IRS Instruction 8938 2015 free printable template

Get, Create, Make and Sign IRS Instruction 8938

How to edit IRS Instruction 8938 online

Uncompromising security for your PDF editing and eSignature needs

IRS Instruction 8938 Form Versions

How to fill out IRS Instruction 8938

How to fill out IRS Instruction 8938

Who needs IRS Instruction 8938?

Instructions and Help about IRS Instruction 8938

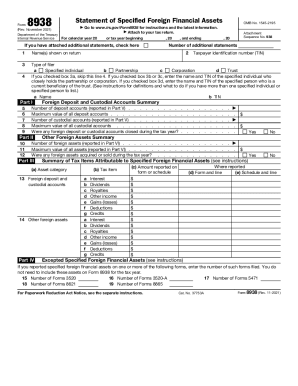

Form 8938 is a form that needs to be filed by US citizens and US resident individuals who have foreign financial assets those individuals generally must attach form 8938 to their US tax return but only if the value of all the foreign financial assets exceed certain thresholds threshold is $50,000 for single individuals and $100,000 for spouses filing jointly and the thresholds for both of those categories are doubled if you live outside the United States currently only individuals need to file form 8938, but the IRS anticipates making it required for domestic entities as well there is a ×10,000 penalties if you're required to file form 8938, and you fail to file it if there is any doubt whether the form needs to be filed I typically go ahead and file it there is no penalty for filing the form if you do not need to file it typically if you do need to file form 8938 you also need to file Fin CEN form 1 1 4 otherwise known as the eff bar on the form you fill out your name your taxpayer identification number typically a social security number you list on line 1 the number of the accounts reported on the form the maximum value of all deposit accounts reported on the form the number of all custodial accounts reported on the form custodial accounts are typically stockbrokerage accounts and then online for you list the value of all the custodial accounts and then on line 5 you list where any of the foreign deposit or custodial accounts closed during the tax year if yes you click yes otherwise you click no other foreign assets in part 2 on line 1 you list the number of the foreign assets reported on line 2 you list the maximum value of all the assets reported on line 3 you list whether there are any other foreign assets were sold during the year if yes you check yes if no you check now on part 3 of the form you list the income that was earned from the foreign financial assets so if deposit assets bank accounts if they earned interest income you would show that amount of the interest income here you would show that it's reported on Form 1040 and on Schedule B if it was on Schedule B dividends same concept royalties typical goes on Schedule II is all of this income is foreign for foreign deposit and custodial accounts at the top and then at the bottom is for the other foreign assets you list the types of income generated by those assets and what form and schedule the income is reported on in part four of the form you show the accepted specified foreign financial assets those are assets that you're filing other forms for either with your tax return or separately you do not include income from these assets or the assets themselves on form 8938 the 35:20 is an example where if you receive a distribution from a foreign trust you filed the 35:20 separately from your tax return, and you list how many 35 20s you've filed in part 4 here also form 86 21 which is for passive foreign investment companies often referred to as p fix-all so if you filed 35 20s where you...

People Also Ask about

What is the threshold for Form 8938 instructions?

Who needs to fill out Form 8938?

What goes on Form 8938?

What is the difference between FBAR and Form 8938?

Who must file Form 8938?

Do you file both FBAR and 8938?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IRS Instruction 8938 without leaving Google Drive?

How do I complete IRS Instruction 8938 online?

How do I edit IRS Instruction 8938 on an iOS device?

What is IRS Instruction 8938?

Who is required to file IRS Instruction 8938?

How to fill out IRS Instruction 8938?

What is the purpose of IRS Instruction 8938?

What information must be reported on IRS Instruction 8938?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.