Get the free TAX RATE AND BUDGET INFORMATION posted by ...

Show details

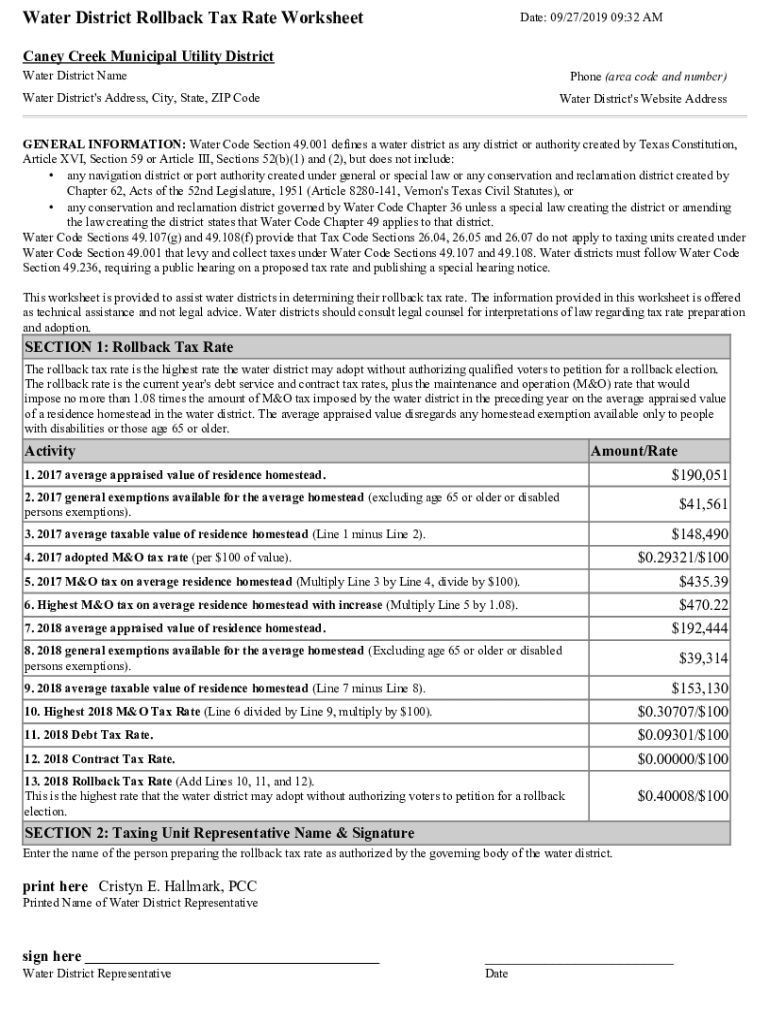

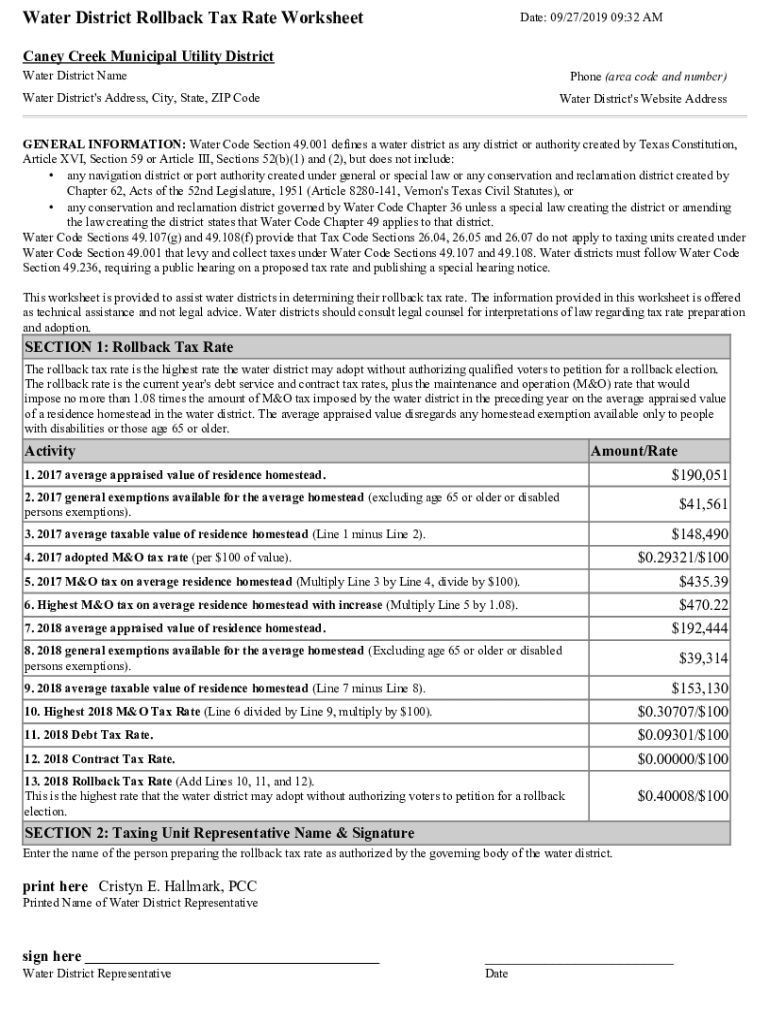

Water District Rollback Tax Rate WorksheetDate: 09/27/2019 09:32 Amanda Creek Municipal Utility District Water District Telephone (area code and number)Water District\'s Address, City, State, ZIP

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax rate and budget

Edit your tax rate and budget form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax rate and budget form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax rate and budget online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax rate and budget. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax rate and budget

How to fill out tax rate and budget

01

To fill out tax rate and budget, follow these steps:

02

Obtain the necessary forms and documentation for tax rate calculations and budget preparation.

03

Gather all relevant financial information, including income, expenses, and previous year's tax filings.

04

Determine the applicable tax rates and thresholds based on your jurisdiction's tax laws.

05

Calculate your taxable income by subtracting allowable deductions and exemptions from your gross income.

06

Fill out the tax rate form, providing accurate information and ensuring all sections are completed.

07

Review and verify the calculated tax rate to ensure accuracy.

08

Prepare the budget by analyzing income sources, projected expenses, and financial goals.

09

Allocate funds to different categories based on priority and anticipated needs.

10

Ensure that the budget is comprehensive and covers all necessary expenses.

11

Regularly review and adjust the budget as needed throughout the year.

Who needs tax rate and budget?

01

Tax rate and budget are needed by individuals and businesses who have a legal obligation to pay taxes and manage their finances.

02

Individual taxpayers need tax rates to correctly calculate and pay their income taxes.

03

Businesses need tax rates to determine their tax liabilities and make appropriate financial decisions.

04

