Get the free WRIT OF GARNISHMENT WITH NOTICE OF EXEMPTION AND PENDING LEVY - courts state co

Show details

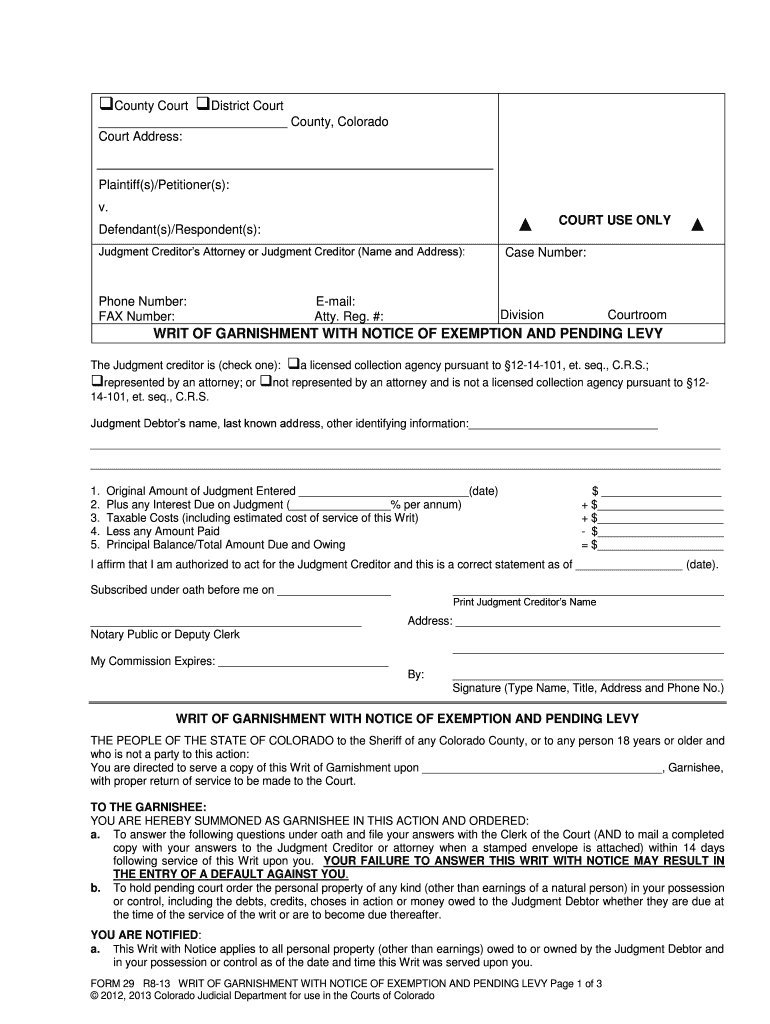

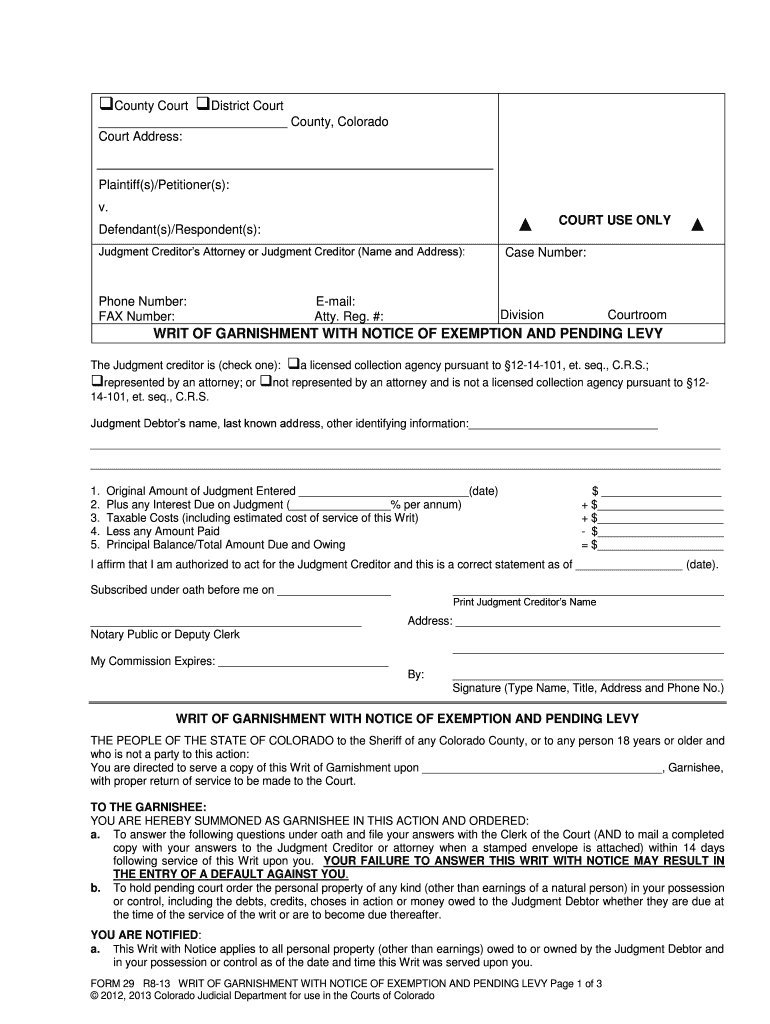

This document is used in Colorado courts to inform a garnishee of their obligation to respond to a writ of garnishment and outlines the rights of the judgment debtor regarding exempt property. It

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign writ of garnishment with

Edit your writ of garnishment with form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your writ of garnishment with form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit writ of garnishment with online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit writ of garnishment with. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out writ of garnishment with

How to fill out WRIT OF GARNISHMENT WITH NOTICE OF EXEMPTION AND PENDING LEVY

01

Obtain the WRIT OF GARNISHMENT form from your local court or online.

