Get the free Payroll Reconciliation with Payroll Services

Show details

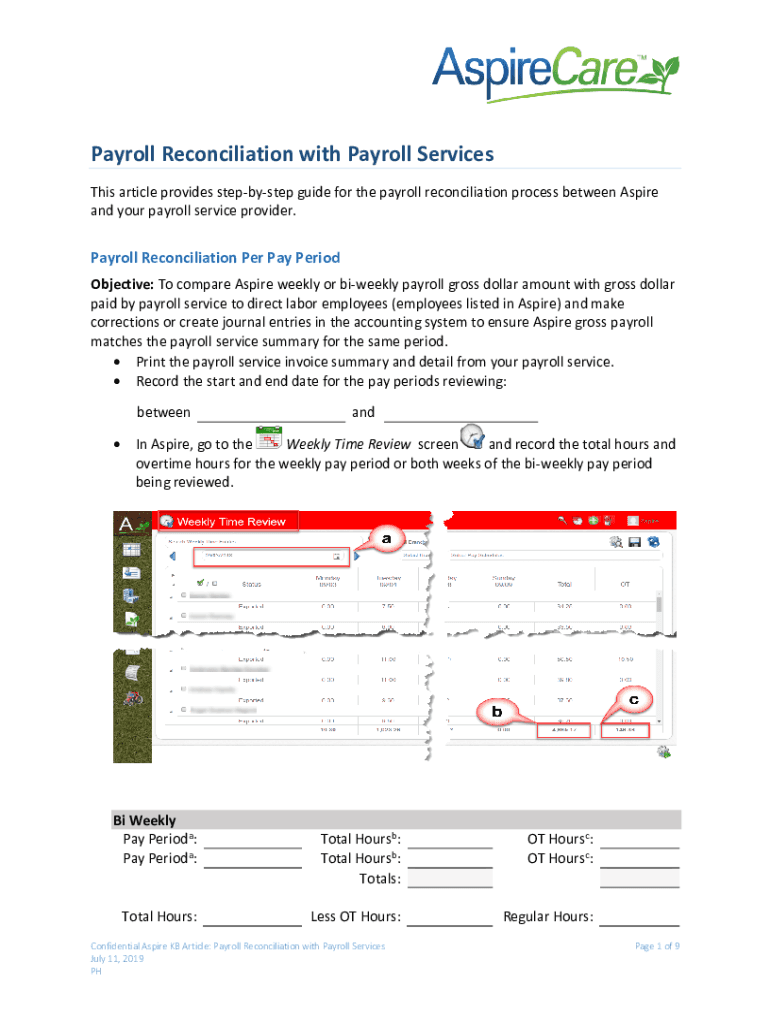

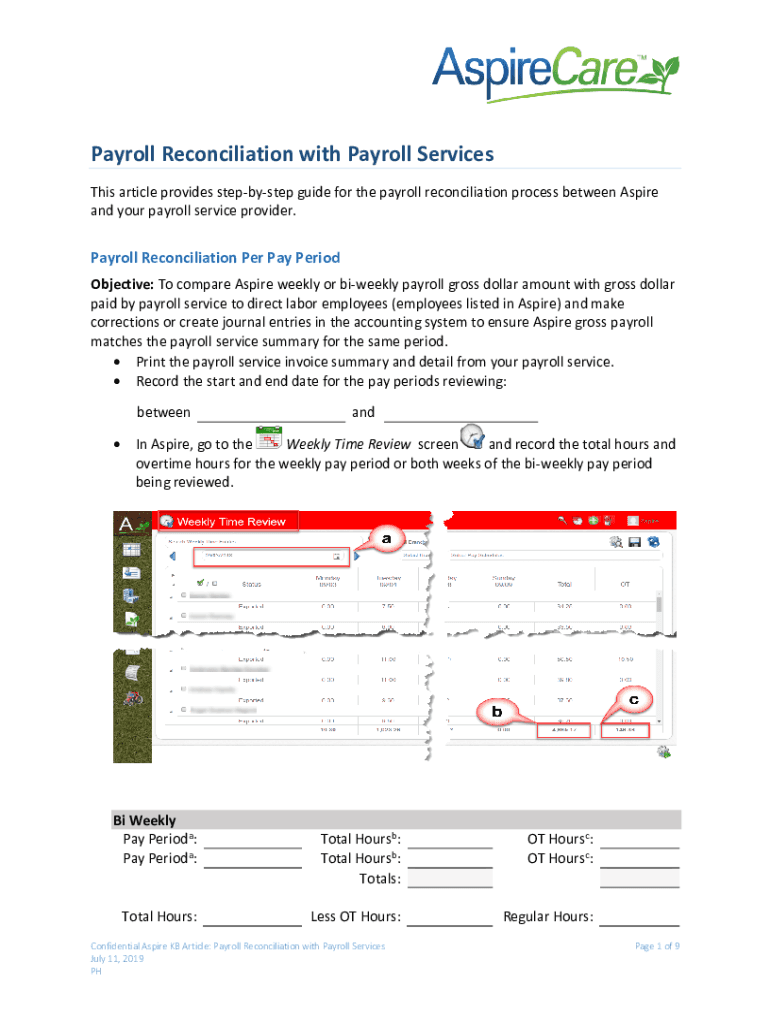

Payroll Reconciliation with Payroll Services This article provides stepsister guide for the payroll reconciliation process between Aspire and your payroll service provider. Payroll Reconciliation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payroll reconciliation with payroll

Edit your payroll reconciliation with payroll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll reconciliation with payroll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payroll reconciliation with payroll online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit payroll reconciliation with payroll. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payroll reconciliation with payroll

How to fill out payroll reconciliation with payroll

01

To fill out payroll reconciliation with payroll, follow these steps:

02

Gather all payroll records, including pay stubs, timesheets, and any other relevant documents.

03

Calculate the total amount of wages paid for the specified period.

04

Subtract any deductions or taxes that were withheld from the wages.

05

Verify that the calculated net pay matches the actual amount paid to employees.

06

Compare the payroll records with the corresponding general ledger accounts to ensure accuracy.

07

Reconcile any discrepancies between the payroll records and the general ledger accounts.

08

Prepare a summary of the payroll reconciliation, including any adjustments made.

09

Review the reconciliation report for accuracy and completeness.

10

Keep a copy of the payroll reconciliation report for future reference or auditing purposes.

Who needs payroll reconciliation with payroll?

01

Payroll reconciliation with payroll is needed by companies or organizations that have employees and need to ensure that their payroll records are accurate and complete.

02

It is particularly important for businesses that have multiple employees or complex payroll systems to carry out regular reconciliations to identify and rectify any errors or discrepancies in their payroll records.

03

Small businesses, medium-sized enterprises, and large corporations alike can benefit from conducting payroll reconciliation to maintain accurate financial records and comply with regulatory requirements.

04

