IL AR 9.10 2014-2026 free printable template

Show details

Print Secretary of State Department of Accounting Revenue Refund Section 222 Hewlett Bldg. Springfield, IL 62756 217-782-4908 (FAX) 217-557-4552 www.cyberdriveillinois.com Save This space for use

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL AR 910

Edit your IL AR 910 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL AR 910 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL AR 910 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IL AR 910. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

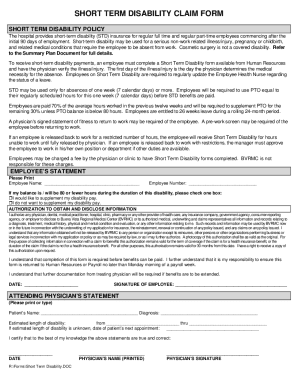

How to fill out IL AR 910

How to fill out IL AR 9.10

01

Obtain the IL AR 9.10 form from the appropriate agency or website.

02

Carefully read the instructions provided with the form.

03

Fill in your personal information in the designated fields, including your name and address.

04

Provide any necessary identification numbers or reference codes as requested.

05

Complete all relevant sections based on the purpose of the form.

06

Review your entries for accuracy and completeness.

07

Sign and date the form where required.

08

Submit the form according to the provided instructions, either by mail or electronically.

Who needs IL AR 9.10?

01

Individuals who are required to report specific information to the state.

02

Businesses seeking to maintain compliance with state regulations.

03

Applicants needing to provide background or demographic information.

Fill

form

: Try Risk Free

People Also Ask about

How do I request a refund?

In order to request for a refund, you can contact the customer service over the phone if available or write a letter or an email stating the cause behind the refund.

What is refund form?

Refund Form means the form to be completed and / or signed by a consumer wishing to receive a refund of the Transfer Amount.

How do I apply for a refund?

You have to upload documents as are required to be filed along with Form RFD-01, as notified under CGST Rules or Circulars issued in the matter and other such documents the refund sanctioning authority may require. Taxpayers have an option to upload 10 documents with the refund application, of size up to 5 MB each.

Can you get a refund on vehicle registration in Illinois?

Obtain a Refund All refund requests must be made within six months of the date of purchase. You may be eligible for a refund if: You have purchased a duplicate vehicle registration (two stickers or license plates) and you return the duplicate sticker or plates.

How do I politely decline a refund request?

Be firm and courteous Start by acknowledging the refund request and your steps in determining if it was valid. Then explain your decision to deny the refund. Use active language like, "I looked into your situation and our refund policy does not allow one in this case."

What is a refund request?

Refund Request means a Merchant generated request to transfer funds to a Customer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IL AR 910 in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your IL AR 910 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make edits in IL AR 910 without leaving Chrome?

IL AR 910 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I complete IL AR 910 on an Android device?

Complete your IL AR 910 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is IL AR 9.10?

IL AR 9.10 is a form used by businesses and individuals in Illinois to report certain financial activities and tax information.

Who is required to file IL AR 9.10?

Businesses and individuals engaged in activities that require reporting under Illinois tax law are required to file IL AR 9.10.

How to fill out IL AR 9.10?

To fill out IL AR 9.10, provide necessary identification details, report financial activities, and ensure all required fields are completed accurately.

What is the purpose of IL AR 9.10?

The purpose of IL AR 9.10 is to provide the Illinois Department of Revenue with necessary information for tax assessment and compliance.

What information must be reported on IL AR 9.10?

Information that must be reported on IL AR 9.10 includes income details, deductions, and any relevant financial transactions that fall under the reporting requirements.

Fill out your IL AR 910 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL AR 910 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.