02

Fill in your name as the creditor at the top of the form.

03

Provide the name and address of the debtor, the person whose assets you wish to garnish.

04

Specify the amount owed by the debtor that you are seeking to collect.

05

Indicate the type of assets you wish to target for garnishment, such as bank accounts or wages.

06

Complete the section for exemption notice, outlining the debtor's rights to claim exemptions.

07

Sign and date the form appropriately.

08

Submit the completed form to the court for approval.

09

Serve the WRIT to the garnishee (the bank or employer) as per local rules.

Who needs WRIT OF GARNISHMENT WITH NOTICE OF EXEMPTION AND PENDING LEVY?

01

Creditors who have obtained a judgment against a debtor and wish to collect the owed money.

02

Individuals or businesses seeking to recover debts through asset garnishment.

03

Those in the process of enforcing a court judgment related to financial disputes.

Fill

form

: Try Risk Free

People Also Ask about

What happens when you get a levy?

It can garnish wages, take money in your bank or other financial account, seize and sell your vehicle(s), real estate and other personal property. If you receive an IRS bill titled Final Notice of Intent to Levy and Notice of Your Right to A Hearing, contact us right away.

What does levy mean on a paycheck?

If the IRS levies (seizes) your wages, part of your wages will be sent to the IRS each pay period until: You make other arrangements to pay your overdue taxes, The amount of overdue taxes you owe is paid, or. The levy is released.

What does writ of garnishment issued mean?

A writ of garnishment is a process by which the court orders the seizure or attachment of the property of a defendant or judgment debtor in the possession or control of a third party. The garnishee is the person or corporation in possession of the property of the defendant or judgment debtor.

Can you get your money back from a levy?

If you act quickly, you may be able to get some or all of the money back. You have only 10 days from the date of the levy to file a claim of exemption (plus 5 days if the notice was sent by mail) with the sheriff. You must show that the funds taken came from a source of income that is exempt from collection.

What is the difference between a levy and a garnishment?

Levy: Involves taking money or property directly, like freezing your bank account or seizing your property. Garnishment: Mainly affects income streams such as wages, bonuses, and sometimes benefits like pensions.

What to do after a writ of garnishment?

If a court has awarded judgment to your creditor and garnishment is part of the plan, here are some potential ways to get rid of it. Pay Off the Debt. Work With Your Creditor. Find a Credit Counselor. Challenge the Garnishment. File a Claim of Exemption. File for Bankruptcy.

What happens if you don't pay the levy?

The IRS can initiate a tax levy if you have a tax lien and don't pay. A tax levy is when the government seizes your property or assets to pay the tax lien. The IRS will take your money from your paycheck or bank account, or they may even seize your property.

What is the difference between a writ and a levy?

A Writ of Execution tells the sheriff or a process server to send out the bank levy. You can't levy a bank account without one. The bank levy tells the bank to give the money to the sheriff for you. Writs expire after 180 days.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is WRIT OF GARNISHMENT WITH NOTICE OF EXEMPTION AND PENDING LEVY?

A WRIT OF GARNISHMENT WITH NOTICE OF EXEMPTION AND PENDING LEVY is a legal document issued by a court that allows a creditor to collect money or property directly from a third party (garnishee) that holds funds or assets belonging to a debtor. It includes a notice informing the debtor of their rights to claim exemptions from garnishment.

Who is required to file WRIT OF GARNISHMENT WITH NOTICE OF EXEMPTION AND PENDING LEVY?

The creditor or their legal representative who has obtained a judgment against the debtor is required to file the WRIT OF GARNISHMENT. This document is filed to initiate the garnishment process and inform the debtor about the pending action.

How to fill out WRIT OF GARNISHMENT WITH NOTICE OF EXEMPTION AND PENDING LEVY?

To fill out the WRIT OF GARNISHMENT, the creditor must provide specific details, including the court's name, case number, parties involved, amount owed, and identification of the garnishee. The form must also include notice to the debtor about their right to claim exemptions, along with any relevant instructions or deadlines.

What is the purpose of WRIT OF GARNISHMENT WITH NOTICE OF EXEMPTION AND PENDING LEVY?

The purpose of the WRIT OF GARNISHMENT is to facilitate the collection of a judgment by allowing a creditor to seize funds or property from the debtor through a third party. The notice of exemption informs the debtor of their rights and options to protect certain exempt assets from being garnished.

What information must be reported on WRIT OF GARNISHMENT WITH NOTICE OF EXEMPTION AND PENDING LEVY?

The WRIT must include the creditor's name, address, and contact information; the debtor's name, address, and identification; details regarding the garnishee; the amount owed; the court information; and information regarding the debtor's rights to claim exemptions against garnishment.

Fill out your writ of garnishment with online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Writ Of Garnishment With is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.