Get the free LONG-TERM CARE INCOME TRUST - billstatus ls state ms

Show details

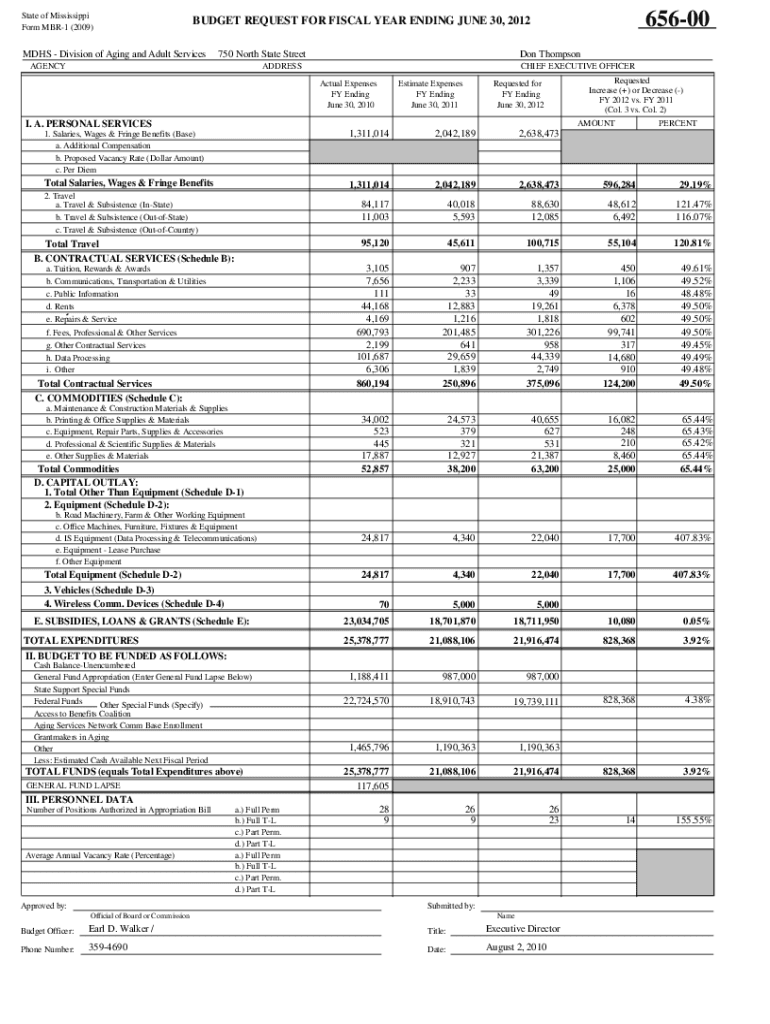

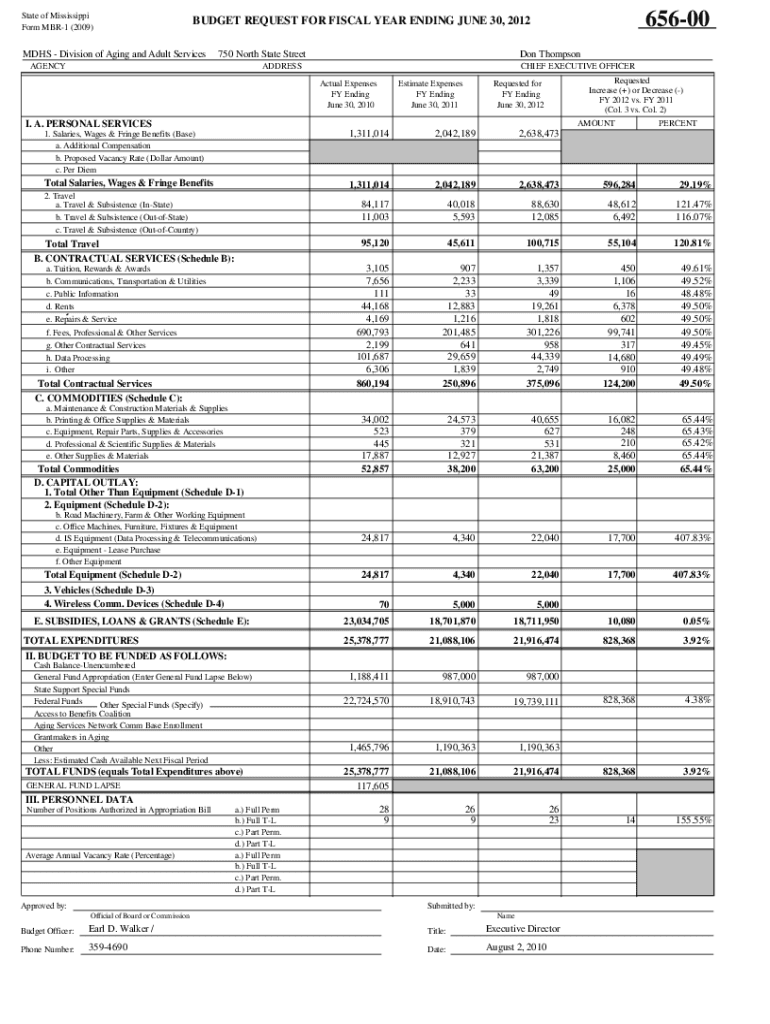

State of Mississippi Form MBR1 (2009)65600BUDGET REQUEST FOR FISCAL YEAR ENDING JUNE 30, 2012MDHS Division of Aging and Adult Services750 North State StreetAGENCYDon ThompsonADDRESSCHIEF EXECUTIVE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign long-term care income trust

Edit your long-term care income trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long-term care income trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing long-term care income trust online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit long-term care income trust. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out long-term care income trust

How to fill out long-term care income trust

01

To fill out a long-term care income trust, follow these steps:

02

Begin by gathering all the necessary documents and information. This may include personal identification, financial statements, and medical records.

03

Contact a qualified attorney who specializes in elder law or estate planning. They will guide you through the process and ensure all legal requirements are met.

04

Consult with your attorney to determine if a long-term care income trust is the right option for your specific situation.

05

Provide the attorney with all the required information and documents needed to establish the trust.

06

Work with your attorney to carefully review and fill out the trust agreement, ensuring accuracy and completeness.

07

Once the trust agreement is finalized, sign the document in the presence of a notary public.

08

Fund the trust by transferring the designated income or assets into the trust's ownership.

09

Follow any additional instructions provided by your attorney to ensure the trust is properly established and maintained.

10

Finally, regularly review and update the trust as needed to reflect any changes in your circumstances or legal requirements.

11

Remember, it is essential to consult with an attorney throughout the entire process to ensure compliance with laws and regulations.

Who needs long-term care income trust?

01

Long-term care income trust is beneficial for individuals who:

02

Are planning for Medicaid or other long-term care assistance programs.

03

Can anticipate significant medical expenses in the future and require planning to protect their assets.

04

Have income or assets that exceed Medicaid's eligibility criteria but still require financial support for long-term care needs.

