Get the free Fourth Quarter and Full Year 2022 MD&A and Financial ...

Show details

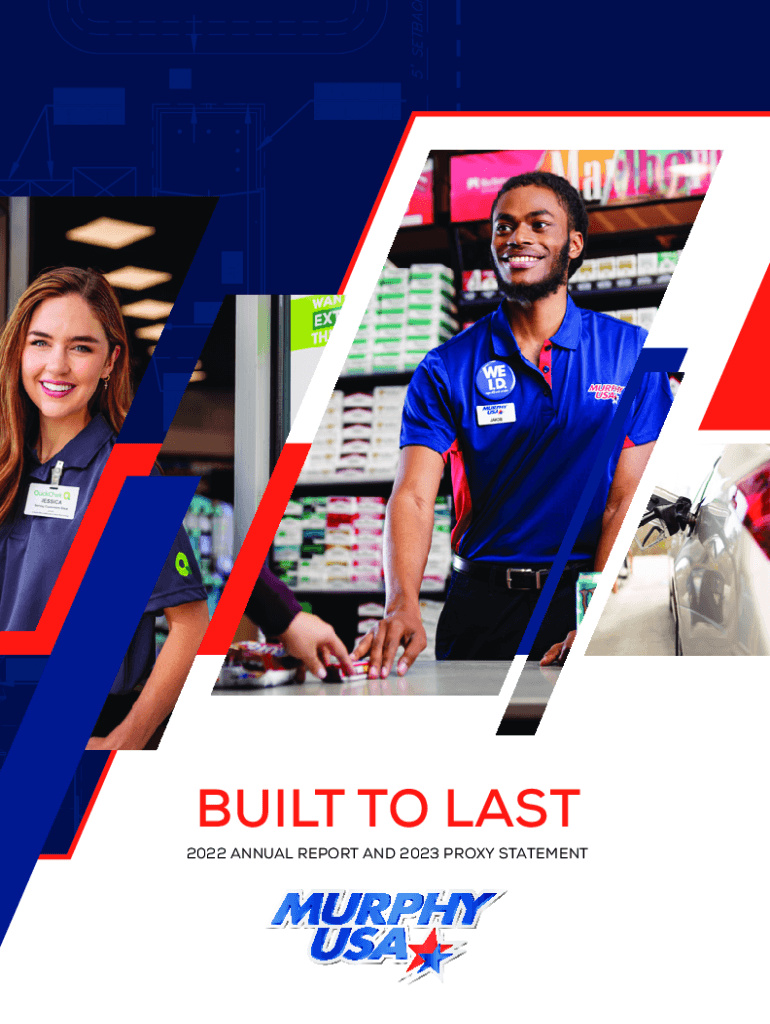

BUILT TO LAST 2022 ANNUAL REPORT AND 2023 PROXY STATEMENTFINANCIAL HIGHLIGHTS 20182019202020212022FUEL METRICS4.2324.3743.9014.3524.752Retail fuel gallons sold (per store month)Total retail gallons

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fourth quarter and full

Edit your fourth quarter and full form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fourth quarter and full form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fourth quarter and full online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fourth quarter and full. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fourth quarter and full

How to fill out fourth quarter and full

01

To fill out the fourth quarter and full, follow these steps:

02

Gather all relevant financial information for the fourth quarter and full year, such as sales revenue, expenses, and profit calculations.

03

Prepare the income statement by recording the revenue earned and subtracting the expenses incurred during the fourth quarter and full year. This will give you the net income or loss for the period.

04

Compile the balance sheet by listing the company's assets, liabilities, and equity as of the end of the fourth quarter and full year.

05

Calculate and record the cash flows for the period in the statement of cash flows, categorizing them as operating activities, investing activities, and financing activities.

06

Analyze the financial statements and provide explanations for any significant changes or fluctuations compared to previous quarters or years.

07

Review the disclosures and footnotes to ensure compliance with accounting standards and regulations.

08

Make any necessary adjustments or corrections to the financial statements based on the analysis and review.

09

Prepare a summary or management report highlighting the key financial results and insights for the fourth quarter and full year.

10

Obtain necessary approvals and sign-off from management or relevant stakeholders, if required.

11

File the completed fourth quarter and full year financial statements with the appropriate regulatory bodies or stakeholders, ensuring compliance with reporting deadlines and requirements.

Who needs fourth quarter and full?

01

Fourth quarter and full financial statements are required by various stakeholders, including:

02

- Business owners and management to assess the financial performance and profitability for the period.

03

- Investors and shareholders to make informed decisions about their investments.

04

- Banks and lenders to evaluate the creditworthiness and financial stability of the company.

05

- Regulatory authorities to ensure compliance with reporting and disclosure requirements.

06

- Tax authorities to determine the accurate tax liability of the company.

07

- Potential buyers or partners during business mergers or acquisitions to assess the financial health of the company.

08

- Analysts and financial professionals for conducting financial analysis and forecasting future performance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify fourth quarter and full without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your fourth quarter and full into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an eSignature for the fourth quarter and full in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your fourth quarter and full right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit fourth quarter and full straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing fourth quarter and full right away.

What is fourth quarter and full?

The fourth quarter refers to the last three months of a calendar year, typically encompassing October, November, and December. The term 'full' generally refers to reporting that includes the entire year's data.

Who is required to file fourth quarter and full?

Employers and businesses that withhold taxes need to file fourth quarter and full-year reports with relevant tax authorities, such as the IRS in the United States.

How to fill out fourth quarter and full?

To fill out the fourth quarter and full reports, gather all necessary financial and payroll data, complete the relevant forms accurately, and ensure all information such as income, deductions, and withheld taxes are correctly reported.

What is the purpose of fourth quarter and full?

The purpose of filing fourth quarter and full reports is to summarize the last period's financial activities and report the total withheld taxes for the year to ensure compliance with tax regulations.

What information must be reported on fourth quarter and full?

Details such as total wages paid, total taxes withheld, and the employer's identification information must be reported on the fourth quarter and full-year forms.

Fill out your fourth quarter and full online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fourth Quarter And Full is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.