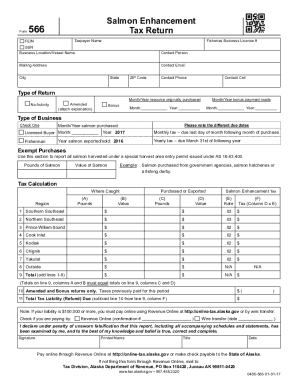

AK Form 566 2016 free printable template

Show details

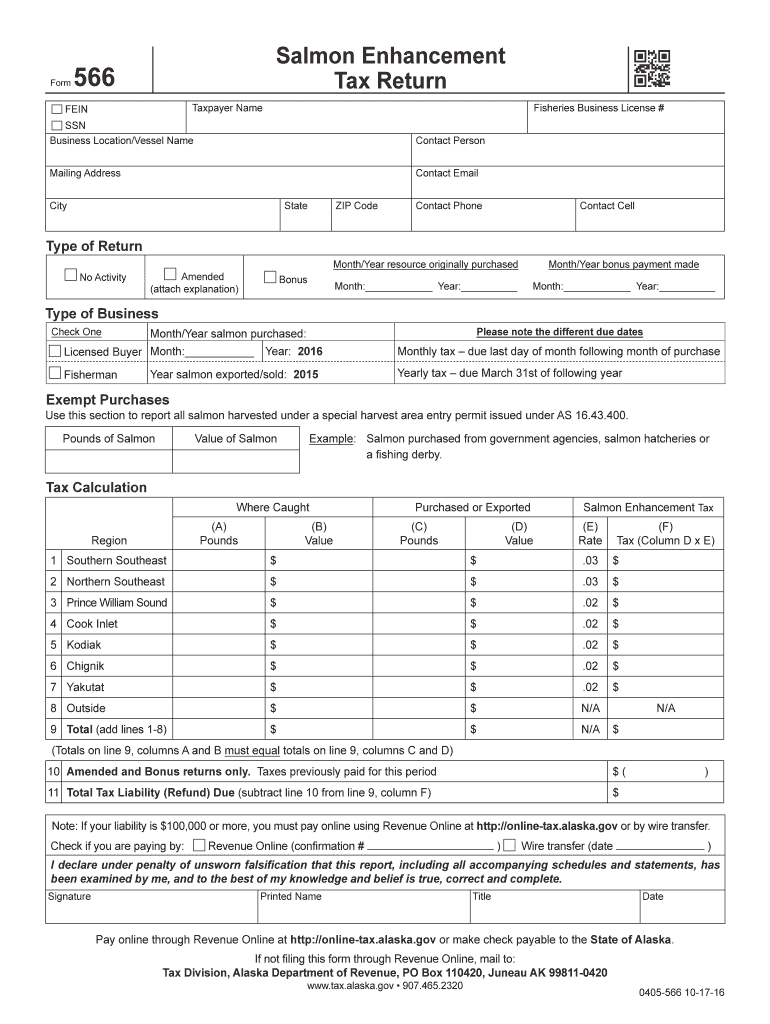

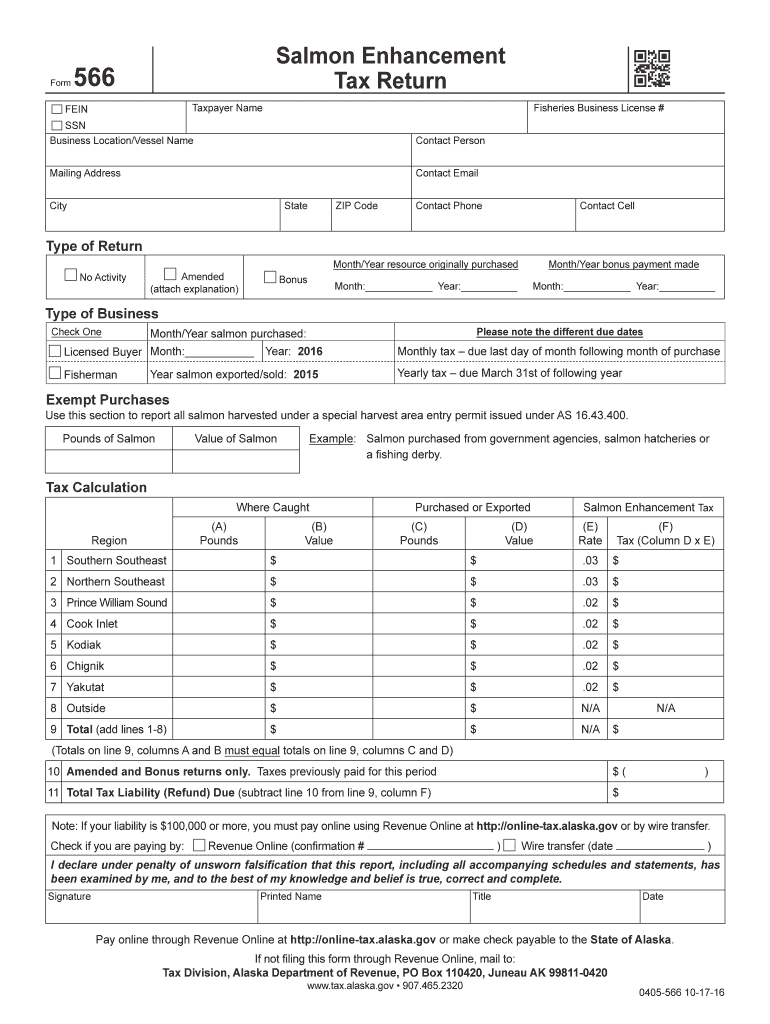

This document serves to report and calculate the salmon enhancement tax owed by businesses involved in the fishing industry in Alaska. It includes information about the taxpayer, business activities,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AK Form 566

Edit your AK Form 566 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AK Form 566 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AK Form 566 online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit AK Form 566. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AK Form 566 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AK Form 566

How to fill out Salmon Enhancement Tax Return

01

Obtain the Salmon Enhancement Tax Return form from your local tax office or download it from the official website.

02

Fill out the identifying information, including your name, address, and tax identification number.

03

Report your total income earned from salmon harvesting during the tax year.

04

Include any applicable deductions related to salmon enhancement activities.

05

Calculate the total tax owed based on the reported income.

06

Review the completed form for accuracy and completeness.

07

Submit the form by the deadline, either electronically or via mail.

Who needs Salmon Enhancement Tax Return?

01

Commercial salmon fishermen and fish processors who engage in salmon enhancement activities.

02

Any entity or individual that earns income from salmon harvesting and is subject to the Salmon Enhancement Tax.

Fill

form

: Try Risk Free

People Also Ask about

How to get a $10,000 tax refund?

While a $10,000 tax refund might sound like a dream, it's achievable in certain situations. This typically happens when you've significantly overpaid taxes throughout the year or qualify for substantial tax credits.

How to get a bigger refund on taxes?

You can increase the amount of your tax refund by decreasing your taxable income and taking advantage of tax credits. Working with a financial advisor and tax professional can help you make the most of deductions and credits you're eligible for.

What is the most overlooked tax break?

The 10 Most Overlooked Tax Deductions State sales taxes. Reinvested dividends. Out-of-pocket charitable contributions. Student loan interest paid by you or someone else. Moving expenses. Child and Dependent Care Credit. Earned Income Tax Credit (EITC) State tax you paid last spring.

How can I speed up my tax return?

Use electronic filing Opting for electronic filing and selecting direct deposit is the fastest and safest way to receive a refund. While taxpayers and tax professionals are urged to choose electronic filing when filing individual tax returns, there are taxpayers who must submit a paper tax return.

