Get the free Small Business Accounting Guide - 20+ TipsQuickBooks

Show details

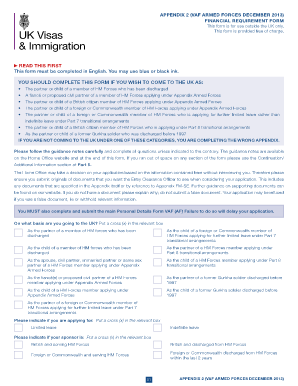

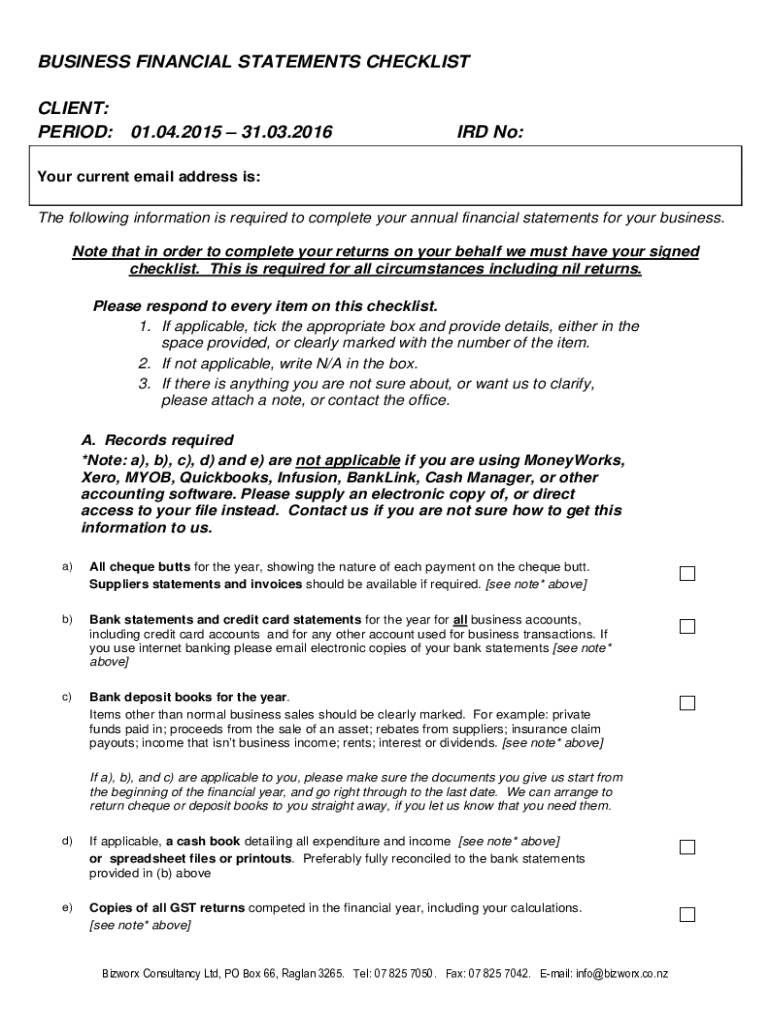

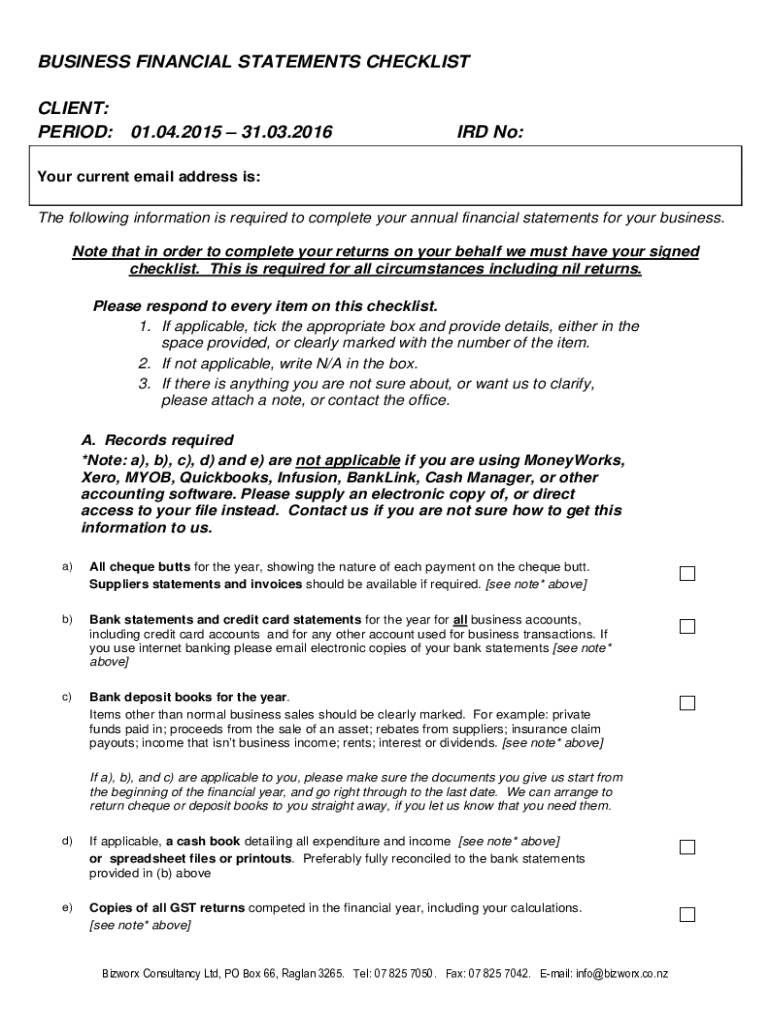

BUSINESS FINANCIAL STATEMENTS CHECKLIST CLIENT: PERIOD: 01.04.2015 31.03.2016IRD No:Your current email address is: The following information is required to complete your annual financial statements

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small business accounting guide

Edit your small business accounting guide form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small business accounting guide form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing small business accounting guide online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit small business accounting guide. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small business accounting guide

How to fill out small business accounting guide

01

Step 1: Gather all relevant financial documents such as receipts, invoices, and bank statements.

02

Step 2: Create a chart of accounts to categorize your income and expenses.

03

Step 3: Set up a bookkeeping system, either manually or using accounting software.

04

Step 4: Record all financial transactions accurately and consistently in your bookkeeping system.

05

Step 5: Reconcile bank statements with your bookkeeping records to ensure accuracy.

06

Step 6: Generate financial reports such as income statements and balance sheets to analyze your business's financial health.

07

Step 7: Regularly review and analyze your financial reports to make informed business decisions.

08

Step 8: Consult with a professional accountant or bookkeeper if you need assistance or have complex financial situations.

09

Step 9: Stay organized and keep up with your bookkeeping tasks on a regular basis to maintain accurate records.

10

Step 10: Periodically review and update your small business accounting guide to reflect any changes in your financial processes or regulations.

Who needs small business accounting guide?

01

Small business owners who want to stay on top of their finances and make informed decisions.

02

Entrepreneurs who are starting a new business and need guidance on how to set up and maintain their accounting system.

03

Freelancers and solopreneurs who need to track their income and expenses for tax purposes.

