Get the free Fiscal Note Process: An Overview - Maine State Legislature

Show details

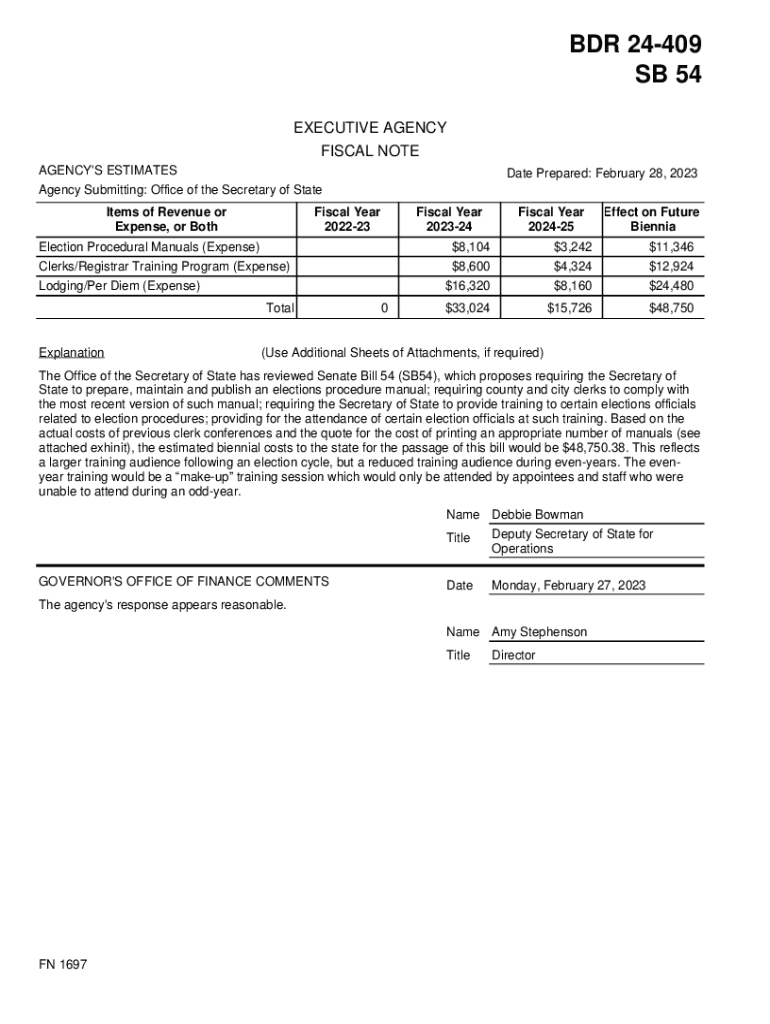

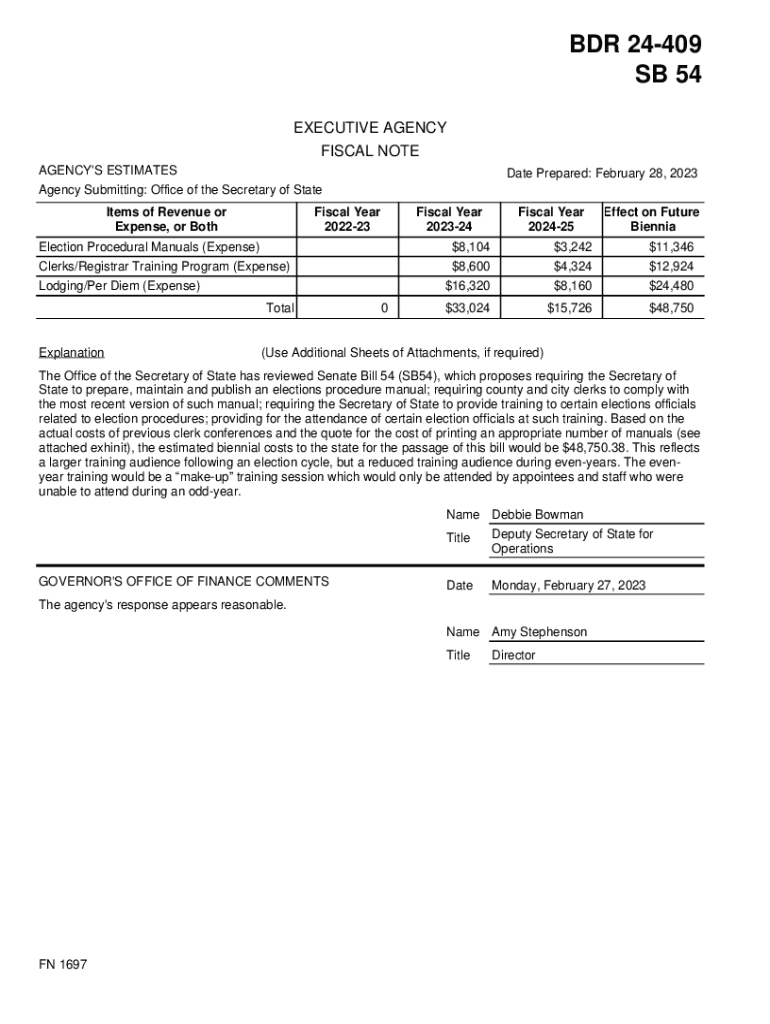

BDR 24409 SB 54 EXECUTIVE AGENCY FISCAL NOTE AGENCY\'S ESTIMATESDate Prepared: February 28, 2023Agency Submitting: Office of the Secretary of State Items of Revenue or Expense, or Botanical Year 202223Fiscal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiscal note process an

Edit your fiscal note process an form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiscal note process an form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fiscal note process an online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fiscal note process an. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fiscal note process an

How to fill out fiscal note process an

01

To fill out a fiscal note process, follow these steps:

02

Gather all necessary information: Collect all relevant data, including projected costs, potential benefits, and any other financial implications of the proposed action.

03

Analyze the impact: Assess the potential effects of the proposed action on the organization's budget, staffing, programs, and services.

04

Estimate financial impact: Use the gathered information to estimate the financial impact of the proposed action. This may involve calculations or projections based on historical data or expert analysis.

05

Document findings: Clearly document the analysis and findings in a fiscal note form or document provided by the appropriate authority.

06

Review and refine: Review the filled out fiscal note for accuracy, clarity, and completeness. Make any necessary revisions or adjustments.

07

Seek approval: Submit the completed fiscal note to the appropriate authority or department for review and approval.

08

Implement recommendations: If necessary, implement the recommendations outlined in the approved fiscal note.

09

Monitor and evaluate: Continuously monitor the implementation of the proposed action and evaluate its financial impact over time.

Who needs fiscal note process an?

01

Various entities and individuals may need to go through the fiscal note process, including:

02

- Government agencies: Government agencies at various levels (federal, state, local) may need to assess the fiscal impact of proposed policies, programs, or regulations.

03

- Legislators: Lawmakers may require fiscal notes to understand the financial implications of proposed bills or amendments.

04

