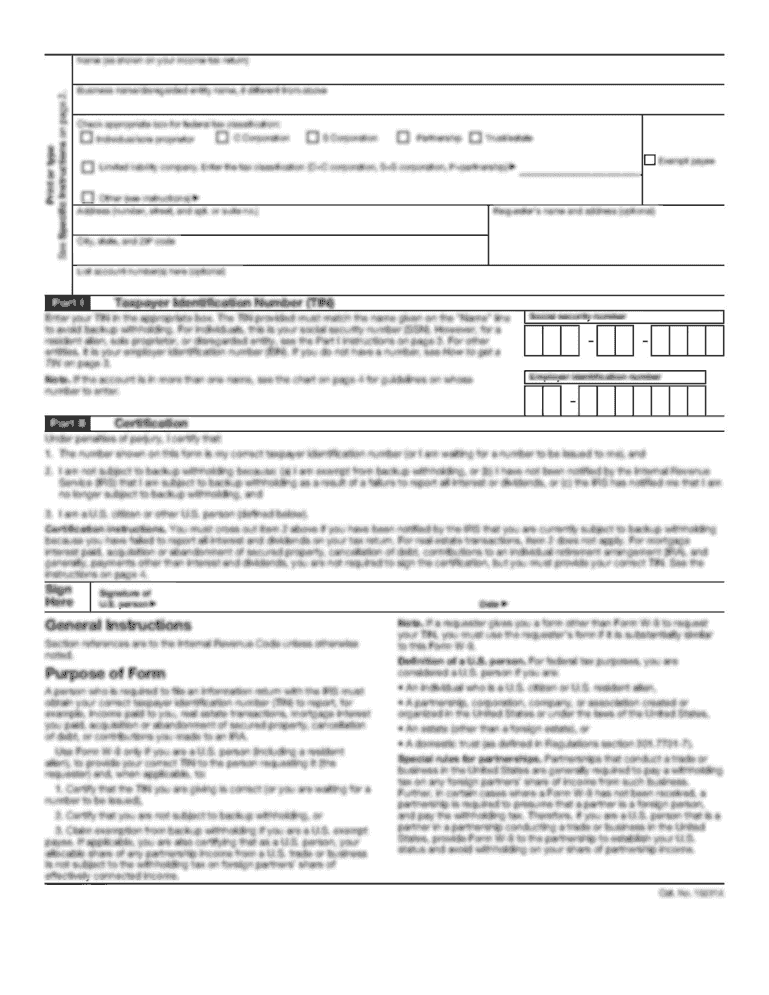

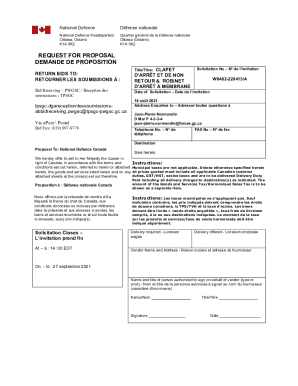

IL 171P-1 2015 free printable template

Get, Create, Make and Sign small estate affidavit bank

Editing small estate affidavit bank online

Uncompromising security for your PDF editing and eSignature needs

IL 171P-1 Form Versions

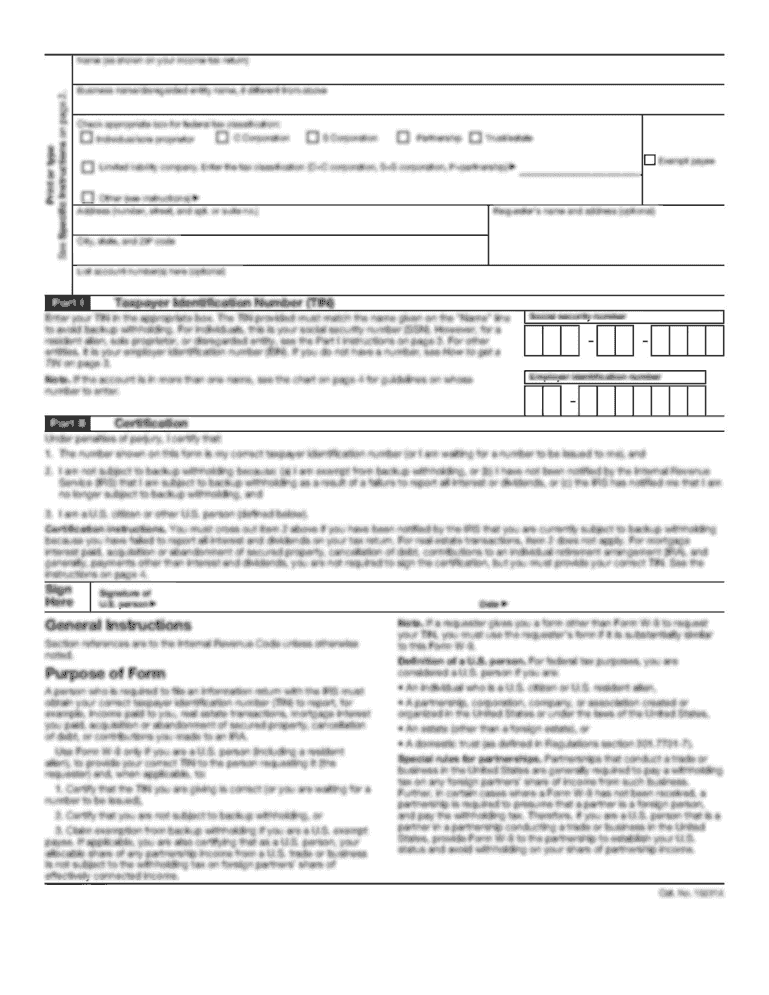

How to fill out small estate affidavit bank

How to fill out IL 171P-1

Who needs IL 171P-1?

Instructions and Help about small estate affidavit bank

Hi if you are looking to claim a property or an asset from someone who had died say the person did not leave a will, and they have left save money and bank accounts or just general assets such as cars anything, and you believe that you are the rightful heir to what they left behind you will fill out this form that is called the small state affidavit now it depends on the state if there's basically anywhere from a value of five thousand all the way up to a hundred thousand it depends on the state each state gives a maximum but basically say the person left behind two hundred thousand dollars, and they did not have a will you probably won't be able to use this form but if the person left behind a smaller amount of money, and again it depends on the state all you have to do is say click on the state in Florida that we have here, and we have the amount that's listed for example the state of Florida's seventy-five thousand dollars so all you have to do is just figure out what it is in your state now the best is to use the state specific forms here but if you decide to use our form that is free and usable in all the states you can do so by just clicking on Adobe PDF or Microsoft Word, so we're going to go through the Adobe PDF version real quick for you, so this is a fillable PDF all you have to do is just enter the name of the deceased right here state county that's applicable comes now you are known as the affine which is the person who's claiming the property you want to write the date of death here, and