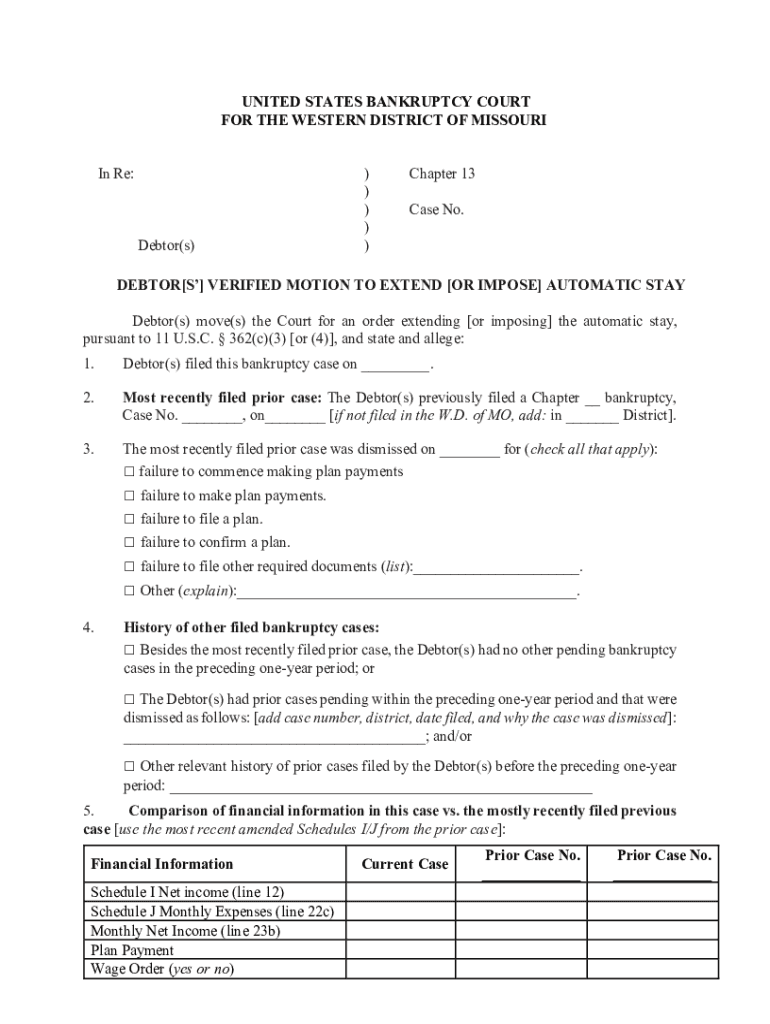

UNITED STATES BANKRUPTCY COURT FOR THE WESTERN DISTRICT OF MISSOURI In Re:Debtor(s))) )) )Chapter 13 Case No. DEBTOR[S] VERIFIED MOTION TO EXTEND [OR IMPOSE] AUTOMATIC STAY Debtor(s) move(s) the Court

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign subchapter v small business

Edit your subchapter v small business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your subchapter v small business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing subchapter v small business online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit subchapter v small business. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out subchapter v small business

How to fill out subchapter v small business

01

To fill out subchapter V small business, follow these steps:

02

Verify eligibility: Ensure that the business meets the criteria for subchapter V small business, such as having total debts below a certain threshold and being primarily engaged in commercial or business activities.

03

Obtain necessary documents: Gather all required documents, including financial statements, tax returns, and a list of creditors and their claims.

04

Consult an attorney: It is recommended to seek legal advice to understand the implications and requirements of subchapter V small business.

05

Complete the necessary forms: Fill out the necessary forms, such as the Official Form 201, which is the voluntary petition for subchapter V small business.

06

Submit the forms: File the completed forms with the appropriate bankruptcy court.

07

Attend required meetings: Participate in the mandatory meeting of creditors and any other hearings or meetings scheduled by the bankruptcy court.

08

Develop a reorganization plan: Work with your attorney to develop a reorganization plan that outlines how the business intends to address its debts and achieve financial stability.

09

Obtain court approval: Present the reorganization plan to the bankruptcy court and obtain approval.

10

Adhere to the plan: Once the plan is approved, follow it diligently and make the required payments as outlined.

11

Monitor progress: Regularly review the financial progress of the business to ensure ongoing compliance with the subchapter V small business requirements and the reorganization plan.

Who needs subchapter v small business?

01

Subchapter V small business is beneficial for several groups of individuals or businesses, including:

02

- Small businesses struggling with debt: If a small business is facing financial difficulties and has accumulated debts that it cannot pay off, subchapter V small business provides a potential solution for debt restructuring and reorganization.

03

- Entrepreneurs seeking to save their business: Subchapter V small business allows entrepreneurs to maintain control of their business and develop a reorganization plan to address their debts, rather than going through liquidation or closure.

04

-Creditors: Creditors who are owed money by a small business may benefit from subchapter V small business, as it offers a structured process for the repayment of debts and may increase the likelihood of receiving payment.

05

- Employees: Employees of a struggling small business may benefit from subchapter V small business, as it provides an opportunity for the business to restructure and potentially continue operations, thus preserving jobs.

06

- Local economies: Subchapter V small business can have positive effects on local economies by preventing the closure of small businesses, preserving jobs, and maintaining economic activity within communities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my subchapter v small business in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign subchapter v small business and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I make changes in subchapter v small business?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your subchapter v small business to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I complete subchapter v small business on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your subchapter v small business. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is subchapter v small business?

Subchapter V of the Bankruptcy Code is a provision specifically designed for small business debtors to facilitate a streamlined process for debt restructuring, enabling businesses with debts under a certain threshold to reorganize while retaining control of their operations.

Who is required to file subchapter v small business?

Small business debtors with an aggregate noncontingent liquidated secured and unsecured debts of less than $2,725,625 are required to file under Subchapter V.

How to fill out subchapter v small business?

To file for Subchapter V, a small business debtor must complete the necessary bankruptcy forms including, but not limited to, the petition for relief, schedules of assets and liabilities, and a statement of financial affairs, ensuring accurate financial information is disclosed.

What is the purpose of subchapter v small business?

The purpose of Subchapter V is to provide a more efficient and less costly bankruptcy process for small businesses, allowing them to restructure their debts and continue operating, thereby supporting the overall economy.

What information must be reported on subchapter v small business?

Debtors must report detailed financial information including assets, liabilities, income, expenses, and any anticipated changes to the business, along with a proposed plan of reorganization.

Fill out your subchapter v small business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Subchapter V Small Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.