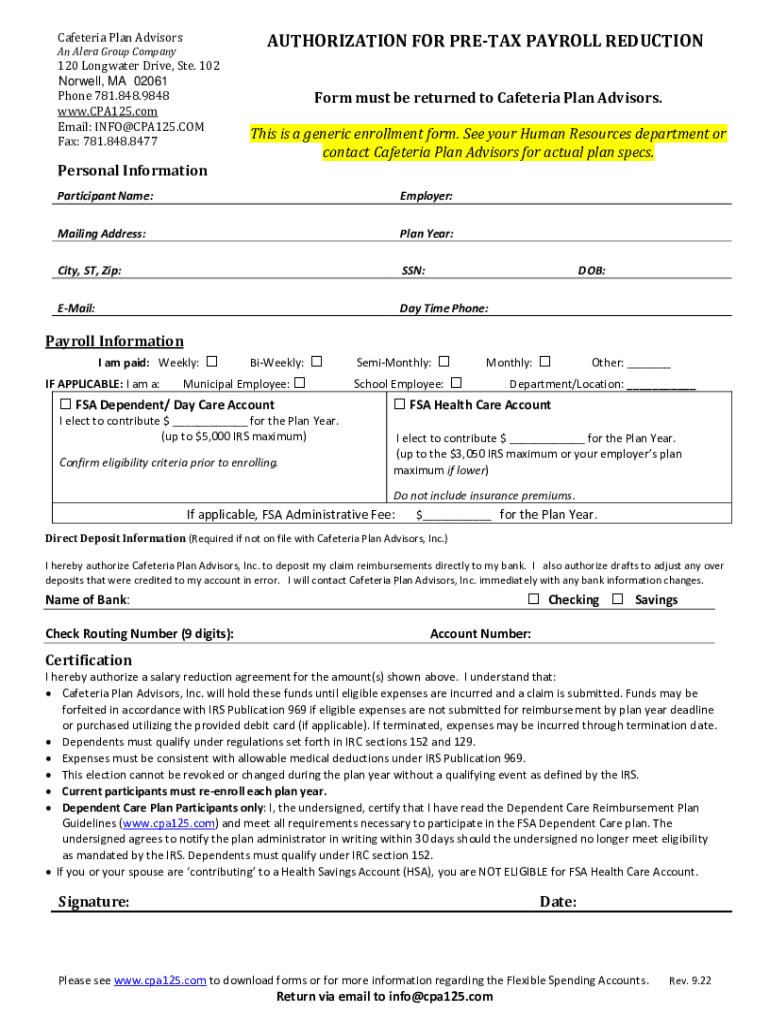

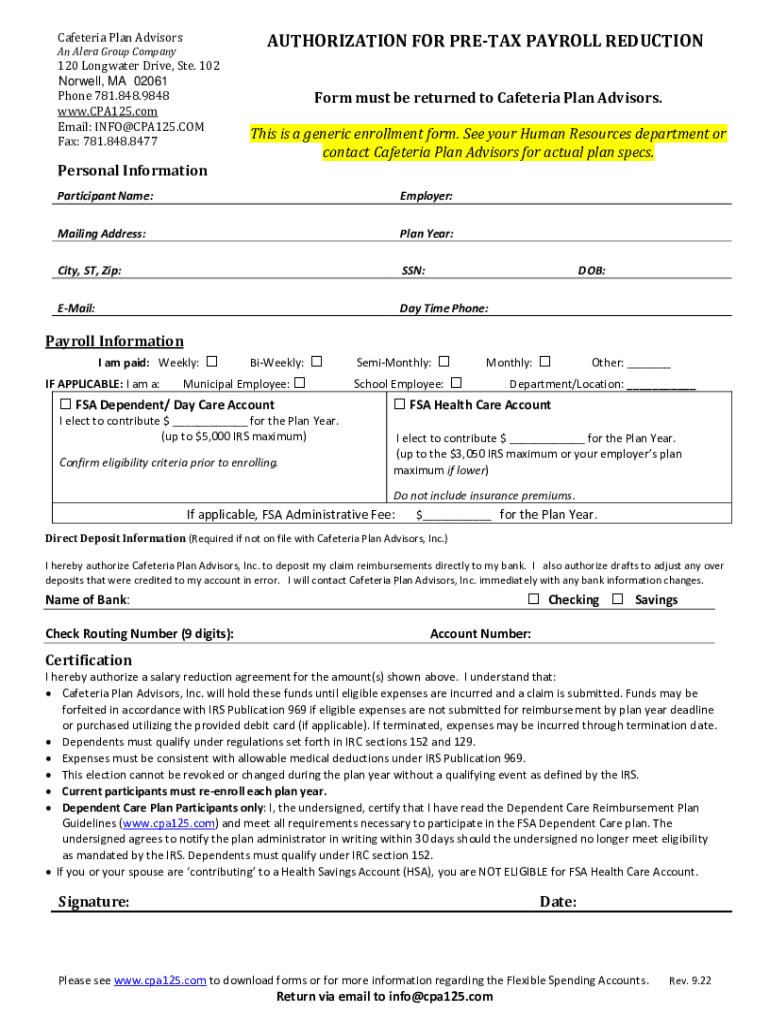

MA Cafeteria Plan Advisors Authorization for Pre-Tax Payroll Reduction 2022 free printable template

Get, Create, Make and Sign authorization for pre-tax payroll

How to edit authorization for pre-tax payroll online

Uncompromising security for your PDF editing and eSignature needs

MA Cafeteria Plan Advisors Authorization for Pre-Tax Payroll Reduction Form Versions

How to fill out authorization for pre-tax payroll

How to fill out MA Cafeteria Plan Advisors Authorization for Pre-Tax Payroll

Who needs MA Cafeteria Plan Advisors Authorization for Pre-Tax Payroll?

Instructions and Help about authorization for pre-tax payroll

Hi I'm kept Kepler CPA here in Dallas people have misconceptions sometimes about CPA's and our businesses, so I'm going to talk to you a little and kind of open the drapes on what goes on behind a CPA door and let you get the truth about that I've been a CPA for 25 years I've got an active business all my clients are small business owners we know the tax code we know how businesses should run to be successful and thriving, so we know all those things, and you would, might think that all CPA's know those things but let me give you a story I go to a network meeting every month that has about a hundred CPA sat that meeting now you might say oh that's really boring, and maybe it is unless you enjoy getting feedback about a wide variety of tax issues so in my case I wanted to give my staff a benefit and that benefit was to pay for their college tuition on classes that they take relating to accounting because I believe in educating my staff I want everybody to be educated as much as they want to be, so I did some tax research and I thought perhaps that the tuition reimbursement plan could be part of a 125 cafeteria plan or there's another tax code paragraph called the 127 plan, and so I decided on 127 plans, but I decided to see what other CPA's thought about that, so I submitted a question