Get the free Small Business Credit Card Disclosure

Show details

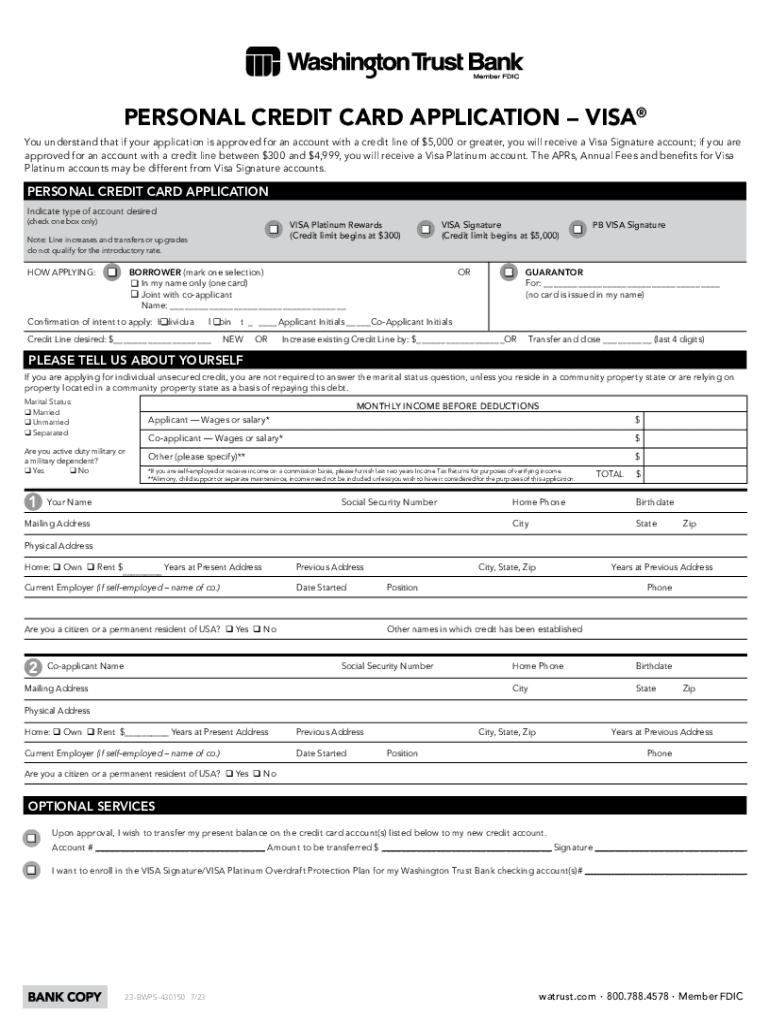

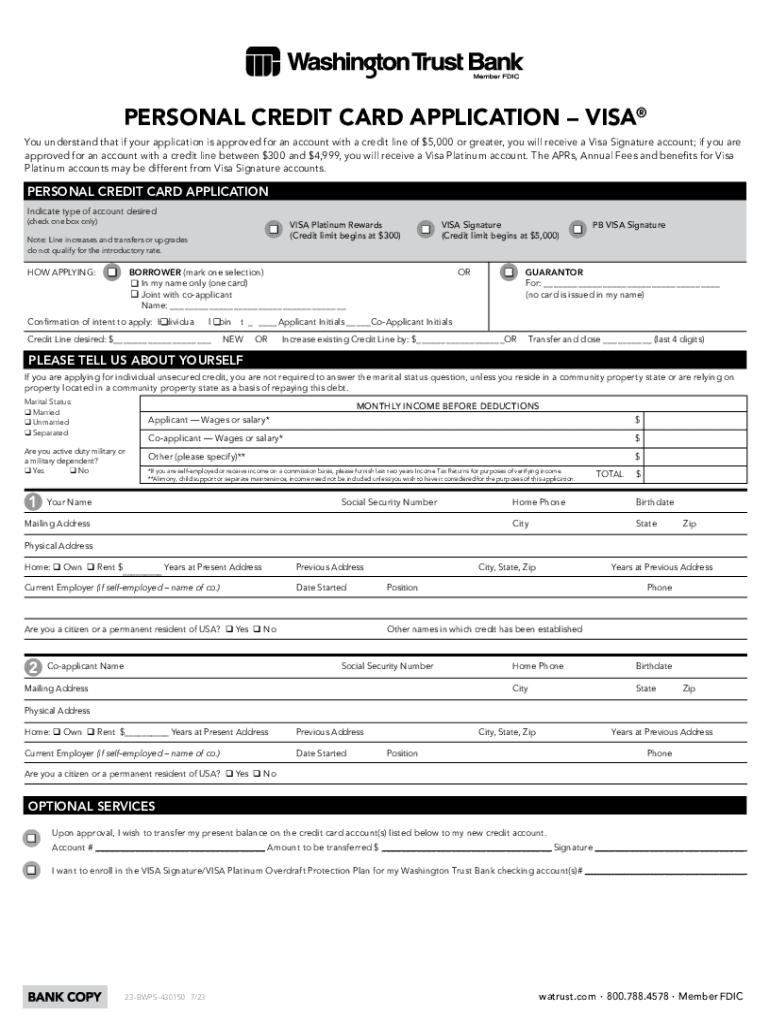

PERSONAL CREDIT CARD APPLICATION VISA You understand that if your application is approved for an account with a credit line of $5,000 or greater, you will receive a Visa Signature account; if you

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small business credit card

Edit your small business credit card form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small business credit card form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit small business credit card online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit small business credit card. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small business credit card

How to fill out small business credit card

01

Gather all the necessary documents and information such as business identification, financial statements, and personal identification.

02

Research and compare different small business credit card options to find the one that best fits your needs and offers the most favorable terms.

03

Visit the chosen credit card provider's website or contact them directly to start the application process.

04

Complete the online application form or fill out a physical application form if available.

05

Provide accurate information about your business, including name, address, phone number, and industry.

06

Enter your personal information, such as your name, date of birth, Social Security number, and contact details.

07

Provide the necessary financial information, including annual revenue, average monthly expenses, and any outstanding debts.

08

Review the terms and conditions of the credit card carefully before submitting the application.

09

Submit the application and wait for a response from the credit card provider. This may take a few days to process.

10

If approved, receive your small business credit card in the mail and activate it according to the instructions provided.

11

Start using your small business credit card responsibly and make timely payments to build a positive credit history.

Who needs small business credit card?

01

Small business owners who want to separate their business expenses from personal expenses.

02

Entrepreneurs who need access to a line of credit to make necessary business purchases.

03

Startups or new businesses looking to establish credit and build a credit history for future financing.

04

Businesses that frequently make online purchases and need a secure and convenient payment method.

