Canada T3 2022-2025 free printable template

Show details

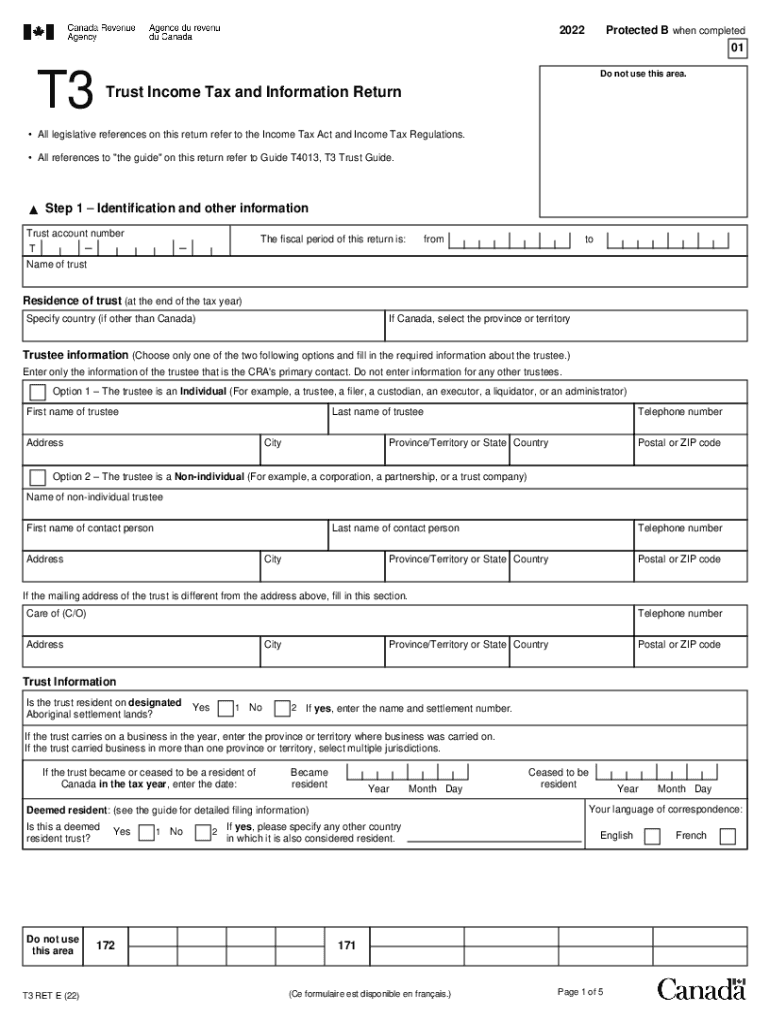

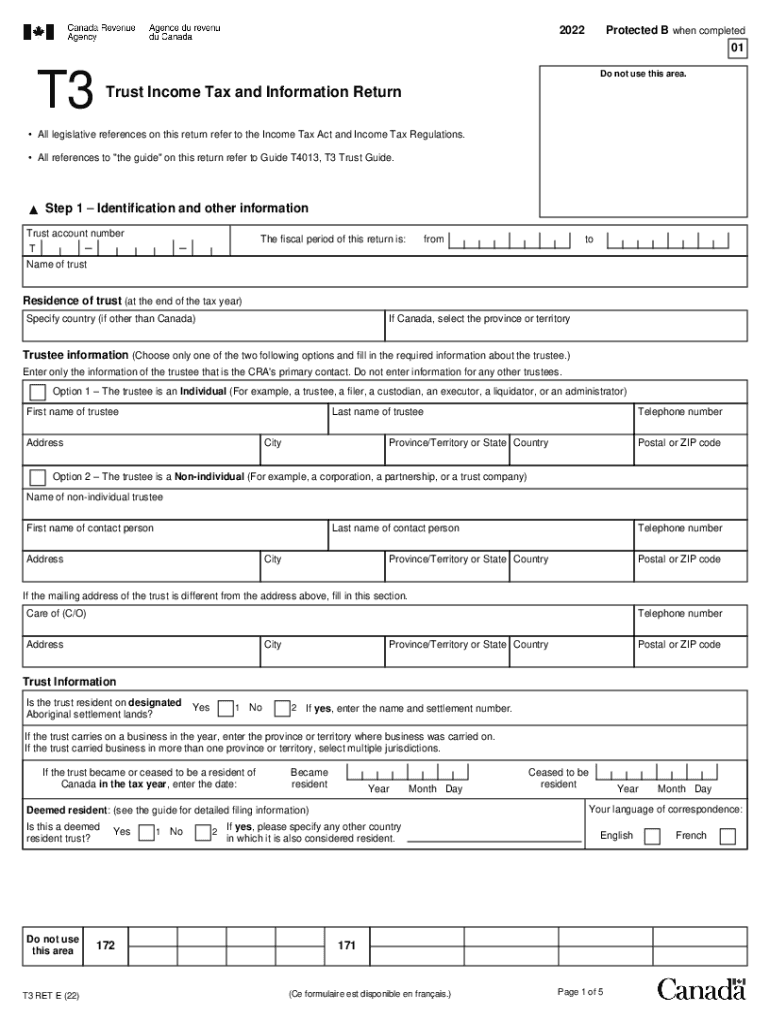

Protected B when completed202201T3Do not use this area.Trust Income Tax and Information Return All legislative references on this return refer to the Income Tax Act and Income Tax Regulations.

All

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign t3ret fillable sample form

Edit your t3ret fillable print form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t3ret form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing t3ret fillable blank online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit t3ret form fillable. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out t3 ret information

How to fill out Canada T3

01

Gather all necessary documents related to the trust, including financial statements and tax records.

02

Ensure you have the trust's business number from the Canada Revenue Agency.

03

Complete Part 1 of the T3 return by providing the trust's name, address, and identification details.

04

Fill out Part 2 by detailing the income of the trust, including capital gains, dividends, and interest.

05

Complete Part 3 to report any distributions made to beneficiaries during the tax year.

06

If applicable, fill out Part 4 to claim credits such as dividend tax credits or foreign tax credits.

07

Review the entire form for accuracy, ensuring all figures match supporting documents.

08

Sign and date the T3 return before submitting it to the Canada Revenue Agency by the due date.

Who needs Canada T3?

01

Any trust that has earned income or capital gains during the tax year.

02

Trustees of estates or registered disability savings plans (RDSPs) that need to report income.

03

Family trusts that distribute income to beneficiaries.

04

Individuals managing pooled investment funds or certain types of partnerships.

Fill

canada t3 ret

: Try Risk Free

People Also Ask about t3ret fillable pdf

What is a T3 statement of trust?

Trusts use the T3 slip, Statement of Trust Income Allocations and Designations, to identify beneficiaries and to report amounts such as income and credits that the trust designates to them. Three individual slips are printed on each page or sheet of the form.

How is trust capital distributed to beneficiaries?

Capital distributions from discretionary trusts The Trustee will use their discretion in ance with the Trust deed and ensure they distribute the capital to the various beneficiaries. The trustee may transfer Trust assets to the beneficiaries in specie, prior to the vesting date.

