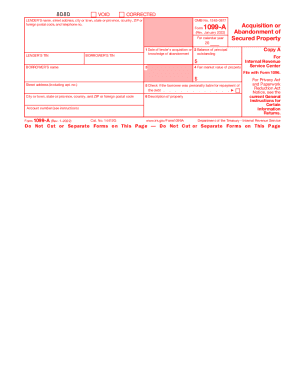

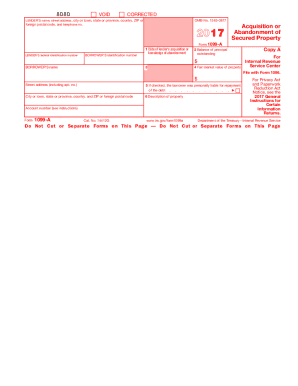

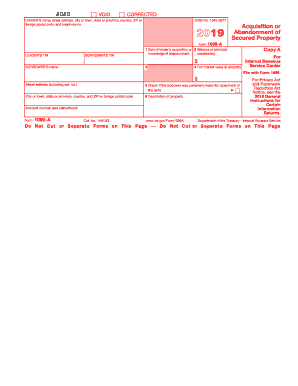

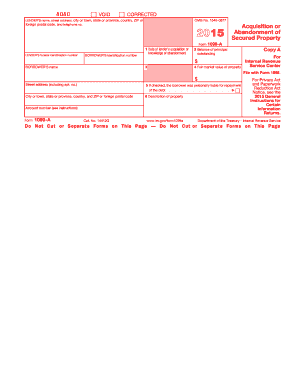

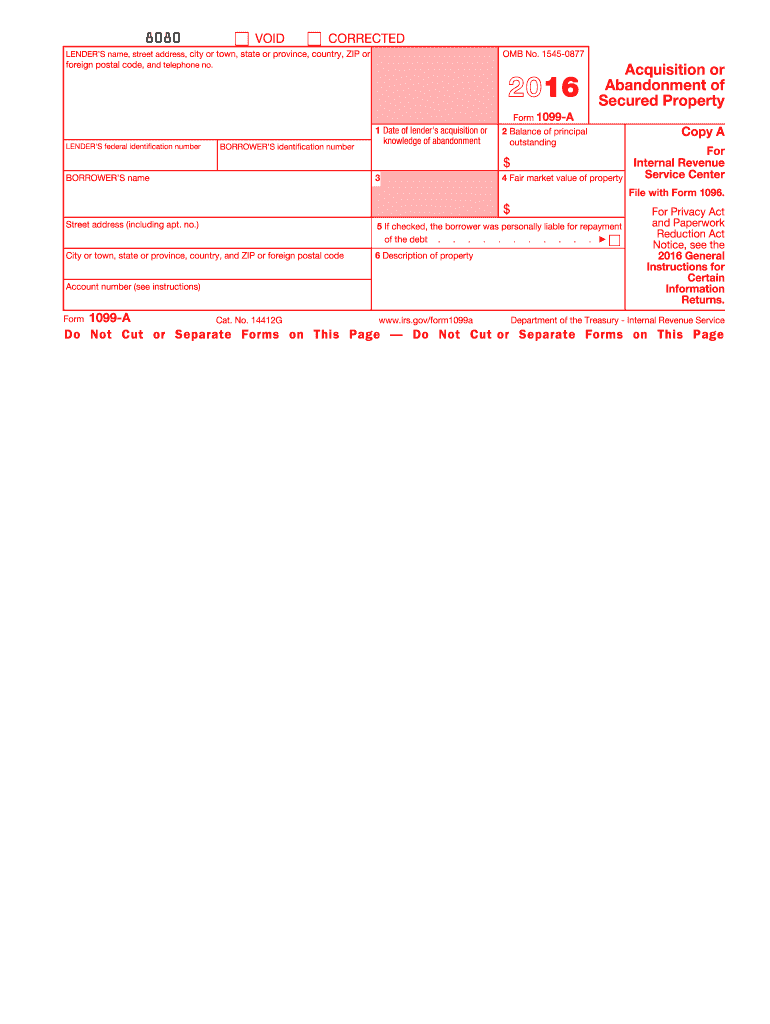

IRS 1099-A 2016 free printable template

Instructions and Help about IRS 1099-A

How to edit IRS 1099-A

How to fill out IRS 1099-A

About IRS 1099-A 2016 previous version

What is IRS 1099-A?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-A

What should I do if I realize I've made a mistake on my IRS 1099-A?

If you discover an error on your IRS 1099-A after filing, it's important to file a corrected form. You can prepare and submit a new IRS 1099-A that reflects the accurate information, and mark it as 'Corrected' to notify the IRS of your changes. Keep in mind that providing accurate information helps avoid complications or discrepancies in your tax reporting.

How can I check the status of my filed IRS 1099-A?

To verify the receipt and processing status of your IRS 1099-A, you can use the IRS e-file tracking tool if you submitted electronically. This tool will indicate whether your submission was received successfully and processed or if there were any issues. It's also advisable to keep records of your filing confirmation for your own tracking.

Are there specific challenges when filing an IRS 1099-A for non-residents?

Yes, when filing an IRS 1099-A for non-residents or foreign payees, additional considerations apply, such as ensuring compliance with IRS regulations regarding withholding taxes and reporting obligations. It's essential to understand the specific requirements set for foreign entities to avoid any issues. Consulting a tax professional who specializes in international tax law can also be beneficial.

What common errors occur with IRS 1099-A submissions, and how can I prevent them?

Common errors with IRS 1099-A submissions include incorrect taxpayer identification numbers (TINs) and mismatched names. To prevent these mistakes, always double-check the information against official documents before filing. Utilizing tax preparation software can also help identify potential errors before submission, enhancing accuracy.

What are the legal implications if my IRS 1099-A information is mishandled?

Improper handling of IRS 1099-A information can lead to privacy violations and potential liability issues. It's crucial to ensure proper data security measures are in place when managing sensitive taxpayer information. Keep records securely and ensure compliance with IRS regulations to mitigate legal risks.

See what our users say