Get the free Property Tax Appeals - Sterling Education Services

Show details

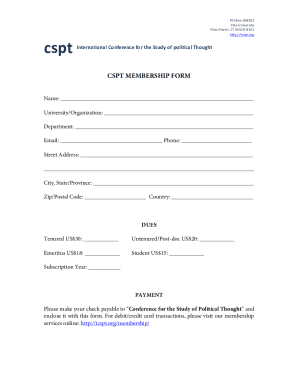

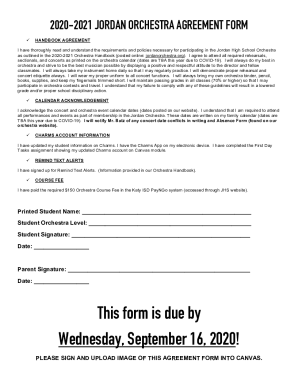

WWW.sterlingeducation.com 11MI12288 P.O. BOX 3127 EAU CLAIRE, WI 54702-3127 (715) 855-0498 E-mail Address Phone STERLING EDUCATION SERVICES, Inc. City State Zip 8 Address SES Firm/Company Name st

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property tax appeals

Edit your property tax appeals form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax appeals form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing property tax appeals online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit property tax appeals. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property tax appeals

How to fill out property tax appeals:

01

Begin by gathering all relevant information about your property and its value. This may include property appraisals, recent sales data of similar properties in your area, and any documentation regarding improvements or damages to your property.

02

Review the assessment notice or tax bill that you received from your local tax authority. Understand the deadlines and procedures for filing an appeal, as these may vary depending on your jurisdiction.

03

Complete the necessary forms for filing a property tax appeal. These forms may be available online or through your local tax authority. Provide accurate and detailed information about your property and why you believe the assessment or tax bill is incorrect.

04

Attach any supporting documents or evidence that strengthen your case. This could include photographs, repair receipts, or expert appraisals.

05

Submit your completed appeal forms and supporting documents to the appropriate department or office, making sure to meet all deadlines and follow any specific submission instructions.

06

Be prepared to attend an appeal hearing or meeting if required. This may involve presenting your case to a tax appeals board or a similar authority. Prepare any necessary presentations or statements to effectively argue your position.

07

If your appeal is successful, you may receive a reduced property tax bill or a revised property assessment. If your appeal is denied, you may explore further legal options or consider reapplying in the future.

Who needs property tax appeals?

01

Homeowners who believe their property has been overvalued and are therefore paying higher property taxes than necessary.

02

Property owners who have made improvements or repairs to their property that have not been accurately reflected in their property assessment.

03

Individuals who have recently purchased a property and believe the assessed value does not align with the purchase price or current market conditions.

04

Business owners who feel their commercial property has been incorrectly assessed, leading to higher property taxes than they should be paying.

05

Real estate investors or developers who need to ensure that their property is assessed accurately for taxation purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send property tax appeals to be eSigned by others?

When your property tax appeals is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I get property tax appeals?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the property tax appeals. Open it immediately and start altering it with sophisticated capabilities.

How do I make changes in property tax appeals?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your property tax appeals to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Fill out your property tax appeals online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Appeals is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.