What is T3 summary of trust income?

A T3 tells you how much income you received from investment in mutual funds in non-registered accounts, from business income trusts or income from an estate for a given tax year.

Can a beneficiary withdraw money from a trust?

With an irrevocable trust, the transfer of assets is permanent. So once the trust is created and assets are transferred, they generally can't be taken out again.

Do beneficiaries pay taxes on trust distributions?

When a portion of a beneficiary's distribution from a trust or the entirety of it originates from the trust's interest income, they generally will be required to pay income taxes on it, unless the trust has already paid the income tax.

How do you report trust income on tax return?

More In Forms and Instructions The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my t3ret fillable template in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign t3 ret e and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an electronic signature for the t3ret fillable printable in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I edit t3ret fillable fill on an iOS device?

You certainly can. You can quickly edit, distribute, and sign t3ret form make on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is Canada T3?

The Canada T3 form is the Trust Income Tax and Information Return, used to report income earned by a trust.

Who is required to file Canada T3?

Trusts that earn income or that dispose of property during the tax year are required to file a T3 return.

How to fill out Canada T3?

To fill out the Canada T3, you must provide details about the trust, its income, and distributions to beneficiaries as well as any applicable receipts or documentation.

What is the purpose of Canada T3?

The purpose of the Canada T3 form is to ensure trust income is reported to the Canada Revenue Agency (CRA) for tax assessment purposes.

What information must be reported on Canada T3?

Information that must be reported on Canada T3 includes income earned by the trust, capital gains, distributions to beneficiaries, and any deductions applicable.

Fill out your Canada T3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

t3ret Form Sample is not the form you're looking for?Search for another form here.

Keywords relevant to t3 tax form

Related to t3 canada

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.