04

Non-profit organizations that need to maintain proper financial records to comply with legal requirements and demonstrate transparency.

05

Small business owners who want to apply for loans or attract potential investors and need accurate financial statements to support their applications.

06

Anyone who wants to gain a better understanding of their business's financial performance and make data-driven decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get small business accounting guide?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the small business accounting guide in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I complete small business accounting guide online?

Completing and signing small business accounting guide online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How can I edit small business accounting guide on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit small business accounting guide.

What is small business accounting guide?

A small business accounting guide is a resource designed to help small business owners understand accounting principles, manage their financial records, and comply with tax regulations.

Who is required to file small business accounting guide?

Small business owners, including sole proprietors, partnerships, and corporations that meet specific financial criteria, are required to file a small business accounting guide.

How to fill out small business accounting guide?

To fill out a small business accounting guide, follow the provided instructions, gather necessary financial documents, and systematically input your financial data into the designated sections of the guide.

What is the purpose of small business accounting guide?

The purpose of the small business accounting guide is to provide a structured framework for tracking income and expenses, assisting with tax preparation, and ensuring compliance with accounting standards.

What information must be reported on small business accounting guide?

The information that must be reported includes revenue, expenses, assets, liabilities, and equity, as well as any other financial data relevant to the business's operations.

Fill out your small business accounting guide online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Business Accounting Guide is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.