Get the free Lodgers Tax ApplicationRuidoso-NM.govMunicipal ...

Show details

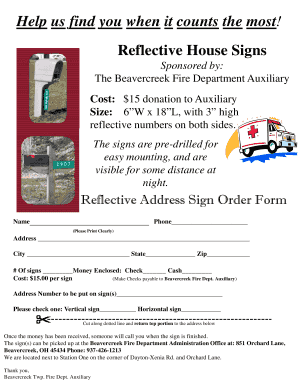

123 Downs Drive Voodoo Downs, NM 88346 5753784422LODGING ESTABLISHMENT APPLICATION LODGERS TAX IMPOSED, City of Voodoo Downs Municipal Code Chapter 36, imposed an occupancy tax of revenues of five

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lodgers tax applicationruidoso-nmgovmunicipal

Edit your lodgers tax applicationruidoso-nmgovmunicipal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lodgers tax applicationruidoso-nmgovmunicipal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing lodgers tax applicationruidoso-nmgovmunicipal online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit lodgers tax applicationruidoso-nmgovmunicipal. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lodgers tax applicationruidoso-nmgovmunicipal

How to fill out lodgers tax applicationruidoso-nmgovmunicipal

01

To fill out the lodgers tax application for Ruidoso-NMGov Municipal, follow these steps:

02

Obtain the lodgers tax application form from the Ruidoso-NMGov Municipal website or any other designated source.

03

Provide your personal information including name, address, phone number, and email address.

04

Fill in the details of your lodging establishment, such as the name, address, and type of accommodation.

05

Specify the duration of your operation and the number of lodging units available.

06

Provide the rates charged for lodging and any additional charges or fees.

07

Include documentation of your gross rental receipts for the previous year.

08

Sign and date the application, certifying the accuracy of the information provided.

09

Submit the completed application and any required supporting documents to the Ruidoso-NMGov Municipal office.

10

Await review and approval of your application by the relevant authorities.

11

Once approved, continue to fulfill your obligations regarding lodgers tax reporting and payments as required by the municipality.

12

Please note that these steps are general guidelines, and it is advisable to refer to the specific instructions provided on the lodgers tax application form for Ruidoso-NMGov Municipal.

Who needs lodgers tax applicationruidoso-nmgovmunicipal?

01

Anyone who operates a lodging establishment within the jurisdiction of Ruidoso-NMGov Municipal needs to fill out the lodgers tax application. This includes hotels, motels, vacation rentals, bed and breakfasts, and any other businesses that provide overnight accommodation for which lodging taxes are applicable. Whether you are a new lodging operator or an existing one, it is important to comply with the lodgers tax requirements set by the municipality.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send lodgers tax applicationruidoso-nmgovmunicipal to be eSigned by others?

Once your lodgers tax applicationruidoso-nmgovmunicipal is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I sign the lodgers tax applicationruidoso-nmgovmunicipal electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your lodgers tax applicationruidoso-nmgovmunicipal in seconds.

How can I edit lodgers tax applicationruidoso-nmgovmunicipal on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing lodgers tax applicationruidoso-nmgovmunicipal right away.

What is lodgers tax applicationruidoso-nmgovmunicipal?

The lodgers tax application for Ruidoso, NM, is a form that property owners or operators of lodging facilities must complete to report and remit taxes on the lodging services they provide.

Who is required to file lodgers tax applicationruidoso-nmgovmunicipal?

All operators of lodging facilities in Ruidoso, NM, including hotels, motels, vacation rentals, and any establishment that provides short-term accommodations for guests, are required to file this application.

How to fill out lodgers tax applicationruidoso-nmgovmunicipal?

To fill out the lodgers tax application, complete all required fields including business information, lodging details, and the amount of tax collected. Ensure accuracy and provide any necessary supporting documents.

What is the purpose of lodgers tax applicationruidoso-nmgovmunicipal?

The purpose of the lodgers tax application is to collect and remit taxes that fund local tourism and infrastructure projects, benefiting the community and enhancing visitor experiences.

What information must be reported on lodgers tax applicationruidoso-nmgovmunicipal?

The application requires information such as the operator's name, business address, type of lodging, total nights rented, gross receipts from lodging, and the amount of lodgers tax collected.

Fill out your lodgers tax applicationruidoso-nmgovmunicipal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lodgers Tax Applicationruidoso-Nmgovmunicipal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.