Get the free Illinois Loan Brokers Act of 1995

Show details

This document contains the Illinois Loan Brokers Act, outlining regulations and compliance requirements for loan brokers operating within the state of Illinois, including registration, obligations,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign illinois loan brokers act

Edit your illinois loan brokers act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your illinois loan brokers act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit illinois loan brokers act online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit illinois loan brokers act. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

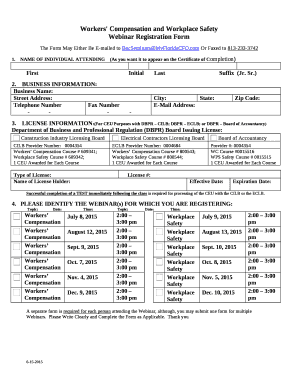

How to fill out illinois loan brokers act

How to fill out Illinois Loan Brokers Act of 1995

01

Obtain a copy of the Illinois Loan Brokers Act of 1995 application form.

02

Review the application requirements carefully.

03

Gather necessary documentation, including proof of identity and business structure.

04

Complete the application form with accurate information.

05

Provide a detailed business plan outlining your loan brokerage operations.

06

Submit a non-refundable application fee as specified in the instructions.

07

Submit the completed application along with all required documentation to the appropriate state authority.

08

Await confirmation of receipt and further instructions from the state.

Who needs Illinois Loan Brokers Act of 1995?

01

Individuals or businesses looking to act as loan brokers in Illinois.

02

Professionals involved in connecting borrowers with lenders.

03

Companies that facilitate loan transactions on behalf of clients.

Fill

form

: Try Risk Free

People Also Ask about

What is the maximum interest rate in Illinois?

A loan broker, or a mortgage broker, is the middle person in between a lender and a borrower. While a borrower can directly borrow from a lender, a loan broker can help the borrower decide which lender meets the borrower's financial goals.

Do you need a license to be a commercial broker?

To be certified as a commercial real estate broker, an individual must obtain a state license in each state that they want to practice their profession in.

What is the highest interest rate you can legally charge?

There's no federal regulation on the maximum interest rate your issuer can charge you, though each state has its own approach to limiting interest rates. State usury laws often dictate the highest interest rate that can be charged on loans, but these often don't apply to credit cards.

Which states require a commercial loan broker license?

1:27 3:46 You can broker commercial loans without license.MoreYou can broker commercial loans without license.

What is the maximum interest rate allowed in Illinois?

Under the PLPA, loans with an annual percentage rate (APR) in excesses of 36%, inclusive of certain fees and charges, are illegal except in very narrow circumstances. If the loan interest rate is adjustable, find out how much the rate can increase over the life of your loan.

What is the Business Brokers Act of 1995 in Illinois?

The Business Brokers Act of 1995 requires any person domiciled in the State of Illinois, received commission or other compensation from another person to procure a business or assist in the procurement of a business; negotiate offers, buy, sell, or otherwise deal in options on businesses, or assists or directs the

What is the interest rate cap in Illinois?

In the past ten years, overwhelming majorities in five states have capped rates at 36% or less: Arizona (2008), Colorado (2018), Montana (2010), Ohio (2008) and South Dakota (2016). There is a strong historic and contemporary consensus that 36% should be the top rate for small loans.

How do I become a commercial loan broker?

You'll need a sound grounding in finance and accounting to become a successful broker, regardless of your educational background. You must understand bookkeeping, accounting, and how businesses run so you can assess their financial health and capture your client's financial needs.

Do you need a license to be a commercial loan broker in Illinois?

A Loan Broker Registration may be required to broker Illinois commercial mortgage loans. A Collection Agency License may be required to collect on Illinois loans. A Loan Broker registration issued by the Illinois Secretary of State is required in order to engage in “loan brokering.” 205 Ill.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Illinois Loan Brokers Act of 1995?

The Illinois Loan Brokers Act of 1995 is a piece of legislation that regulates loan brokers in the state of Illinois, establishing requirements for licensing, operation, and disclosure to protect consumers in loan transactions.

Who is required to file Illinois Loan Brokers Act of 1995?

Individuals and businesses that act as loan brokers in Illinois to facilitate loans between borrowers and lenders are required to file under the Illinois Loan Brokers Act of 1995.

How to fill out Illinois Loan Brokers Act of 1995?

To fill out the forms for the Illinois Loan Brokers Act of 1995, applicants must provide detailed personal and business information, including financial disclosures, background information, and any necessary supporting documentation as outlined in the application process.

What is the purpose of Illinois Loan Brokers Act of 1995?

The purpose of the Illinois Loan Brokers Act of 1995 is to ensure consumer protection by regulating loan brokers, promoting transparency, and requiring ethical practices in the loan brokerage industry.

What information must be reported on Illinois Loan Brokers Act of 1995?

The Illinois Loan Brokers Act of 1995 requires reporting of information such as the broker's business name, address, ownership details, financial statements, and any previous legal or regulatory actions taken against them.

Fill out your illinois loan brokers act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Illinois Loan Brokers Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.