- Non-profit organizations: Non-profit organizations receiving government funding or involved in advocacy work may need to provide fiscal notes to demonstrate the potential impact of their initiatives.

05

- Business owners: Business owners who are affected by potential legislative changes or regulatory actions may use fiscal notes to understand the financial consequences and plan accordingly.

06

- Researchers and analysts: Researchers and analysts may use fiscal notes to study the financial effects of various policies or actions.

07

- General public: The general public can benefit from fiscal notes to understand the cost and benefits of proposed actions and voice their opinions based on the financial impact.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find fiscal note process an?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific fiscal note process an and other forms. Find the template you need and change it using powerful tools.

How do I make edits in fiscal note process an without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing fiscal note process an and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the fiscal note process an electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your fiscal note process an in seconds.

What is fiscal note process an?

The fiscal note process is a procedure used to assess the financial implications of proposed legislation, including estimates of costs, benefits, and projected revenues.

Who is required to file fiscal note process an?

Typically, state agencies or legislative sponsors are required to file fiscal notes, especially when proposing new legislation that may have financial implications.

How to fill out fiscal note process an?

To fill out a fiscal note, one must provide details regarding the anticipated financial impact of the proposed legislation, including cost estimates, funding sources, and potential savings.

What is the purpose of fiscal note process an?

The purpose of the fiscal note process is to provide lawmakers and stakeholders with an understanding of the financial consequences of legislative proposals, aiding in informed decision-making.

What information must be reported on fiscal note process an?

Fiscal notes must report estimated costs, projected revenues, fiscal impacts on state or local budgets, and any relevant assumptions used in the analysis.

Fill out your fiscal note process an online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiscal Note Process An is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.