Get the free Calculation of capital cost allowance on form T2125

Show details

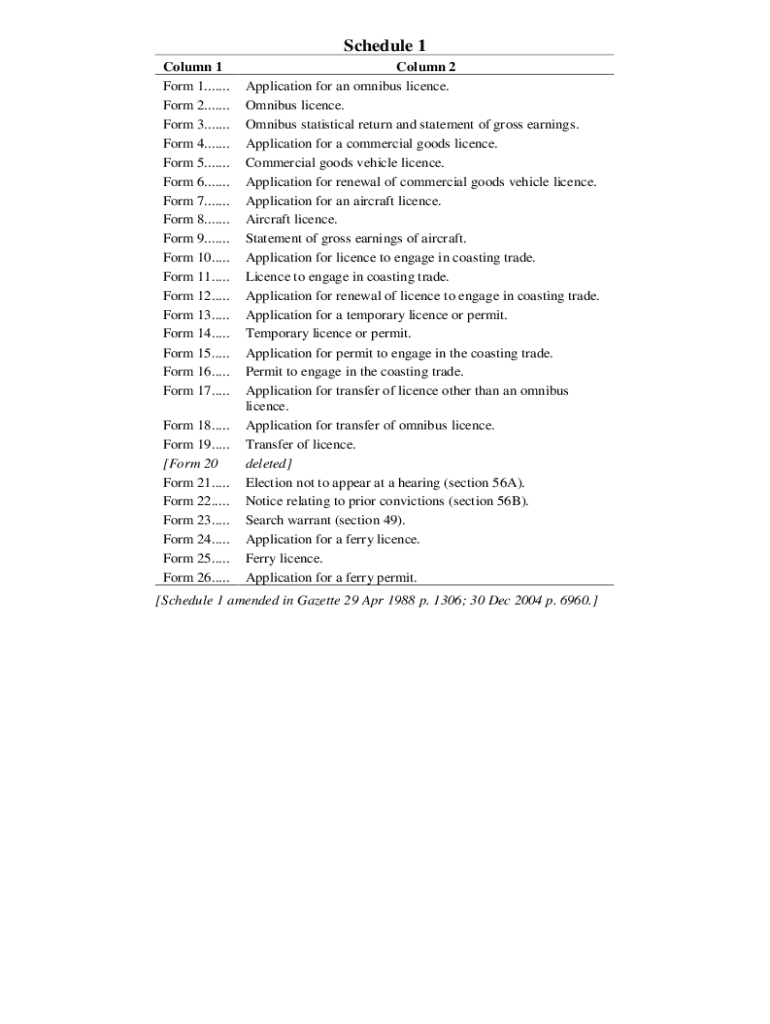

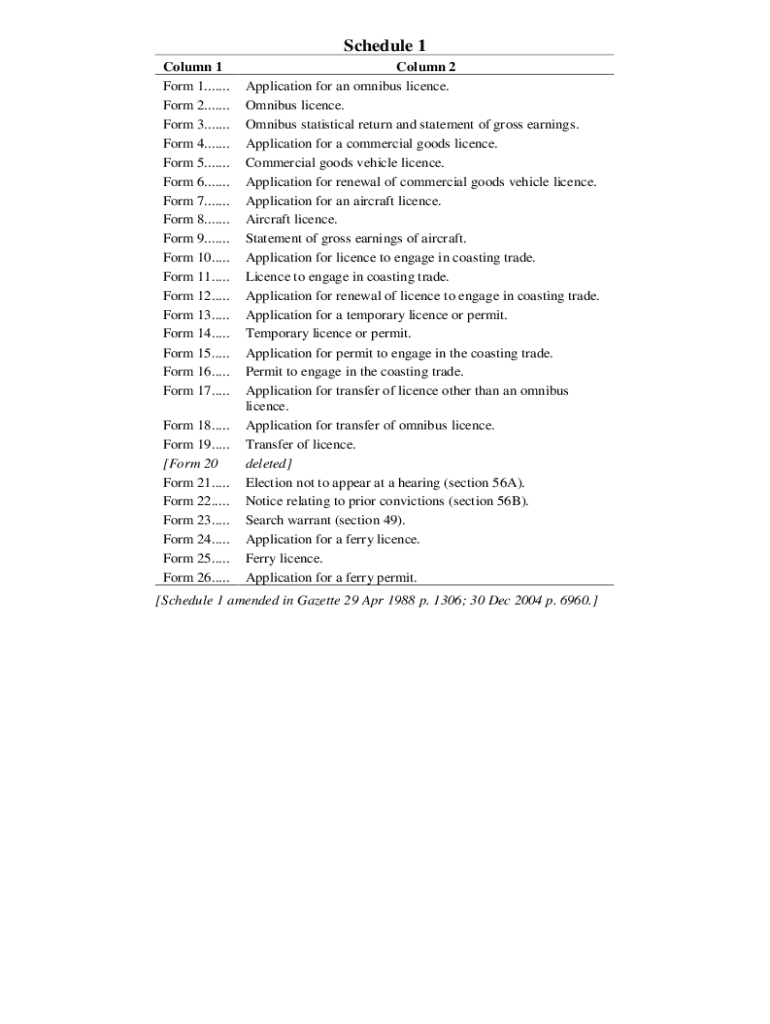

Schedule 1 Column 1 Form 1....... Form 2....... Form 3....... Form 4....... Form 5....... Form 6....... Form 7....... Form 8....... Form 9....... Form 10..... Form 11..... Form 12..... Form 13.....

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign calculation of capital cost

Edit your calculation of capital cost form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your calculation of capital cost form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit calculation of capital cost online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit calculation of capital cost. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out calculation of capital cost

How to fill out calculation of capital cost

01

Identify all the capital assets that need to be included in the calculation.

02

Determine the initial cost of each capital asset. This includes both the purchase cost and any installation or delivery costs.

03

Determine the useful life of each capital asset. This is the estimated period of time over which the asset will be used for the business.

04

Calculate the depreciation expense for each capital asset. This can be done using various depreciation methods, such as straight-line depreciation or declining balance method.

05

Determine the salvage value of each capital asset. This is the estimated value of the asset at the end of its useful life.

06

Calculate the annual depreciation expense for each capital asset by dividing the depreciable cost (initial cost - salvage value) by the useful life.

07

Sum up the annual depreciation expenses for all the capital assets to get the total annual depreciation expense.

08

Calculate the weighted average cost of capital (WACC) for the business. This includes the cost of debt and the cost of equity.

09

Calculate the weighted average cost of debt by multiplying the cost of debt by the proportion of debt in the capital structure.

10

Calculate the weighted average cost of equity by multiplying the cost of equity by the proportion of equity in the capital structure.

11

Add the weighted average cost of debt and the weighted average cost of equity to get the overall cost of capital.

12

Calculate the capital cost by subtracting the total annual depreciation expense from the overall cost of capital.

Who needs calculation of capital cost?

01

Businesses and organizations that are planning to make significant capital investments.

02

Companies that need to evaluate the financial feasibility of capital projects.