for this group went to the group meeting and the leader read my question any thoughts about a 125 plan worth versus a 127 plan now here's the truth nobody except myself knew what a 127 plan was that not heard of it they never implemented they never understood the issue so even though somebody has the title of a CPA the truth is we all have our own experience we all took the CPA exam we pass the CPA exam, so we must know a number of things if we do a lot of tax and accounting work the real world teaches us about what we need to learn we also are required to take continuing education 40 hours every year on various tax and accounting topics so even with all of that there's no guarantee that a CPA is going to know the answer to your question right off the top of their heads so if you want somebody who can't think through that with you can examine what you the truth of your question and how it should be applied then we're good at that so if we can help you give us call thanks

People Also Ask about

What is a Section 125 flex spending plan?

Who is not eligible for Section 125 plan?

What expenses are eligible for Flex 125 plan?

What qualifies as Section 125 benefits?

What qualifies for medical FSA?

What is an example of a Section 125 plan?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify authorization for pre-tax payroll without leaving Google Drive?

Can I create an electronic signature for the authorization for pre-tax payroll in Chrome?

How do I edit authorization for pre-tax payroll on an Android device?

What is MA Cafeteria Plan Advisors Authorization for Pre-Tax Payroll?

Who is required to file MA Cafeteria Plan Advisors Authorization for Pre-Tax Payroll?

How to fill out MA Cafeteria Plan Advisors Authorization for Pre-Tax Payroll?

What is the purpose of MA Cafeteria Plan Advisors Authorization for Pre-Tax Payroll?

What information must be reported on MA Cafeteria Plan Advisors Authorization for Pre-Tax Payroll?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.