Get the free Risk Management Insurance Brokerage Services ...

Show details

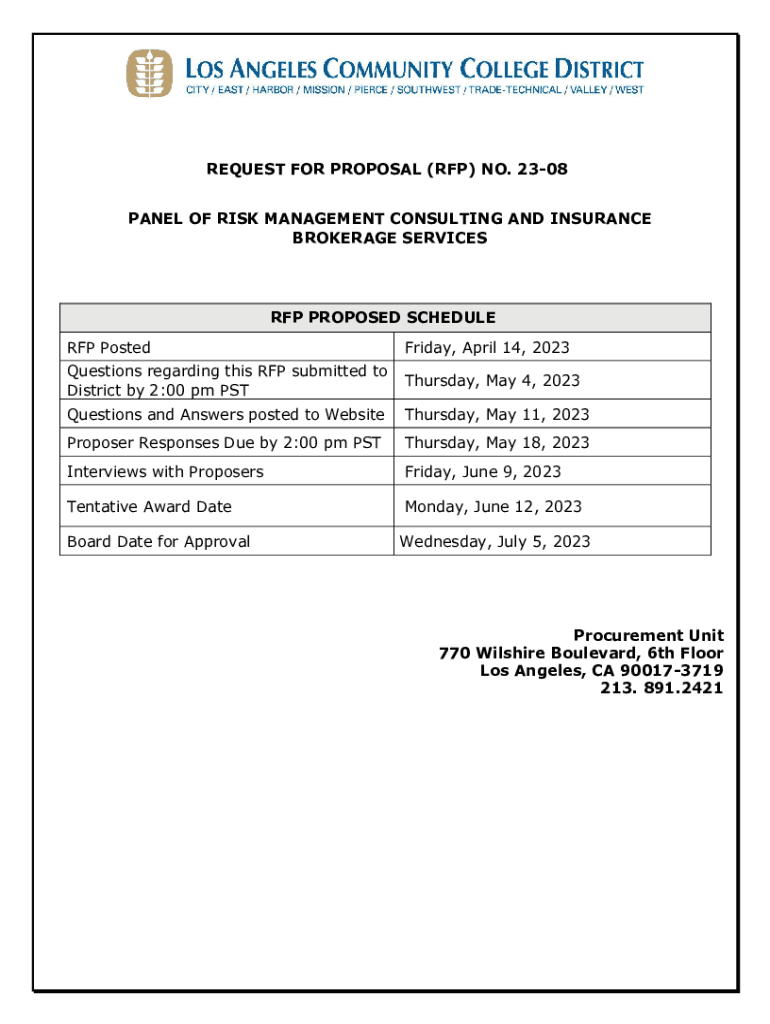

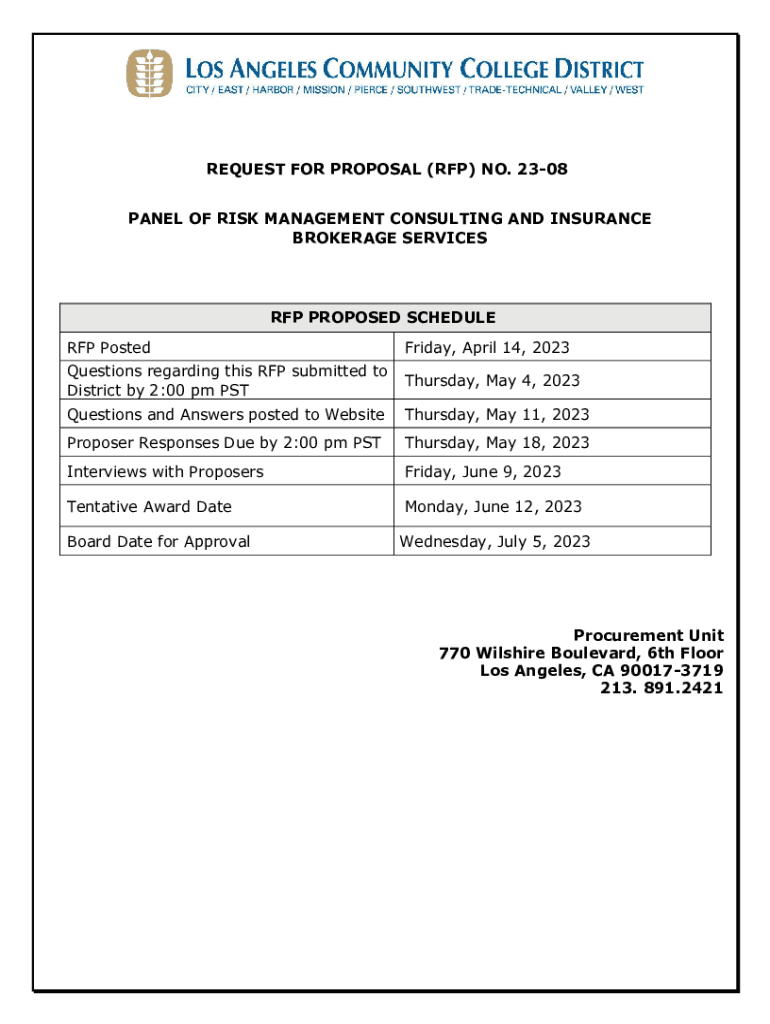

REQUEST FOR PROPOSAL (RFP) NO. 2308 PANEL OF RISK MANAGEMENT CONSULTING AND INSURANCE BROKERAGE SERVICES RFP PROPOSED SCHEDULE RFP Posted Friday, April 14, 2023Questions regarding this RFP submitted

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign risk management insurance brokerage

Edit your risk management insurance brokerage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your risk management insurance brokerage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing risk management insurance brokerage online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit risk management insurance brokerage. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out risk management insurance brokerage

How to fill out risk management insurance brokerage

01

Identify the specific risks associated with your business or industry.

02

Determine the appropriate level of coverage needed for each risk.

03

Research and compare different insurance brokers or agencies that specialize in risk management.

04

Schedule a meeting with a selected insurance broker to discuss your business's risk management needs.

05

Provide the insurance broker with detailed information about your business, including its operations, financials, and past claims history.

06

Collaborate with the insurance broker to develop a tailored risk management insurance plan that addresses your specific needs.

07

Review the terms and conditions of the proposed insurance policy to ensure it aligns with your requirements.

08

Negotiate the coverage limits, deductibles, and premiums to ensure a favorable agreement.

09

Obtain a finalized risk management insurance policy from the insurance broker.

10

Regularly review and update your risk management insurance policy to accommodate changes in your business's risk profile.

Who needs risk management insurance brokerage?

01

Businesses of all sizes and industries can benefit from risk management insurance brokerage.

02

Specifically, companies that face significant risks such as liability claims, property damage, cybersecurity threats, or natural disasters should consider risk management insurance brokerage.

03

Risk management insurance brokerage helps businesses mitigate potential financial losses and protect their assets in case of unexpected events or accidents.

04

