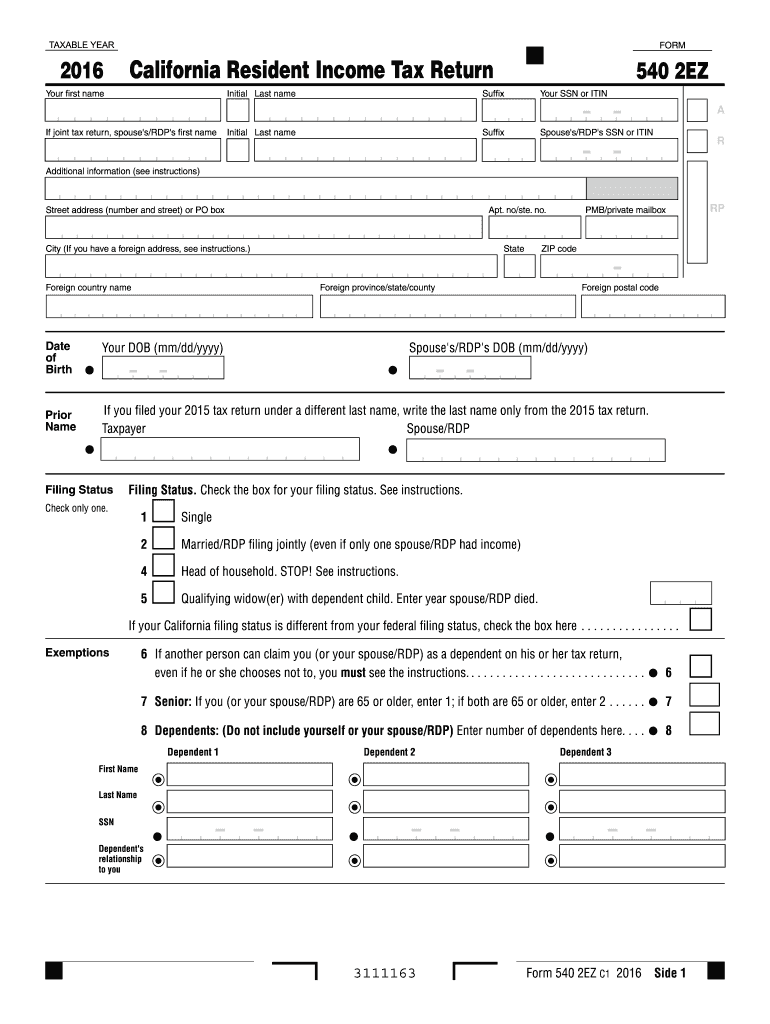

CA FTB 540 2EZ 2016 free printable template

Instructions and Help about CA FTB 540 2EZ

How to edit CA FTB 540 2EZ

How to fill out CA FTB 540 2EZ

About CA FTB 540 2EZ 2016 previous version

What is CA FTB 540 2EZ?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about CA FTB 540 2EZ

What should I do if I realize I've made a mistake after submitting my CA FTB 540 2EZ?

If you've submitted your CA FTB 540 2EZ and need to correct a mistake, you must file an amended return using Form 540X. Be sure to explain the reason for the amendment clearly and provide any necessary supporting documentation. It's also important to keep records of both your original and amended filings for your records.

How can I track the status of my CA FTB 540 2EZ after submission?

To verify the status of your CA FTB 540 2EZ, you can use the California FTB's online tools. After filing, you may check receipt and processing status via their website, which can provide updates on whether your return is still in process or has been completed. Common rejection codes can also be found to help troubleshoot issues with your filing.

What steps should I take if I receive a notice from the FTB regarding my CA FTB 540 2EZ?

Upon receiving a notice from the FTB regarding your CA FTB 540 2EZ, carefully read the letter to understand the nature of the inquiry or issue. Prepare any required documentation and respond according to the instructions provided in the notice. Ensure your response is timely, and maintain copies for your records.

Is it possible to e-file my CA FTB 540 2EZ using different devices or software?

Yes, you can e-file your CA FTB 540 2EZ using compatible software or browsers. It's recommended to check that your software is updated and meets the technical requirements set by the FTB for e-filing. Many popular tax preparation tools support e-filing for this form across various devices, enhancing convenience while ensuring compliance.

See what our users say