Get the free TAX ABATEMENT AGREEMENT BETWEEN FORT BEND ...

Show details

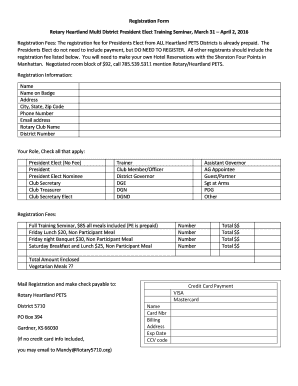

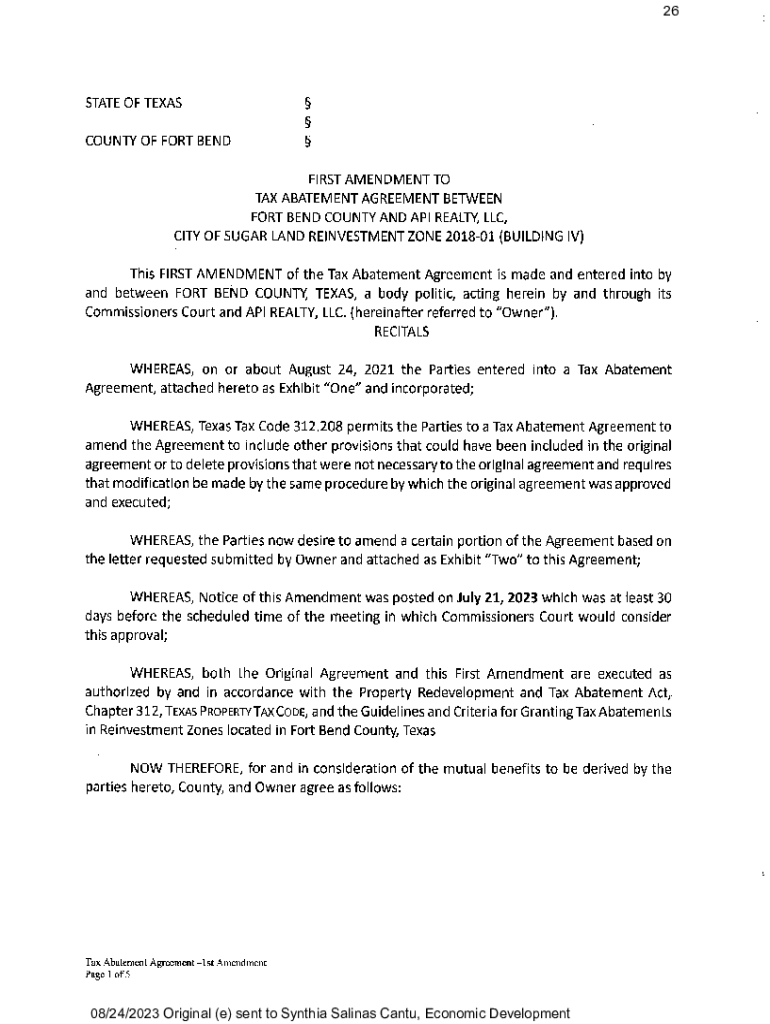

26STATE OF TEXAS COUNTY OF FORT HEADFIRST AMENDMENT TO TAX ABATEMENT AGREEMENT BETWEEN FORT BEND COUNTY AND API REALTY, LLC, CITY OF SUGAR LAND REINVESTMENT ZONE 201801 (BUILDING IV) This FIRST AMENDMENT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax abatement agreement between

Edit your tax abatement agreement between form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax abatement agreement between form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax abatement agreement between online

Follow the guidelines below to benefit from a competent PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax abatement agreement between. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax abatement agreement between

How to fill out tax abatement agreement between

01

Begin by gathering all necessary documents such as the tax abatement agreement form, relevant financial statements, and any supporting documentation.

02

Carefully read through the tax abatement agreement form to understand the requirements and obligations for both parties involved.

03

Fill in the required information in the agreement form, including the names and contact information of the parties, the duration of the tax abatement, and any specific conditions or terms.

04

Be sure to provide accurate and up-to-date financial information to support the need for a tax abatement, such as proof of financial hardship or evidence of job creation.

05

Review the completed agreement form to ensure all necessary information is included and that it accurately reflects the intentions and agreements of both parties.

06

Sign and date the tax abatement agreement, and ensure that all involved parties also sign the document

07

Keep copies of the signed tax abatement agreement for your records, and distribute copies as required to relevant parties.

08

Take note of any filing or submission deadlines for the tax abatement agreement, and ensure that all necessary paperwork is submitted in a timely manner.

09

Consult with a legal professional or tax advisor if you have any doubts or questions about the tax abatement agreement or its implications.

10

Monitor and fulfill the obligations outlined in the tax abatement agreement, such as making any required payments or adhering to specific conditions, to maintain compliance and maximize the benefits of the agreement.

Who needs tax abatement agreement between?

01

Tax abatement agreements are typically needed by individuals or businesses who meet certain criteria and qualify for tax incentives or relief. These agreements are commonly used by property owners, developers, and businesses looking to invest in a particular area or project. The purpose of a tax abatement agreement is to provide financial incentives, such as reduced property taxes or tax credits, in exchange for specific actions or investments that benefit the community or contribute to economic growth. The specific eligibility requirements for tax abatement agreements may vary depending on the jurisdiction and the nature of the project or investment.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax abatement agreement between in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your tax abatement agreement between, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit tax abatement agreement between straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit tax abatement agreement between.

How do I fill out the tax abatement agreement between form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign tax abatement agreement between and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is tax abatement agreement between?

A tax abatement agreement is a negotiated arrangement between a government entity and a property owner or developer that reduces or eliminates property taxes on a particular property for a specified period of time.

Who is required to file tax abatement agreement between?

Typically, the property owner or developer seeking the abatement must file a tax abatement agreement with the relevant government authority.

How to fill out tax abatement agreement between?

To fill out a tax abatement agreement, provide the necessary details such as the property owner's information, property description, the terms of the abatement, and any conditions or requirements set by the government.

What is the purpose of tax abatement agreement between?

The purpose of a tax abatement agreement is to encourage development or redevelopment in a specific area, stimulate investment, and promote economic growth by providing temporary tax relief.

What information must be reported on tax abatement agreement between?

The agreement must report information including the property location, owner details, duration of the abatement, the percentage of tax reduction, and any conditions related to the abatement.

Fill out your tax abatement agreement between online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Abatement Agreement Between is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.