MO DoR 5060 2015 free printable template

Show details

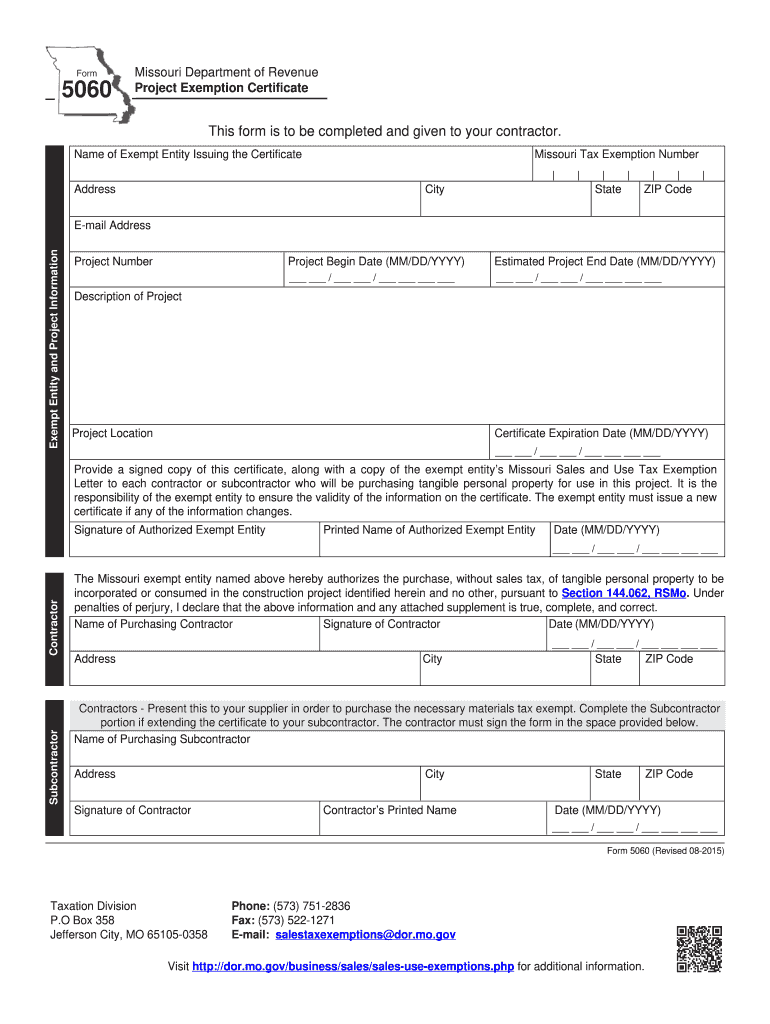

Form 5060 Revised 08-2015 Taxation Division P. O Box 358 Jefferson City MO 65105-0358 Phone 573 751-2836 Fax 573 522-1271 E-mail salestaxexemptions dor. Reset Form Form Print Form Missouri Department of Revenue Project Exemption Certificate This form is to be completed and given to your contractor. Name of Exempt Entity Issuing the Certificate Missouri Tax Exemption Number Address City State ZIP Code Exempt Entity and Project Information E-mail Address Project Number Project Begin Date...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO DoR 5060

Edit your MO DoR 5060 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO DoR 5060 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MO DoR 5060 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MO DoR 5060. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO DoR 5060 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO DoR 5060

How to fill out MO DoR 5060

01

Start by downloading the MO DoR 5060 form from the official website.

02

Fill in your personal information at the top, including your name, address, and contact details.

03

Provide your Social Security Number or Taxpayer Identification Number as required.

04

In the designated section, input the relevant tax period for the submission.

05

Follow through the form, ensuring you complete all necessary fields for your income and deductions.

06

Review all the entered information for accuracy.

07

Sign and date the form at the bottom.

08

Submit the completed form as per the instructions provided.

Who needs MO DoR 5060?

01

Individuals or businesses who are required to report their income and file taxes in Missouri.

02

Taxpayers who have specific deductions or credits to claim related to the filing period.