05

Companies that have employees who require business credit cards for travel expenses or other business-related needs.

06

Businesses looking to take advantage of rewards programs, cashback offers, or other benefits provided by credit card issuers.

07

Businesses that want to track and manage their expenses more efficiently by having all transactions recorded in one place.

08

Companies that need the extra flexibility and financial cushion that a credit card can provide in times of unexpected expenses or emergencies.

09

Businesses that want to establish relationships with credit card providers and banks for future financial partnerships and opportunities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my small business credit card directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your small business credit card and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Where do I find small business credit card?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific small business credit card and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for the small business credit card in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is small business credit card?

A small business credit card is a financial tool designed specifically for small business owners, allowing them to make purchases on credit while managing their business expenses more effectively.

Who is required to file small business credit card?

Typically, small business credit card holders need to file if they have employees or if their business meets certain reporting thresholds set by the IRS.

How to fill out small business credit card?

To fill out a small business credit card application, provide your business details, including the legal business name, address, tax identification number, and personal information of the owner or authorized users.

What is the purpose of small business credit card?

The purpose of a small business credit card is to help business owners separate personal and business expenses, manage cash flow, earn rewards, and build business credit.

What information must be reported on small business credit card?

Information such as business income, business expenses, and employee information, if applicable, must be reported for tax purposes related to small business credit card use.

Fill out your small business credit card online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Business Credit Card is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.