Get the free This DEED OF TRUST, SECURITY AGREEMENT, ...

Show details

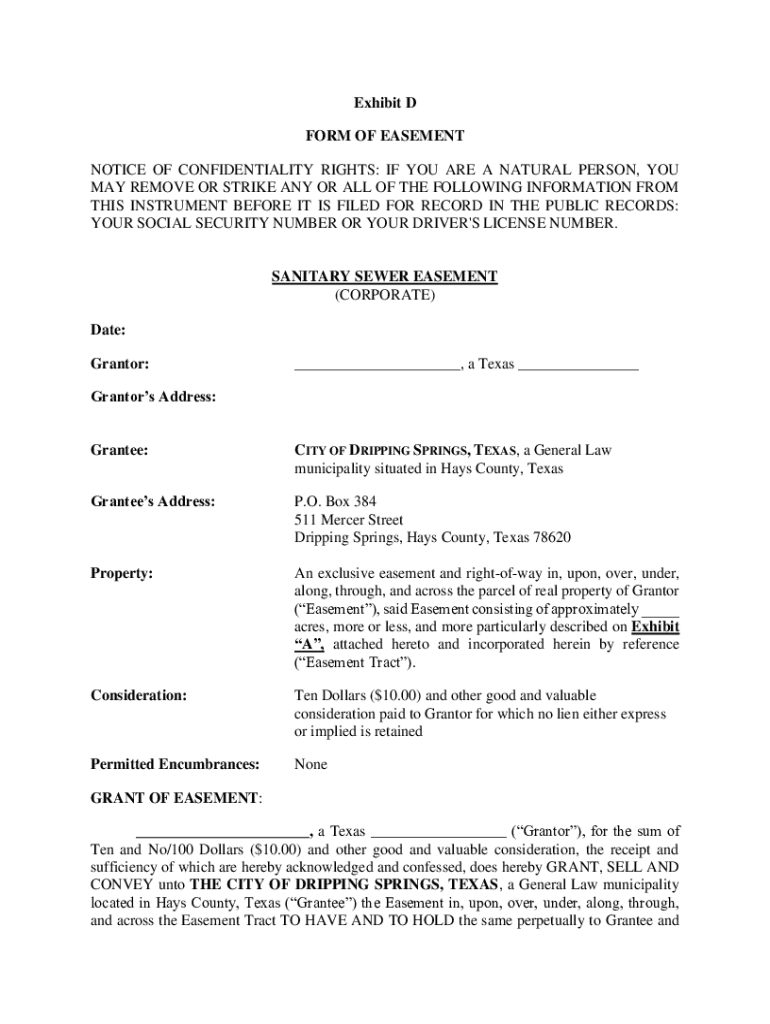

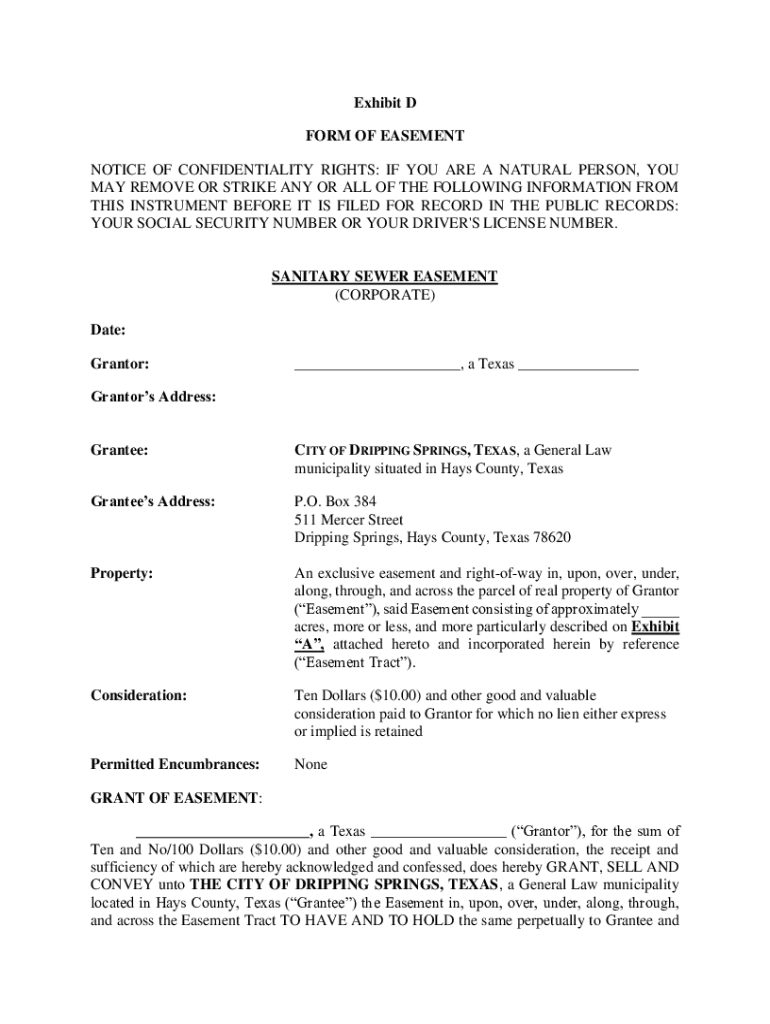

Exhibit D FORM OF EASEMENT NOTICE OF CONFIDENTIALITY RIGHTS: IF YOU ARE A NATURAL PERSON, YOU MAY REMOVE OR STRIKE ANY OR ALL OF THE FOLLOWING INFORMATION FROM THIS INSTRUMENT BEFORE IT IS FILED FOR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign this deed of trust

Edit your this deed of trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your this deed of trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit this deed of trust online

In order to make advantage of the professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit this deed of trust. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out this deed of trust

How to fill out this deed of trust

01

Step 1: Begin by reviewing the deed of trust document thoroughly and understanding its requirements and terms.

02

Step 2: Identify the necessary information for filling out the deed of trust, such as the names and addresses of all parties involved, the property description, and loan details.

03

Step 3: Start by providing the names and addresses of the grantor(s) and the grantee(s) in the appropriate sections of the deed of trust.

04

Step 4: Proceed to accurately describe the property being secured by the deed of trust, including specific details such as the legal description, address, and any relevant parcel numbers.

05

Step 5: Clearly outline the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any additional provisions or requirements.

06

Step 6: Include any necessary attachments or exhibits to the deed of trust, such as property surveys or insurance information, as specified by the document.

07

Step 7: Sign the deed of trust in the presence of a notary public and ensure that all required signatures are obtained from the appropriate parties.

08

Step 8: Make copies of the completed deed of trust for all interested parties, including the grantor(s), grantee(s), and any involved lenders or title companies.

09

Step 9: Record the deed of trust with the appropriate county or municipal office to establish its public record and ensure its legal validity.

10

Step 10: Keep the executed deed of trust in a safe and secure location for future reference and use, as needed.

Who needs this deed of trust?

01