Furthermore, industries with regulatory compliance requirements or those involved in high-risk activities, such as construction, healthcare, finance, and manufacturing, can greatly benefit from risk management insurance brokerage services.

05

Ultimately, any business that wants to proactively manage and reduce its exposure to potential risks can benefit from the expertise and coverage provided by risk management insurance brokerage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find risk management insurance brokerage?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the risk management insurance brokerage. Open it immediately and start altering it with sophisticated capabilities.

How do I make changes in risk management insurance brokerage?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your risk management insurance brokerage to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit risk management insurance brokerage on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign risk management insurance brokerage. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is risk management insurance brokerage?

Risk management insurance brokerage refers to the practice of advising clients on managing risks associated with their business activities, typically by securing appropriate insurance coverage to protect against those risks.

Who is required to file risk management insurance brokerage?

Generally, businesses and organizations that engage in risk management activities and deal with insurance brokerage must file risk management insurance brokerage to comply with regulatory requirements.

How to fill out risk management insurance brokerage?

To fill out a risk management insurance brokerage, one must gather necessary data regarding business operations, identify potential risks, and provide relevant details in the required forms or applications as specified by the regulatory authority.

What is the purpose of risk management insurance brokerage?

The purpose of risk management insurance brokerage is to help organizations identify, assess, and mitigate risks while ensuring they have the necessary insurance coverage to protect against unforeseen circumstances.

What information must be reported on risk management insurance brokerage?

Information that must be reported includes details about the business, types of risks encountered, insurance policies held, and any claims made or anticipated claims.

Fill out your risk management insurance brokerage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Risk Management Insurance Brokerage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.