Additionally, payroll reconciliation can be helpful for internal auditing purposes and to provide a clear overview of labor costs for management and financial reporting.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the payroll reconciliation with payroll electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your payroll reconciliation with payroll in seconds.

How do I edit payroll reconciliation with payroll on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign payroll reconciliation with payroll right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I edit payroll reconciliation with payroll on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as payroll reconciliation with payroll. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is payroll reconciliation with payroll?

Payroll reconciliation is the process of comparing and verifying the payroll records of a company to ensure that the amounts paid to employees, as well as the taxes withheld, are accurate and match the company's financial records.

Who is required to file payroll reconciliation with payroll?

Employers are required to file payroll reconciliation with payroll. This applies to all businesses that have employees and are subject to payroll taxes.

How to fill out payroll reconciliation with payroll?

To fill out payroll reconciliation, employers typically need to gather payroll records, including gross wages, deductions, and tax liabilities. They must ensure these figures match their financial statements and tax filings before submitting the reconciliation form to the appropriate tax authority.

What is the purpose of payroll reconciliation with payroll?

The purpose of payroll reconciliation is to ensure accuracy in payroll processing, validate that the payroll taxes are correctly withheld and paid, and to help identify any discrepancies that may affect financial reporting and tax obligations.

What information must be reported on payroll reconciliation with payroll?

The information that must be reported includes total wages paid, total taxes withheld, contributions to retirement plans, and any other deductions. Employers must also report the total amounts paid to each employee during the reconciliation period.

Fill out your payroll reconciliation with payroll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Reconciliation With Payroll is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.