Get the free SALE OF ASSETS INCLUDING A HOLLAND ROTARY KILN ...

Show details

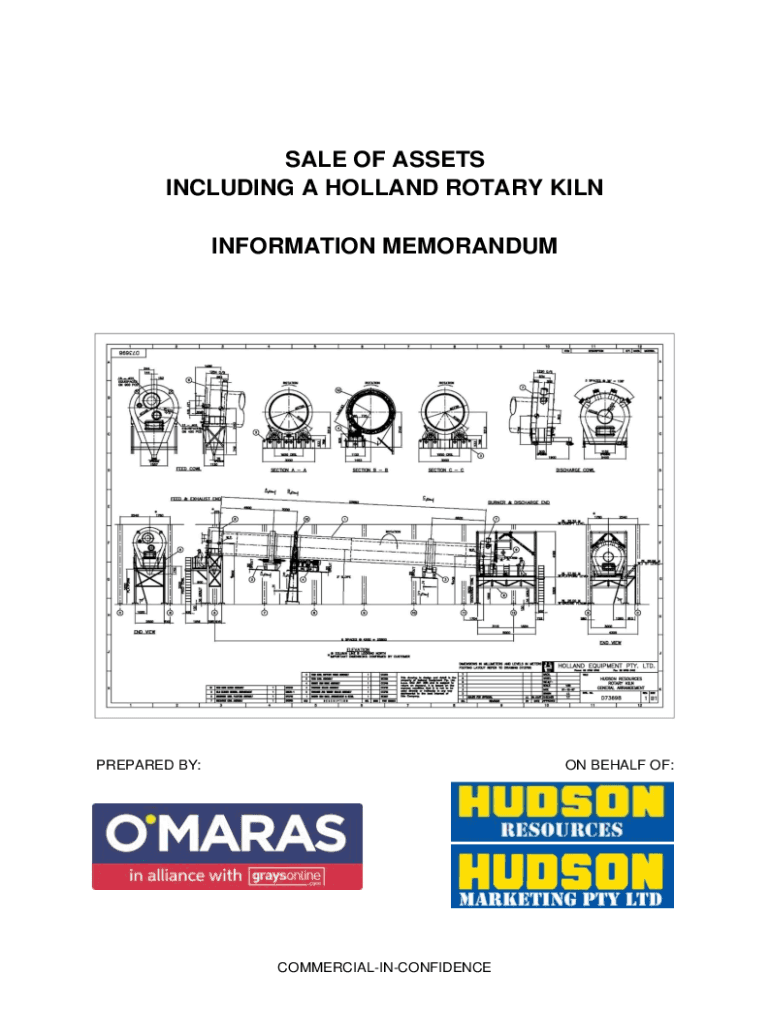

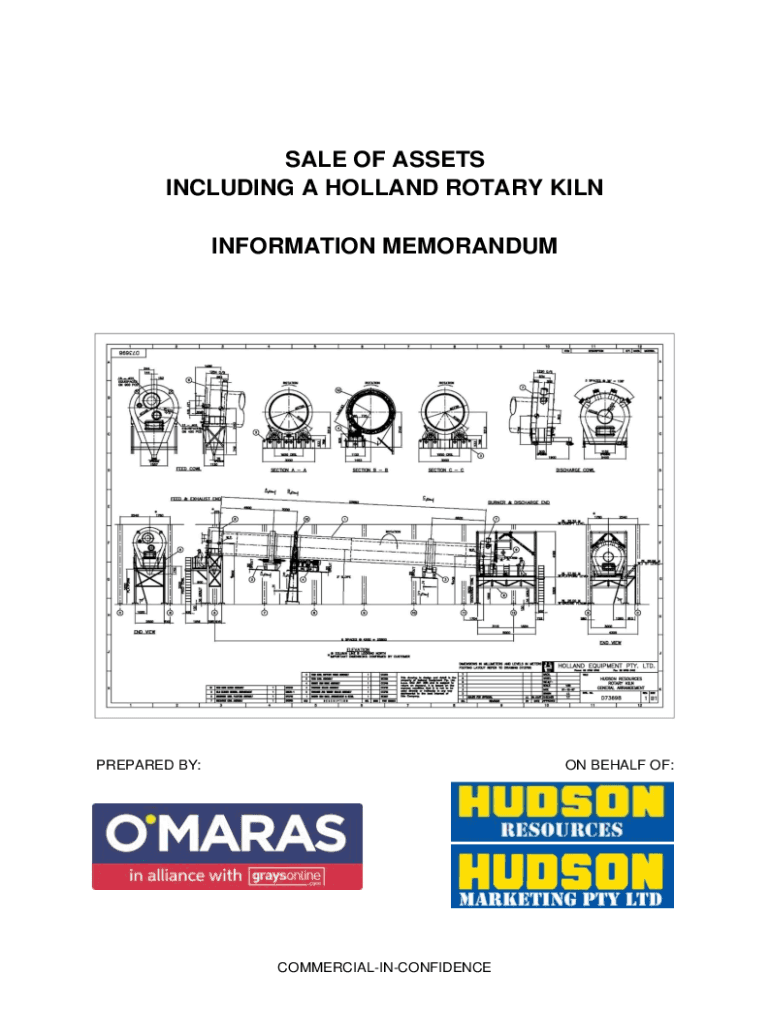

SALE OF ASSETS INCLUDING A HOLLAND ROTARY KILN INFORMATION MEMORANDUMPREPARED BY:ON BEHALF OF:COMMERCIALINCONFIDENCECOMMERCIALINCONFIDENCEContents Contents ...............................................................................................................................

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sale of assets including

Edit your sale of assets including form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sale of assets including form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sale of assets including online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sale of assets including. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sale of assets including

How to fill out sale of assets including

01

Gather all necessary documents related to the assets being sold, such as ownership documents, valuation reports, and any relevant legal contracts.

02

Determine the method of sale, whether it will be through a public auction, private sale, or any other agreed-upon method.

03

Set a fair and competitive price for the assets being sold, taking into consideration market value and any existing agreements or contracts.

04

Advertise the sale of assets to reach potential buyers, using various channels such as online listings, industry publications, or contacting relevant individuals or organizations.

05

Respond to inquiries and provide additional information to potential buyers to help them make informed decisions.

06

Negotiate with interested parties, including discussing terms and conditions of the sale and addressing any concerns or queries they may have.

07

Finalize the sale agreement, ensuring that all necessary legal and financial obligations are met by both parties.

08

Complete the transfer of ownership and payment process according to the agreed-upon terms, ensuring all necessary documentation is provided and that both parties are satisfied.

09

Properly record the sale of assets in relevant financial and legal records, ensuring compliance with applicable regulations and reporting requirements.

10

Evaluate and analyze the sale process to identify any areas for improvement or lessons learned for future asset sales.

Who needs sale of assets including?

01

Businesses or organizations that have surplus or underutilized assets and want to liquidate them for financial reasons.

02

Individuals or companies looking to downsize, restructure, or divest certain assets as part of their overall business strategy.