03

Anyone who needs to provide detailed income information to the Missouri Department of Revenue for assessment.

Fill

form

: Try Risk Free

People Also Ask about

What is Missouri form 5060 for?

Not-for-Profit Construction Contracts Exempt charitable, religious and educational entities, or political subdivisions may complete a project exemption certificate (Missouri Form 5060).

What is tax-exempt form 5060 in Missouri?

This form is to be completed and given to your contractor. The Missouri exempt entity named above hereby authorizes the purchase, without sales tax, of tangible personal property to be incorporated or consumed in the construction project identified herein and no other, pursuant to Section 144.062, RSMo.

How do I avoid paying sales tax on my car in Missouri?

the vehicle is less than eleven years old and the mileage is less than 150,000 miles; you are a resident of a state other than Missouri; or. you are obtaining a temporary permit for a trailer.

How do you get around sales tax on a car?

If you live in a state that doesn't charge sales tax, but you're planning to move to one that does, consider buying your car before you move out of state. This way, you can buy and register your used car in your current state to avoid paying sales tax, then register it in the new state once you move.

What is Missouri agricultural tax exemption?

Missouri agricultural producers are eligible to recover any sales tax overpayments on machinery, equipment, repair & replacement parts and supplies used in agricultural production by submitting a Missouri Form 472P with the Missouri Department of Revenue.

What happens if you don t pay sales tax on a car in Missouri?

Missouri's criminal failure to pay sales tax penalty is an up to $10,000 fine and/or imprisonment for up to 5 years.

What personal property is exempt in Missouri?

Under Missouri Law, the following property may be exempt: 1) Property owned by the State or other political subdivision such as city, county, public water district, etc. 2) Agricultural and Horticultural societies and non-profit cemeteries. 3) Property used exclusively for religious worship.

What is exempt from use tax in Missouri?

The non-reusable items of tangible personal property furnished in hotels and motels are not subject to sales tax. Non-reusable items include (but are not limited to) soap, shampoo, tissue, other toiletries, food, or confectionery items.

How do I get a sales tax waiver in Missouri?

You may be entitled to a tax waiver if one of the following applies: A new Missouri resident. First licensed asset you have ever owned. You did not own any personal property on January 1st of the prior year. You are in the military and your home of record is not Missouri (LES papers are required)

What is the income tax exemption in Missouri?

The 2021 standard deduction allows taxpayers to reduce their taxable income by $12,550 for single filers, $25,100 for married filing jointly, $18,800 for head of household and $25,100 for qualifying widows/widowers.

What is Missouri tax-exempt form 5060?

Not-for-Profit Construction Contracts Only the materials incorporated into the real property are exempt. Missouri Form 5060 requires the following information: The exempt entity's name, address, Missouri tax identification number, and a signature of an authorized representative.

How do I get a tax-exempt number for my farm in Missouri?

How to Claim the Missouri Sales Tax Exemption for Agriculture. In order to claim the Missouri sales tax exemption for agriculture, qualifying agricultural producers must fully complete a Missouri Form 149 Sales and Use Tax Exemption Certificate and furnish this completed form to their sellers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute MO DoR 5060 online?

pdfFiller has made it simple to fill out and eSign MO DoR 5060. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make edits in MO DoR 5060 without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your MO DoR 5060, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How can I edit MO DoR 5060 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing MO DoR 5060.

What is MO DoR 5060?

MO DoR 5060 is a tax form used in Missouri for reporting income and deductions to the Department of Revenue.

Who is required to file MO DoR 5060?

Individuals and entities that have taxable income in Missouri are required to file MO DoR 5060.

How to fill out MO DoR 5060?

To fill out MO DoR 5060, provide personal information, report income and deductions, and sign the form before submitting it to the Missouri Department of Revenue.

What is the purpose of MO DoR 5060?

The purpose of MO DoR 5060 is to report and assess tax liabilities for income earned in Missouri.

What information must be reported on MO DoR 5060?

Information that must be reported on MO DoR 5060 includes taxpayer identification details, total income, deductions, and tax credits.

Fill out your MO DoR 5060 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO DoR 5060 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.