Anyone involved in a real estate transaction where a loan or mortgage is being provided can benefit from having a deed of trust.

02

This includes lenders, borrowers, and other parties with a financial interest in the property being financed.

03

For example, banks, mortgage companies, and private lenders may require a deed of trust as a security instrument for the loan they are providing.

04

Similarly, individuals or entities seeking a loan or mortgage to purchase or refinance a property will need to complete a deed of trust to secure the lender's interest.

05

Additionally, title companies and real estate attorneys may also need a deed of trust to facilitate the closing process and ensure a smooth transaction.

06

Overall, anyone seeking to legally protect their financial investment in a property or ensure the enforceability of a loan should consider using a deed of trust.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send this deed of trust to be eSigned by others?

When you're ready to share your this deed of trust, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Where do I find this deed of trust?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the this deed of trust in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out this deed of trust on an Android device?

Use the pdfFiller Android app to finish your this deed of trust and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is this deed of trust?

A deed of trust is a legal document that secures a loan by transferring the title of the property to a trustee until the loan is repaid.

Who is required to file this deed of trust?

Typically, the borrower and the lender are required to file the deed of trust, often with involvement from a title company.

How to fill out this deed of trust?

To fill out a deed of trust, provide information such as the names of the borrower and lender, property description, loan amount, and terms of repayment.

What is the purpose of this deed of trust?

The purpose of a deed of trust is to protect the lender's interests by providing a legal claim to the property in case of default on the loan.

What information must be reported on this deed of trust?

Information required includes the names of the parties, legal description of the property, loan amount, interest rate, and repayment terms.

Fill out your this deed of trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

This Deed Of Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.