Get the free Earnings Upside vs Multiple for Stock Selection

Show details

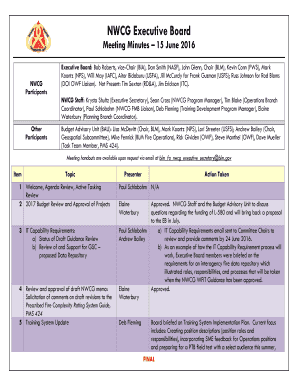

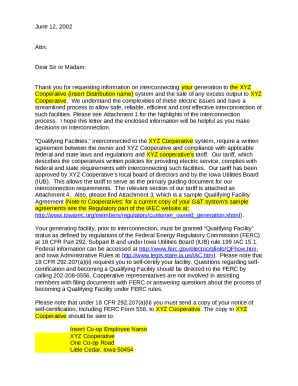

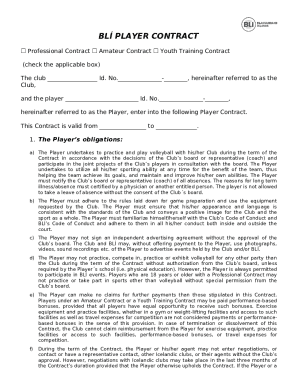

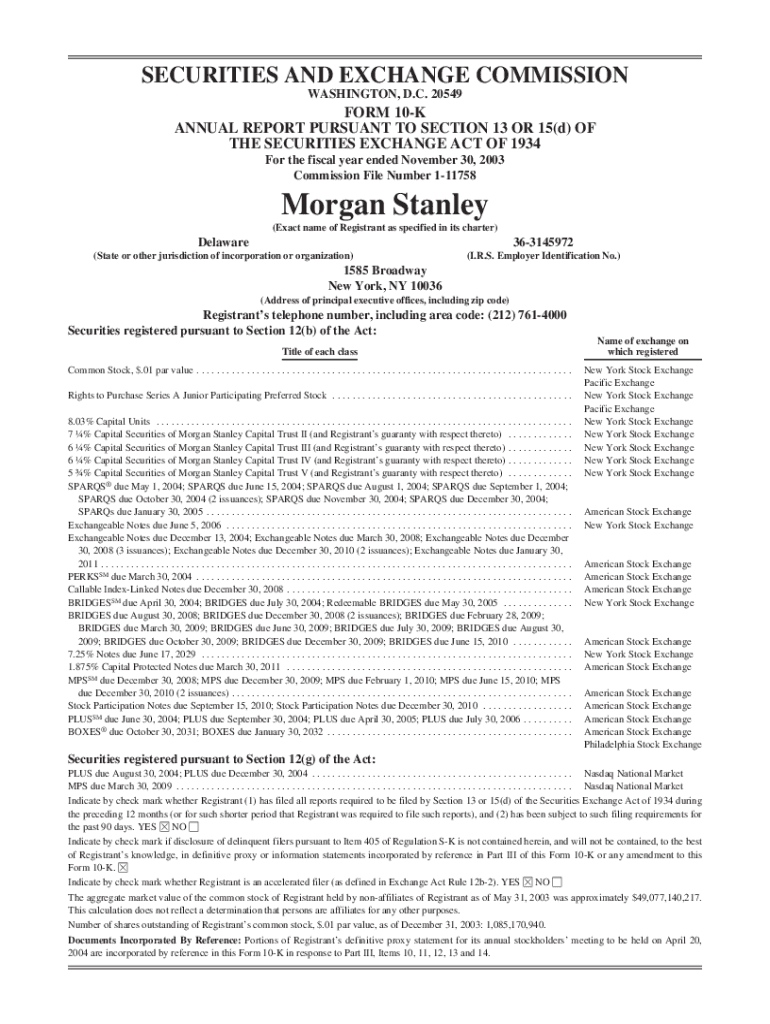

SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549FORM 10K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended November 30, 2003,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign earnings upside vs multiple

Edit your earnings upside vs multiple form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your earnings upside vs multiple form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing earnings upside vs multiple online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit earnings upside vs multiple. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out earnings upside vs multiple

How to fill out earnings upside vs multiple

01

Understand the concept of earnings upside vs multiple: Earnings upside refers to the potential increase in a company's earnings in the future, while multiple refers to the price-to-earnings ratio (P/E ratio) of a company's stock.