03

Financial analysts and investors who want to assess the profitability and financial health of a business.

04

Government agencies and regulatory bodies that require capital cost estimation for regulatory purposes.

05

Management teams that need to make informed decisions regarding capital budgeting and allocation of resources.

06

Lenders and creditors who want to evaluate the creditworthiness of a business before providing financing.

07

Insurance companies that need to determine the replacement value of capital assets for insurance coverage purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in calculation of capital cost?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your calculation of capital cost to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I sign the calculation of capital cost electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your calculation of capital cost in seconds.

How can I fill out calculation of capital cost on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your calculation of capital cost, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is calculation of capital cost?

Calculation of capital cost refers to the process of determining the total expenses incurred in acquiring or upgrading assets, which includes the purchase price, installation costs, and any other expenses necessary to prepare the asset for use.

Who is required to file calculation of capital cost?

Businesses and individuals who acquire or improve capital assets are required to file a calculation of capital cost as part of their financial reporting and tax obligations.

How to fill out calculation of capital cost?

To fill out the calculation of capital cost, categorize all costs associated with the asset, including acquisition, installation, and related expenses. Input these figures into the appropriate forms as required by tax authorities, ensuring accuracy and completeness.

What is the purpose of calculation of capital cost?

The purpose of calculation of capital cost is to provide an accurate assessment of the total investment in capital assets, which is essential for determining depreciation, tax deductions, and financial reporting.

What information must be reported on calculation of capital cost?

The information that must be reported includes the type of capital asset, acquisition date, purchase price, installation costs, and any additional expenses related to the asset's acquisition or improvement.

Fill out your calculation of capital cost online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Calculation Of Capital Cost is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.