Budgets are needed by individuals and businesses to plan and manage their income, expenses, and financial goals.

05

Governments and organizations also need tax rates and budgets to assess revenue streams, allocate resources, and plan public spending.

06

In summary, anyone who wants to comply with tax laws, make informed financial decisions, and effectively manage their finances needs tax rates and budgets.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax rate and budget to be eSigned by others?

Once your tax rate and budget is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I make edits in tax rate and budget without leaving Chrome?

tax rate and budget can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I fill out tax rate and budget on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your tax rate and budget, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is tax rate and budget?

The tax rate is the percentage at which an individual or corporation is taxed by the government, and the budget refers to the financial plan that outlines expected revenues and expenditures for a specific period.

Who is required to file tax rate and budget?

Generally, individuals, businesses, and government entities that meet specific income thresholds or possess taxable assets are required to file tax rates and budgets.

How to fill out tax rate and budget?

To fill out a tax rate and budget, you typically need to provide detailed financial information including income, allowable deductions, and other pertinent data on the appropriate forms as dictated by tax regulations.

What is the purpose of tax rate and budget?

The purpose of the tax rate and budget is to manage government finances, ensure the effective allocation of resources, and ensure compliance with tax laws.

What information must be reported on tax rate and budget?

The information that must be reported includes total income, deductions, tax credits, estimated taxes owed, and specifics about expenditures for the budget.

Fill out your tax rate and budget online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Rate And Budget is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.