Get the free Revenue Consequences of 162(m)

Show details

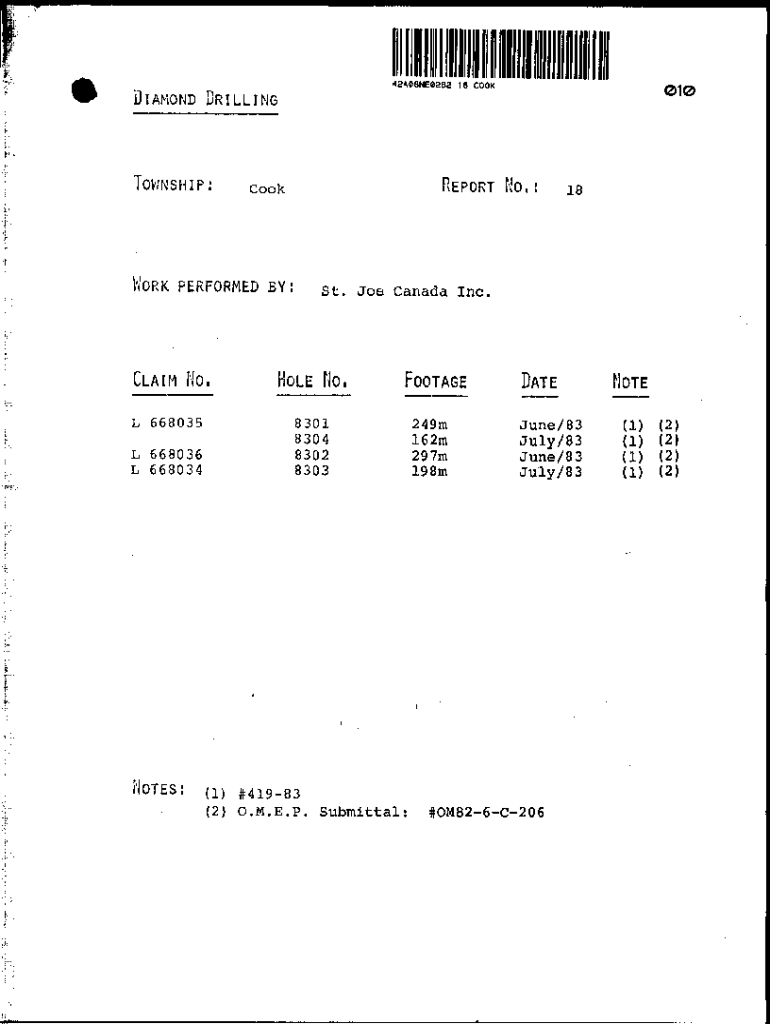

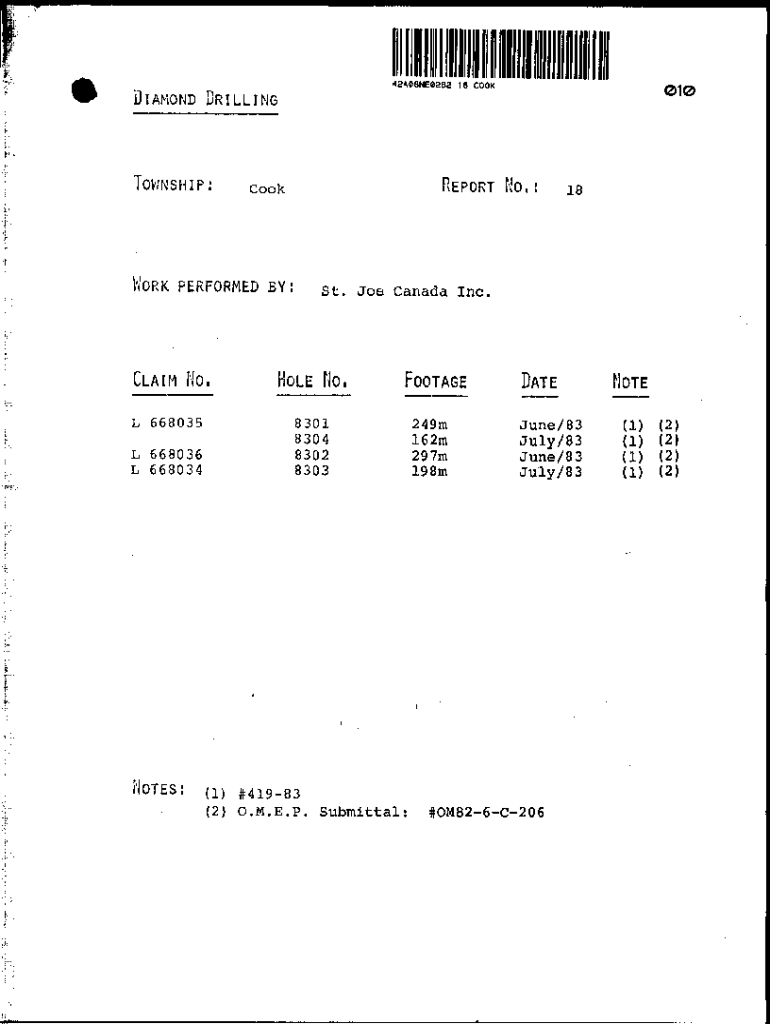

42A08NE0a63 16 COOK010DIAMOND DRILLINGTOWNSHIP:REPORT No, CookWORK PERFORMED BY’s t. Joe Canada Inc. CLAIM No, HOLE No, L 6680358301

8304

8302

8303L 668036

L 668034NOTES:FOOTAGE

249 m

162 m

297 m

198mDATE

June/83

July/83

June/83

July/83(1)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revenue consequences of 162m

Edit your revenue consequences of 162m form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revenue consequences of 162m form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit revenue consequences of 162m online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit revenue consequences of 162m. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revenue consequences of 162m

How to fill out revenue consequences of 162m

01

Start by accessing the revenue documentation or form provided by the relevant authority.

02

Locate the section or field specifically designated for reporting revenue consequences.

03

Enter the amount '162m' in the designated field or section. Make sure to use the correct format and units specified by the documentation.

04

Double-check the accuracy of the entered value to ensure it matches the intended revenue consequences of 162 million.

05

Save or submit the filled-out revenue form as per the instructions provided.

06

If required, retain a copy of the filled-out form for your records or as proof of reporting.

Who needs revenue consequences of 162m?

01

Various individuals or entities may need the revenue consequences of 162m depending on the context. Potential stakeholders who might need this information include:

02

- Accountants or financial analysts who are responsible for analyzing financial data and preparing financial statements.

03

- Business owners or executives who need to assess the financial impact of revenue consequences on their organization.

04

- Tax authorities or government agencies that require accurate reporting of revenue consequences for taxation or regulatory purposes.

05

- Investors or shareholders who rely on financial information to make informed decisions about their investments.

06

- Research institutions or academic scholars studying the economic or financial implications of revenue consequences.