How can I beef up my tax return?

How to maximize tax return: 4 ways to increase your tax refund Consider your filing status. Believe it or not, your filing status can significantly impact your tax liability. Explore tax credits. Tax credits are a valuable source of tax savings. Make use of tax deductions. Take year-end tax moves.

How can I get the IRS to speed up my refund?

Request an expedited refund by calling the IRS at 800-829-1040 (TTY/TDD 800-829-4059). Explain your hardship situation; and. Request a manual refund expedited to you.

What is the Alaska salmon enhancement tax?

The Salmon Enhancement Tax is a self-imposed tax elected through a vote of the fishermen. Southeast and Northern Southeast at 3%, and Prince William Sound, Cook Inlet, Kodiak, Chignik, and Yakutat at 2%. payment to the department.

How to get $7000 tax refund?

The Earned Income Tax Credit (EITC or EIC) is one of the largest credits available, worth up to more than $7,000 in 2024 for a family of five. It is specifically for low- to moderate-income earners. Sometimes, the credit is worth more than the amount of income you received in the first place.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Salmon Enhancement Tax Return?

The Salmon Enhancement Tax Return is a tax form used by businesses or individuals involved in the salmon industry to report their sales and related tax obligations to support salmon enhancement programs.

Who is required to file Salmon Enhancement Tax Return?

Those who are involved in the sale of salmon or salmon products are required to file the Salmon Enhancement Tax Return, which typically includes commercial fishers and registered fish processing facilities.

How to fill out Salmon Enhancement Tax Return?

To fill out the Salmon Enhancement Tax Return, one must provide details on sales figures, related expenses, and calculate the tax owed based on the applicable tax rate for salmon sales, ensuring all required fields are completed accurately.

What is the purpose of Salmon Enhancement Tax Return?

The purpose of the Salmon Enhancement Tax Return is to collect funds that support salmon enhancement and restoration projects, ensuring sustainable fish populations and healthy ecosystems.

What information must be reported on Salmon Enhancement Tax Return?

Required information includes total sales of salmon and salmon products, any deductions or exemptions claimed, amount of tax collected, and other relevant business details such as business identification and contact information.

Fill out your AK Form 566 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AK Form 566 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.