02

Start by analyzing the company's historical financial statements, including income statements, balance sheets, and cash flow statements. This will help you assess the company's earnings growth over time and identify any potential upside.

03

Evaluate the company's competitive position in the market and its ability to generate future revenue growth. Look for factors such as market demand, industry trends, and the company's unique value proposition.

04

Assess the company's cost structure and profitability drivers. Analyze the company's margins, operating efficiency, and ability to control costs and expenses. This will give you insights into the company's earnings potential.

05

Consider macroeconomic factors and industry-specific dynamics that could impact the company's earnings potential. Look at factors like economic growth, interest rates, regulatory environment, and technological advancements.

06

Compare the company's earnings upside with its valuation multiple. A low valuation multiple relative to earnings upside may indicate an undervalued stock, while a high multiple may indicate an overvalued stock.

07

Take into account the company's risk profile and potential downside risks. Assess factors like competition, industry disruption, regulatory changes, and geopolitical risks that could impact the company's earnings.

08

Use financial models and valuation techniques to estimate the potential upside in earnings and determine an appropriate multiple for the company's stock. This will help you make informed investment decisions.

Who needs earnings upside vs multiple?

01

Investors interested in value investing: Earnings upside vs multiple is relevant for investors who follow a value investing approach. These investors are looking for undervalued stocks that have the potential for future earnings growth.

02

Analysts and financial professionals: Professionals working in finance and investment industry, such as analysts, portfolio managers, and investment bankers, need to understand and assess earnings upside vs multiple to make informed investment recommendations.

03

Company executives and management: Executives and management teams of publicly traded companies need to understand earnings upside vs multiple to effectively communicate their company's growth potential to investors and analysts.

04

Individual investors: Individual investors who actively manage their investment portfolio can benefit from understanding earnings upside vs multiple to make informed buy or sell decisions.

05

Researchers and academics: Researchers and academics studying finance and investments may analyze earnings upside vs multiple to develop new theories and models in the field of financial analysis.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my earnings upside vs multiple in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your earnings upside vs multiple and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I make changes in earnings upside vs multiple?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your earnings upside vs multiple to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I fill out earnings upside vs multiple on an Android device?

Use the pdfFiller app for Android to finish your earnings upside vs multiple. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is earnings upside vs multiple?

Earnings upside vs multiple refers to the relationship between a company's projected earnings growth and its current valuation multiple, such as price-to-earnings (P/E) ratio. It examines how much the stock price might increase based on anticipated earnings improvements.

Who is required to file earnings upside vs multiple?

Typically, public companies and investment funds are required to file earnings upside vs multiple as part of their financial reporting to inform investors about potential growth and valuation.

How to fill out earnings upside vs multiple?

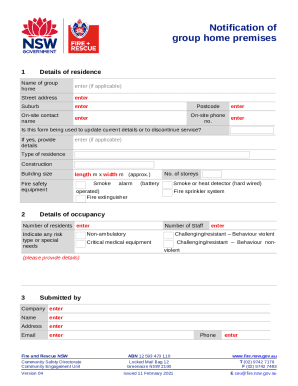

To fill out earnings upside vs multiple, the filer must input current earnings forecasts, historical earnings data, current market multiples, and projected growth rates into the designated reporting forms set by regulatory organizations.

What is the purpose of earnings upside vs multiple?

The purpose of earnings upside vs multiple is to provide stakeholders with insights into a company's future potential for growth in relation to its current valuation, helping them make informed investment decisions.

What information must be reported on earnings upside vs multiple?

The information that must be reported includes earnings forecasts, actual earnings history, relevant market multiples, and any assumptions or methodologies used in calculating potential upside.

Fill out your earnings upside vs multiple online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Earnings Upside Vs Multiple is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.