05

Wish to preserve their assets and income for their spouse, children, or other beneficiaries while ensuring access to necessary long-term care services.

06

Desire to maintain control and decision-making authority over their finances and healthcare choices even when receiving government benefits.

07

It is always recommended to consult with a qualified attorney or financial advisor to determine if a long-term care income trust is suitable for your specific circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit long-term care income trust from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your long-term care income trust into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send long-term care income trust to be eSigned by others?

When you're ready to share your long-term care income trust, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I fill out long-term care income trust on an Android device?

Use the pdfFiller mobile app to complete your long-term care income trust on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is long-term care income trust?

A long-term care income trust is a financial tool designed to help individuals qualify for long-term care benefits while protecting a portion of their income and assets from being counted against eligibility limits.

Who is required to file long-term care income trust?

Individuals who seek to qualify for long-term care benefits, such as Medicaid, and who have income or assets above the allowed thresholds may be required to file a long-term care income trust.

How to fill out long-term care income trust?

To fill out a long-term care income trust, individuals typically need to complete the trust document, provide information about their income sources, list beneficiaries, and ensure that the trust aligns with state regulations.

What is the purpose of long-term care income trust?

The purpose of a long-term care income trust is to help individuals manage their income to stay within eligibility limits for long-term care assistance while protecting their assets from being depleted by care costs.

What information must be reported on long-term care income trust?

Information that must be reported on a long-term care income trust includes the individual's income, assets, beneficiaries of the trust, and any conditions or stipulations related to the trust.

Fill out your long-term care income trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Long-Term Care Income Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.