Get the free 2011 S-COLI Consent - SLUS - insurance arkansas

Show details

Este documento es una solicitud de consentimiento para la compra de un seguro de vida por parte de la compañía en nombre del asegurado propuesto. Incluye detalles sobre el cumplimiento de normas

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2011 s-coli consent

Edit your 2011 s-coli consent form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011 s-coli consent form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2011 s-coli consent online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2011 s-coli consent. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2011 s-coli consent

How to fill out 2011 S-COLI Consent - SLUS

01

Obtain the 2011 S-COLI Consent form from the relevant department or website.

02

Ensure you have all necessary personal information ready, such as your name, address, and date of birth.

03

Fill in any required fields on the form accurately.

04

Review the consent details provided in the form to understand what you are agreeing to.

05

Sign and date the form in the designated spaces.

06

Submit the completed form as instructed, whether it be online or through traditional mail.

Who needs 2011 S-COLI Consent - SLUS?

01

Individuals who are participating in a study or program that requires the 2011 S-COLI Consent.

02

Participants in clinical trials or research studies related to health and safety.

03

Any person whose information is being collected and used for research purposes under this consent form.

Fill

form

: Try Risk Free

People Also Ask about

Is coli unethical?

Key Takeaways It helps businesses cover financial losses from the death of key employees and can fund benefits. Death benefits are usually tax-free, and cash value growth is tax-deferred. Legal and ethical concerns may arise, especially if policies are taken out without employee consent.

What is the meaning of coli in insurance?

Company-owned life insurance (COLI), also referred to as corporate-owned life insurance, is a policy taken out on one or more critical employees. The company pays the insurance premiums and receives the death benefit if a covered employee dies.

Are life insurance premiums tax deductible for a S-corporation?

Can you deduct life insurance premiums as a business expense for S-Corps & LLCs? The short answer is: yes, it's possible to utilize a life insurance business expense as an S corporation or LLC. However, there are some stipulations in order to take advantage of a life insurance tax deductible business expense.

Is coli tax deductible?

Corporate-owned life insurance (COLI) premiums are generally not tax-deductible for businesses. However, the policy's cash value grows tax-deferred, and death benefits paid to the company are typically received tax-free, providing other financial advantages.

Can I claim my life insurance premiums on my taxes?

Life insurance premiums are not typically income tax deductible because they are considered to be a personal expense.

Which insurance premiums are tax deductible?

If you've paid premiums or expenses with after-tax money, you may be able to deduct: Medical insurance. Dental insurance. Prescription medications. Medicare A insurance (if you're enrolled voluntarily and not as a Social Security recipient or government employee) Medicare B supplemental insurance.

Are coli premiums tax deductible?

Business Expense Deductions: While the premiums paid on COLI policies are generally not tax-deductible, the cash value growth and the tax-free death benefits make it an attractive option for companies looking to optimize their financial strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

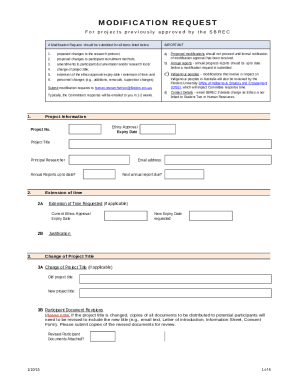

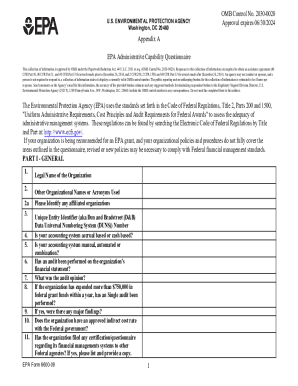

What is 2011 S-COLI Consent - SLUS?

The 2011 S-COLI Consent - SLUS is a specific consent form required for entities involved in the S-Corporation and Limited Liability Company community to disclose certain financial and operational information for compliance purposes.

Who is required to file 2011 S-COLI Consent - SLUS?

Entities that operate as S-Corporations and Limited Liability Companies (LLCs) and are using the S-COLI consent for reporting and compliance purposes are required to file the 2011 S-COLI Consent - SLUS.

How to fill out 2011 S-COLI Consent - SLUS?

To fill out the 2011 S-COLI Consent - SLUS, entities must provide accurate information regarding their financial status, company structure, and any other relevant details as outlined in the form instructions.

What is the purpose of 2011 S-COLI Consent - SLUS?

The purpose of the 2011 S-COLI Consent - SLUS is to ensure compliance with tax regulations and to facilitate the proper reporting of financial information for S-Corporations and LLCs.

What information must be reported on 2011 S-COLI Consent - SLUS?

The information that must be reported on the 2011 S-COLI Consent - SLUS includes details about company ownership, financial data, operational activities, and any other pertinent information that ensures transparency and compliance with applicable regulations.

Fill out your 2011 s-coli consent online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2011 S-Coli Consent is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.