Get the free Claims Investigation Red Flags

Show details

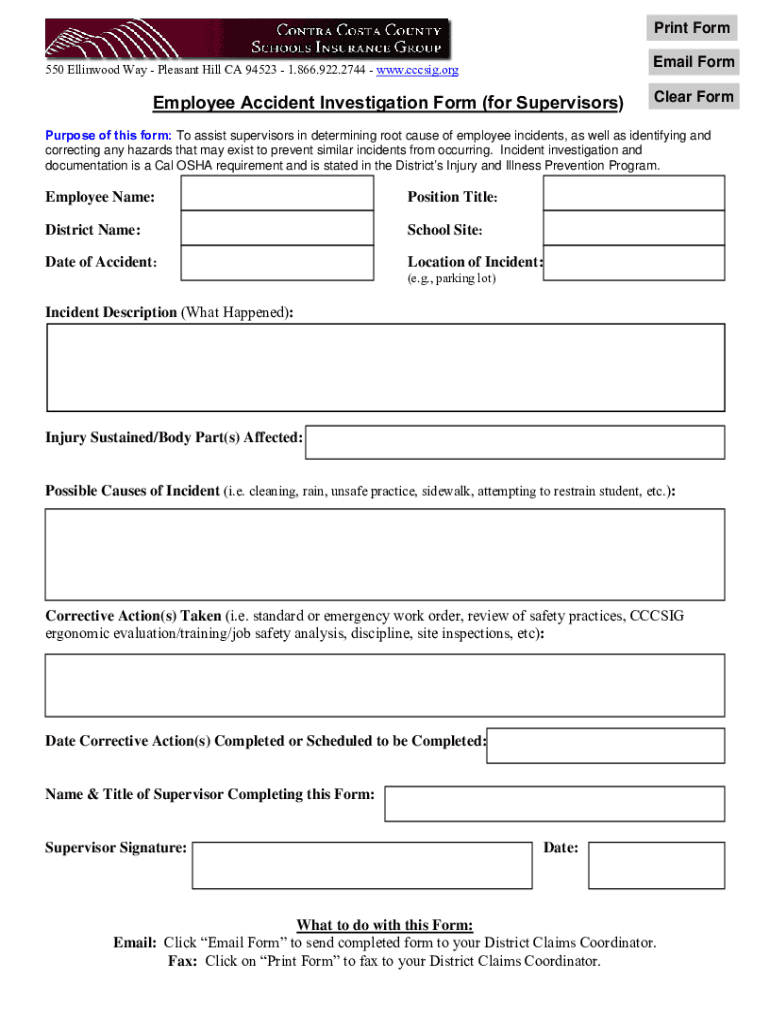

Print Form Email Form550 Linwood Way Pleasant Hill CA 94523 1.866.922.2744 www.cccsig.orgEmployee Accident Investigation Form (for Supervisors)Clear Repurpose of this form: To assist supervisors in

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claims investigation red flags

Edit your claims investigation red flags form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claims investigation red flags form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit claims investigation red flags online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit claims investigation red flags. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claims investigation red flags

How to fill out claims investigation red flags

01

Gather all relevant information and documentation related to the claims investigation.

02

Identify the specific red flags or indicators that may suggest potential fraudulent activity or suspicious claims.

03

Evaluate any inconsistencies or discrepancies in the provided information and documentation.

04

Conduct a thorough investigation by interviewing involved parties, conducting site visits, and collecting any additional evidence.

05

Document all findings and observations during the investigation process.

06

Analyze the gathered information and determine the validity of the claims.

07

If suspicious activity is identified, escalate the case for further investigation or legal action.

08

Take appropriate actions based on the investigation findings, such as denying the claim, referring it for legal action, or implementing preventive measures to mitigate future risks.

09

Communicate the investigation results to relevant stakeholders and maintain proper documentation for reference purposes.

Who needs claims investigation red flags?

01

Insurance companies

02

Claims adjusters

03

Risk management departments

04

Fraud detection units

05

Law enforcement agencies

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the claims investigation red flags in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your claims investigation red flags and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out claims investigation red flags using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign claims investigation red flags. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Can I edit claims investigation red flags on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share claims investigation red flags from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is claims investigation red flags?

Claims investigation red flags are indicators or warning signs that suggest potential fraud, misrepresentation, or irregularities in a claim. They help investigators identify suspicious activities warranting further scrutiny.

Who is required to file claims investigation red flags?

Insurance companies, claims adjusters, and other entities involved in processing and investigating claims are typically required to file claims investigation red flags.

How to fill out claims investigation red flags?

To fill out claims investigation red flags, gather relevant information about the claim, document any suspicious activities or discrepancies, and accurately complete the designated forms according to the guidelines provided by the regulatory body.

What is the purpose of claims investigation red flags?

The purpose of claims investigation red flags is to detect and prevent fraudulent claims, protect against financial loss, and ensure that only legitimate claims are paid out.

What information must be reported on claims investigation red flags?

Information that must be reported includes details about the claim, identified red flags, any evidence of suspicious behavior, and findings from the investigation.

Fill out your claims investigation red flags online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claims Investigation Red Flags is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.