then you want to initial one of these two which is I am the dissidents assessor and interest, or you are the authorized agent of someone who's claiming the property so here you want to write the maximum amount of what you think everything is worth come down here you want to enter all the property here that you are claiming and then on we'll get back down here you want to enter the affine which is you your name are here your address and then what you have to do down here is you have to get what this far he's doing what you have to do is get two witnesses that knew you know you and knew the person that died and that have no monetary interest in basically sticking out for you so what you need to do is get both of those people to sign on this area in front of a notary public, and then you can file this form with the probate county office in your jurisdiction of where the person died and then hopefully you'll get they'll rule in your favor, and you'll be able to claim that property and that's it as how you can claim Odessa dense property without a will

People Also Ask about

What is a small estate affidavit for bank account in Tennessee?

What is a small estate affidavit for bank account in Iowa?

What is a small estate affidavit for bank account in Texas?

What is a small estate affidavit for bank account in Illinois?

What qualifies for small estate affidavit in Texas?

Can you use an affidavit of heirship for a bank account in Texas?

What is the purpose of a small estate affidavit in Texas?

Do you have to file a small estate affidavit in Texas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute small estate affidavit bank online?

Can I create an electronic signature for the small estate affidavit bank in Chrome?

How do I fill out the small estate affidavit bank form on my smartphone?

What is IL 171P-1?

Who is required to file IL 171P-1?

How to fill out IL 171P-1?

What is the purpose of IL 171P-1?

What information must be reported on IL 171P-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.