Get the free Tax Increment Financing (TIF) Annual ReportCity of Chicago

Show details

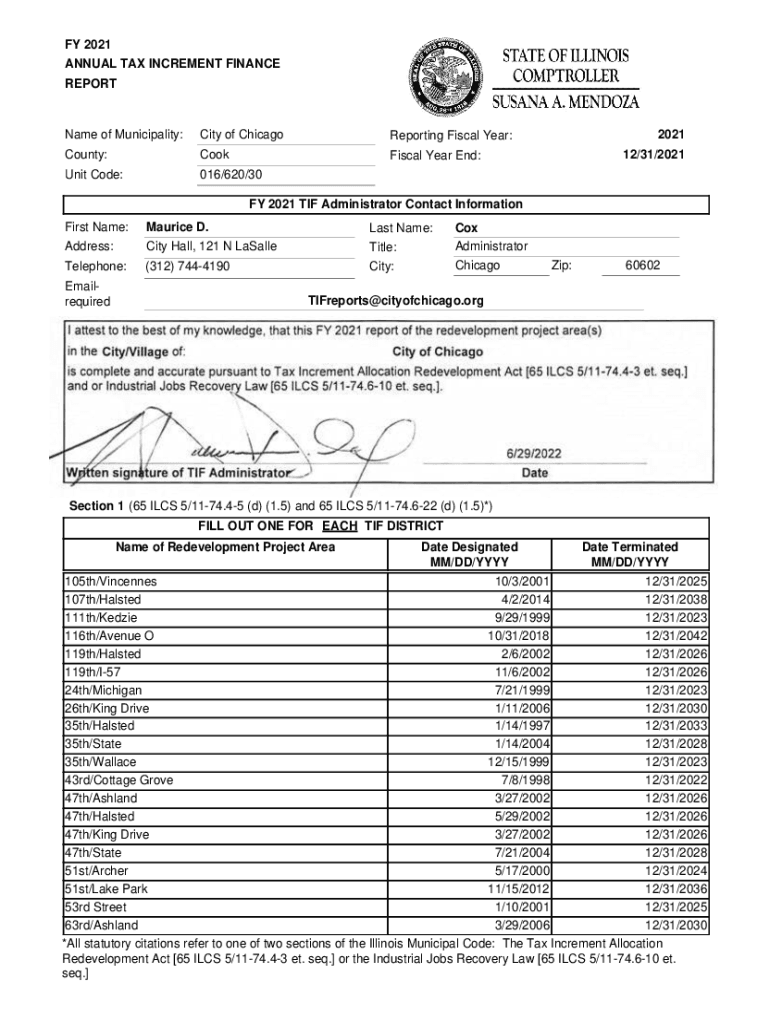

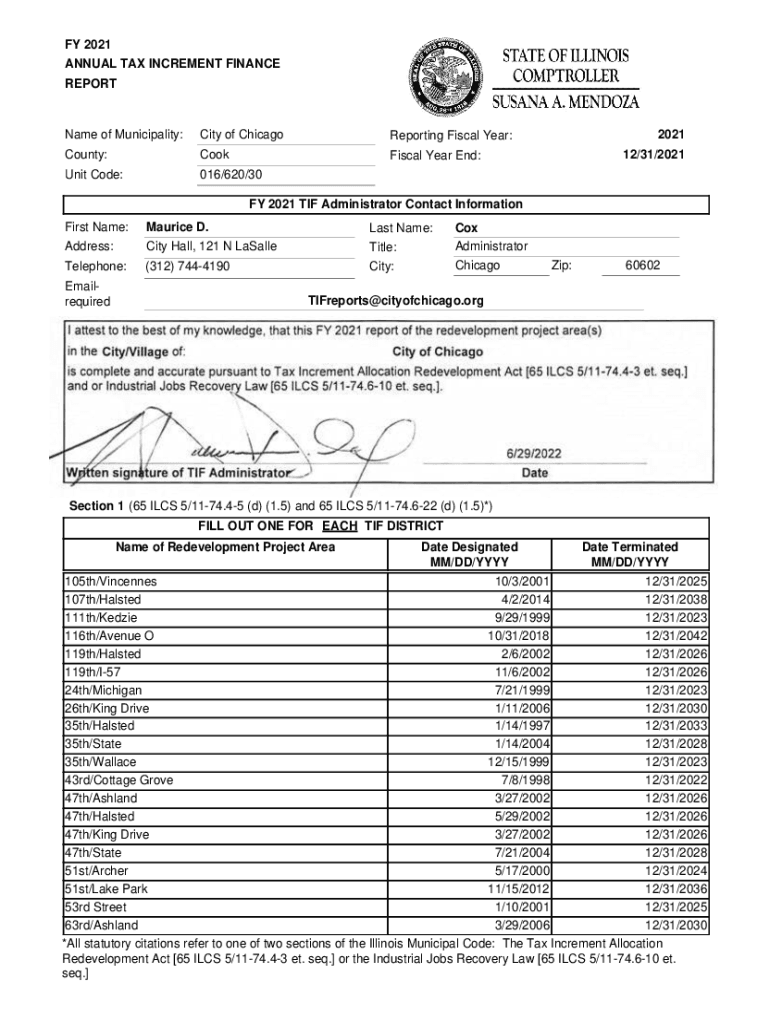

FY 2021 ANNUAL TAX INCREMENT FINANCE Reportage of Municipality:City of ChicagoReporting Fiscal Year:County:CookFiscal Year End:Unit Code:016/620/302021 12/31/2021FY 2021 TIF Administrator Contact

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax increment financing tif

Edit your tax increment financing tif form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax increment financing tif form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax increment financing tif online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax increment financing tif. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax increment financing tif

How to fill out tax increment financing tif

01

To fill out tax increment financing (TIF), follow these steps:

02

Start by gathering all the necessary documents and information related to the TIF. This may include financial statements, property assessments, and project plans.

03

Determine the eligibility criteria for TIF in your jurisdiction. This could include factors such as the location of the project, the type of development, or the estimated increase in property value.

04

Understand the specific TIF application process in your area. This may involve submitting an application form, providing supporting documentation, and paying any required fees.

05

Fill out the TIF application form accurately and completely. Ensure that all the required fields are filled in and that the provided information is accurate.

06

Attach any necessary supporting documents to the application form. This may include financial statements, project plans, or property assessments.

07

Review the completed TIF application to ensure that all the information is correct and that no mistakes or omissions have been made.

08

Submit the TIF application along with any required fees to the appropriate authority or government department. Keep a copy of the application and any supporting documents for your records.

09

Wait for the TIF application to be reviewed and processed. This may take some time, so be patient and follow up with the relevant authorities if necessary.

10

Once the TIF application is approved, comply with any additional requirements or conditions that may be imposed. This may include implementing the proposed project within a certain time frame or providing regular progress reports.

11

Keep track of any additional reporting or monitoring requirements that may apply to TIF. This could involve submitting financial reports, property value assessments, or other documentation at regular intervals.

12

By following these steps and understanding the specific requirements of your jurisdiction, you can successfully fill out tax increment financing (TIF) applications.

Who needs tax increment financing tif?

01