07

- Legal professionals involved in litigation or dispute resolution that may require understanding the revenue consequences of a specific amount.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute revenue consequences of 162m online?

pdfFiller makes it easy to finish and sign revenue consequences of 162m online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make edits in revenue consequences of 162m without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing revenue consequences of 162m and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit revenue consequences of 162m on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute revenue consequences of 162m from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is revenue consequences of 162m?

The revenue consequences of 162 million typically refer to the financial impact or implications that a revenue amount of 162 million may have on a business or entity's financial statements, tax obligations, and compliance requirements.

Who is required to file revenue consequences of 162m?

Entities or individuals that report revenue exceeding 162 million are generally required to file the corresponding revenue consequences as part of their tax or financial reporting obligations.

How to fill out revenue consequences of 162m?

To fill out revenue consequences of 162 million, one must gather all relevant financial data, follow the prescribed reporting format, ensure accuracy in figures, and submit the document according to the guidelines provided by the tax authority or regulatory body.

What is the purpose of revenue consequences of 162m?

The purpose of reporting revenue consequences of 162 million is to ensure transparency, compliance with tax laws, and proper financial reporting which helps in assessing the financial health and tax obligations of an entity.

What information must be reported on revenue consequences of 162m?

Information that must be reported may include total revenue figures, breakdown of different revenue streams, tax implications, deductions, and any relevant notes or explanations required by the reporting authorities.

Fill out your revenue consequences of 162m online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revenue Consequences Of 162m is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.