Get the free pension and opeb plan consulting actuarial services

Show details

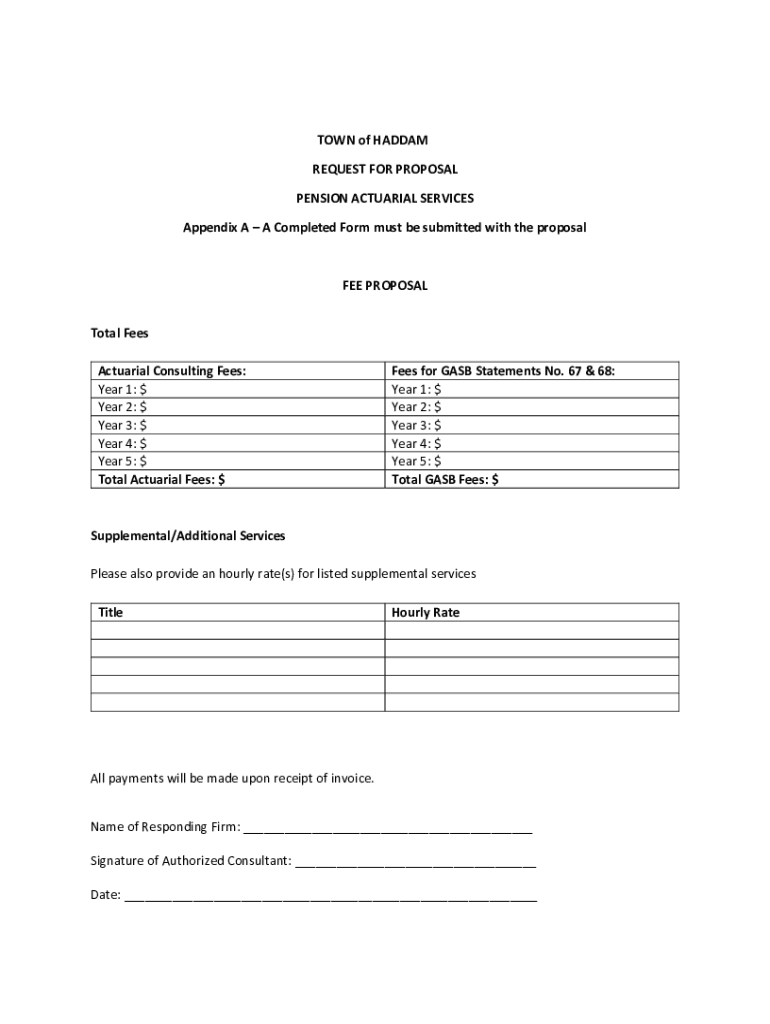

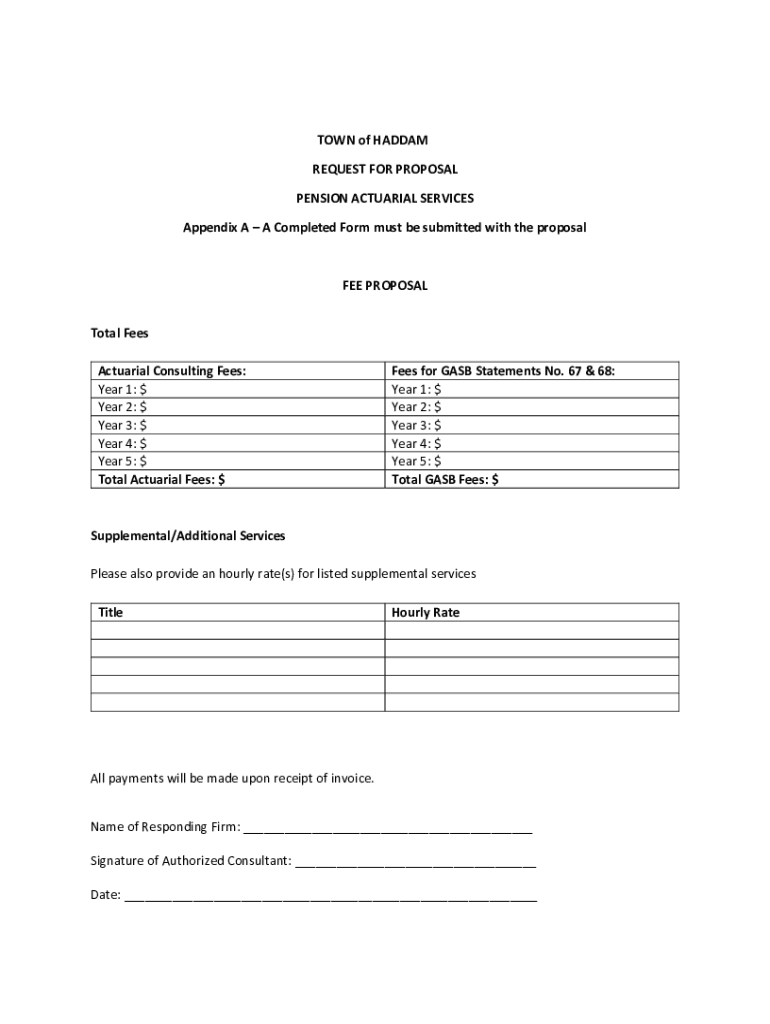

Request for Proposals Municipal Pension Actuarial ServicesIntroduction: The Town of Saddam, Connecticut administers two single employer defined benefit pension plans: The Town Employees Pension Plan

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pension and opeb plan

Edit your pension and opeb plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pension and opeb plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pension and opeb plan online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit pension and opeb plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pension and opeb plan

How to fill out pension and opeb plan

01

To fill out a pension and OPEB (Other Post-Employment Benefits) plan, follow these steps:

1. Collect necessary information such as employee demographics, employment details, and retirement eligibility criteria.

2. Determine the funding method, contribution rates, and investment strategies for the plan.

3. Calculate the actuarial present value of the benefits using appropriate actuarial assumptions.

4. Assess the financial status and compliance of the plan with regulatory requirements.

5. Draft the plan document and obtain necessary approvals.

6. Communicate the plan details and enrollment procedures to employees.

7. Manage the ongoing administration, record-keeping, and periodic valuation of the plan.

8. Monitor the plan's performance and make adjustments as required.

9. Conduct regular actuarial valuations to assess the plan's funded status and project future liabilities.

10. Stay updated with changing regulations and reporting requirements to ensure compliance.

Who needs pension and opeb plan?

01

Pension and OPEB plans are beneficial for various entities, including:

1. Employees: They need these plans to secure their financial future and receive retirement benefits once they stop working.

2. Employers: Offering pension and OPEB plans helps attract and retain talented employees, enhances employee satisfaction, and demonstrates a commitment to employee welfare.