Tax increment financing (TIF) is typically used by:

02

- Municipalities or local governments: They use TIF to promote economic development and revitalize blighted or underdeveloped areas within their jurisdiction.

03

- Developers or property owners: They utilize TIF to fund infrastructure improvements or property renovations that would otherwise be financially challenging.

04

- Businesses: They may seek TIF to finance expansion or relocation projects, especially if they provide significant economic benefits to the community.

05

- Investors: They may be interested in TIF as a way to support development projects and potentially receive financial returns.

06

In summary, TIF can be useful for entities or individuals looking to stimulate economic growth, address urban blight, or fund development projects in their community.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in tax increment financing tif without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing tax increment financing tif and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for the tax increment financing tif in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your tax increment financing tif and you'll be done in minutes.

How do I complete tax increment financing tif on an Android device?

On Android, use the pdfFiller mobile app to finish your tax increment financing tif. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is tax increment financing tif?

Tax Increment Financing (TIF) is a public financing method used to subsidize redevelopment, infrastructure, and other community improvement projects by capturing the future tax benefits generated by the increased property values resulting from those investments.

Who is required to file tax increment financing tif?

Typically, municipalities or local government agencies that are involved in TIF districts are required to file tax increment financing forms to report on the fiscal activities related to those districts.

How to fill out tax increment financing tif?

To fill out a TIF form, a municipality must gather data on property tax assessments, redevelopment costs, and revenues generated within the TIF district and input this information into the designated form according to state-specific guidelines.

What is the purpose of tax increment financing tif?

The purpose of TIF is to promote economic development by funding public improvements, encouraging private investment, and revitalizing blighted areas through the increase in property values.

What information must be reported on tax increment financing tif?

Information that must be reported typically includes the baseline property tax values, the amount of tax increment collected, the expenditures made in the TIF district, and the progress of redevelopment projects.

Fill out your tax increment financing tif online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Increment Financing Tif is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.