03

Estate administrators or executors who need to sell assets as part of settling an estate or executing a will.

04

Banks, creditors, or other financial institutions that need to recover debts or collateral by selling assets.

05

Government agencies or public entities that want to sell assets that are no longer needed or have been seized through legal processes.

06

Investors or speculators interested in buying and selling assets for profit.

07

Non-profit organizations or charities that receive donations in the form of assets and wish to sell them to fund their programs or operations.

08

Individuals or businesses facing financial distress or bankruptcy who may need to sell their assets to repay debts or regain financial stability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sale of assets including directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign sale of assets including and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I edit sale of assets including from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your sale of assets including into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit sale of assets including on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute sale of assets including from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is sale of assets including?

The sale of assets includes the transfer of ownership of physical or intangible assets owned by a business or individual, such as real estate, machinery, vehicles, patents, and trademarks.

Who is required to file sale of assets including?

Individuals, businesses, and organizations that have sold assets during a tax year are required to file a sale of assets, typically reported on their tax returns.

How to fill out sale of assets including?

To fill out a sale of assets, report the details on the appropriate tax form, providing information about the asset, the sale price, acquisition date, and any applicable costs associated with the sale.

What is the purpose of sale of assets including?

The purpose of reporting the sale of assets is to ensure that any capital gains or losses are accurately reported for tax purposes and to comply with legal financial reporting requirements.

What information must be reported on sale of assets including?

Required information typically includes the description of the asset, date of sale, sale amount, acquisition cost, and any associated selling expenses.

Fill out your sale of assets including online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sale Of Assets Including is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.