3. Government Agencies: Public sector organizations provide pension and OPEB plans to their employees as part of their compensation packages.

4. Pension Funds: Institutions managing pension funds need these plans to ensure proper funding, investment, and payment of retirement benefits.

5. Insurance Companies: Some insurance companies offer pension and OPEB plans as part of their product portfolio, providing individuals and organizations with the means to secure their post-employment financial needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the pension and opeb plan in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your pension and opeb plan in seconds.

How do I complete pension and opeb plan on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your pension and opeb plan. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I edit pension and opeb plan on an Android device?

You can make any changes to PDF files, like pension and opeb plan, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is pension and opeb plan?

Pension plan is a retirement plan that provides a specified monthly benefit to employees upon retirement. OPEB (Other Post-Employment Benefits) plan refers to benefits other than pensions provided to retirees.

Who is required to file pension and opeb plan?

Employers who offer pension and/or OPEB plans to their employees are required to file the necessary forms and reports with the appropriate regulatory authorities.

How to fill out pension and opeb plan?

Employers must gather all necessary data related to the pension and OPEB plans, complete the required forms accurately, and submit them to the relevant regulatory authorities within the specified deadline.

What is the purpose of pension and opeb plan?

The purpose of pension and OPEB plans is to provide employees with retirement benefits and other post-employment benefits to ensure financial security after they stop working.

What information must be reported on pension and opeb plan?

Employers must report information such as plan assets, liabilities, contributions, benefits paid, and other relevant financial data related to pension and OPEB plans.

Fill out your pension and opeb plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pension And Opeb Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.