AK DR-301 2016 free printable template

Show details

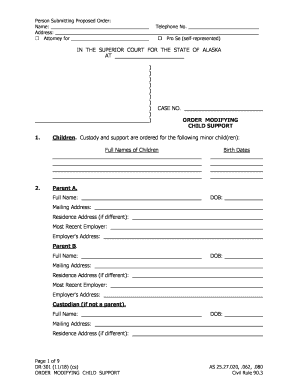

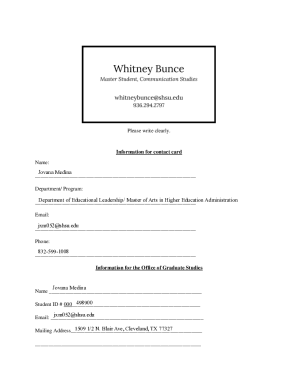

Person Submitting Proposed Order: Name: Address: ? Attorney for Telephone No. ? Pro Se (self-represented) IN THE SUPERIOR COURT FOR THE STATE OF ALASKA AT)))))))))) 1. CASE NO. ORDER MODIFYING CHILD

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AK DR-301

Edit your AK DR-301 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AK DR-301 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AK DR-301 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit AK DR-301. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AK DR-301 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AK DR-301

How to fill out AK DR-301

01

Begin by downloading the AK DR-301 form from the official Alaska Department of Revenue website.

02

Fill in your name and contact information in the designated fields at the top of the form.

03

Provide details about the property or asset for which you are filing the form.

04

Indicate the reason for filing the AK DR-301, such as a change in ownership or valuation.

05

Enter the required financial information accurately.

06

Review all information for completeness and accuracy.

07

Sign and date the form at the bottom.

08

Submit the completed form via mail to the address specified on the form or electronically if possible.

Who needs AK DR-301?

01

Individuals or businesses in Alaska who need to report a change in property ownership or address to the Department of Revenue.

02

Property owners seeking to appeal their property tax assessment.

03

Anyone involved in transferring property or assets in the state requiring documentation.

Fill

form

: Try Risk Free

People Also Ask about

What is the oldest age for child support?

Under California law, you pay child support until the child turns 18, or 19 if the child is unmarried and still attending high school full time. Under special circumstances, the court may order child support to continue after the child is an adult.

At what age can a child choose which parent to live with Alaska?

Though there is no strict age guideline under Alaska law, children are not generally mature enough to make reasoned decisions about which parent to live with until they are teenagers. Even then, a judge will look at the reason the teenager is expressing a preference for one parent over another.

At what age does child support stop in Alaska?

In Alaska, the obligation to support your child typically lasts until the child turns 18 years of age.

What is the income limit for child support in Alaska?

For purposes of calculating child support, a court will use either a parent's actual annual net income or $126,000, whichever amount is lower. (The $126,000 figure is subject to change, so be sure to use the most current version of Form 305.)

What is the cap for child support in Alaska?

In Alaska, the withholding limit for child support is 40% of net income or 50% if Medical Support is required. Net income is gross wages minus federal income taxes, Social Security, Medicare, and other mandatory deductions.

How do I get court records in Alaska?

You may also contact the Alaska Court System at 907-274-8611 or you can look up your case status in “COURTVIEW” on the court website. You can determine your next court date by viewing the DOCKETS tab.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my AK DR-301 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your AK DR-301 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I complete AK DR-301 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your AK DR-301, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I complete AK DR-301 on an Android device?

Use the pdfFiller Android app to finish your AK DR-301 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is AK DR-301?

AK DR-301 is a form used for reporting various types of taxes in the state of Alaska.

Who is required to file AK DR-301?

Individuals and businesses that have tax obligations in Alaska are required to file AK DR-301.

How to fill out AK DR-301?

To fill out AK DR-301, you need to provide relevant tax information, including income, deductions, and credits, and ensure all sections of the form are completed accurately.

What is the purpose of AK DR-301?

The purpose of AK DR-301 is to report income and calculate any taxes owed to the state of Alaska.

What information must be reported on AK DR-301?

The information that must be reported on AK DR-301 includes taxpayer identification, income details, applicable deductions, credits claimed, and calculations of tax liability.

Fill out your AK DR-301 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AK DR-301 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.