Get the free Fiscal Reports

Show details

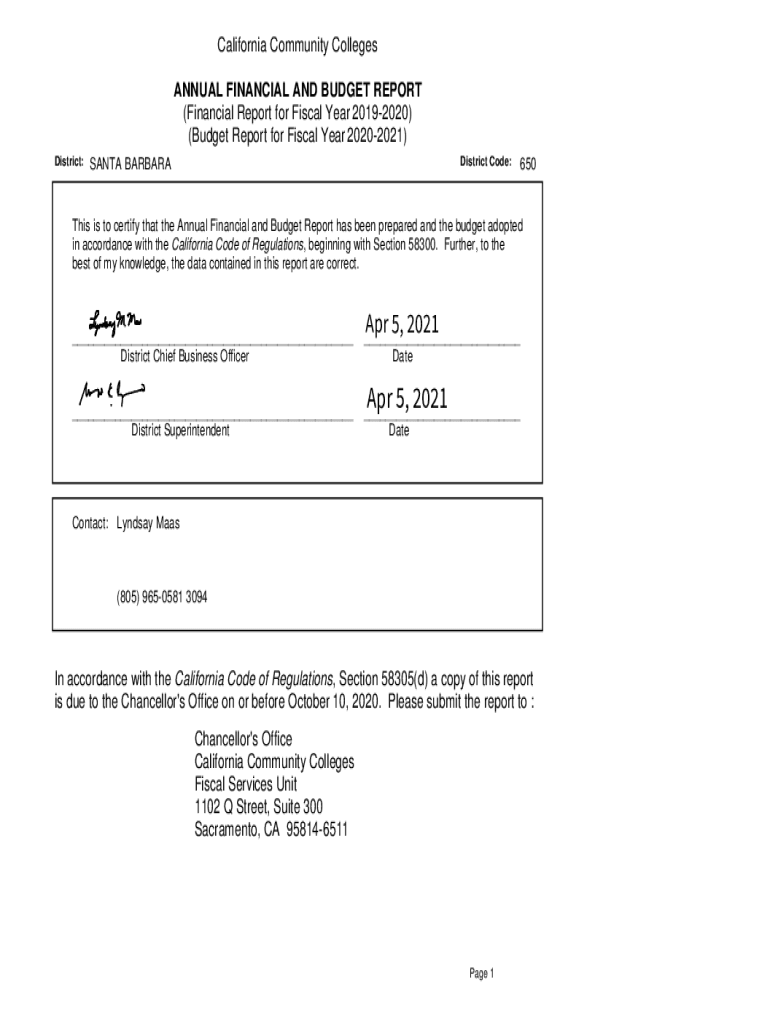

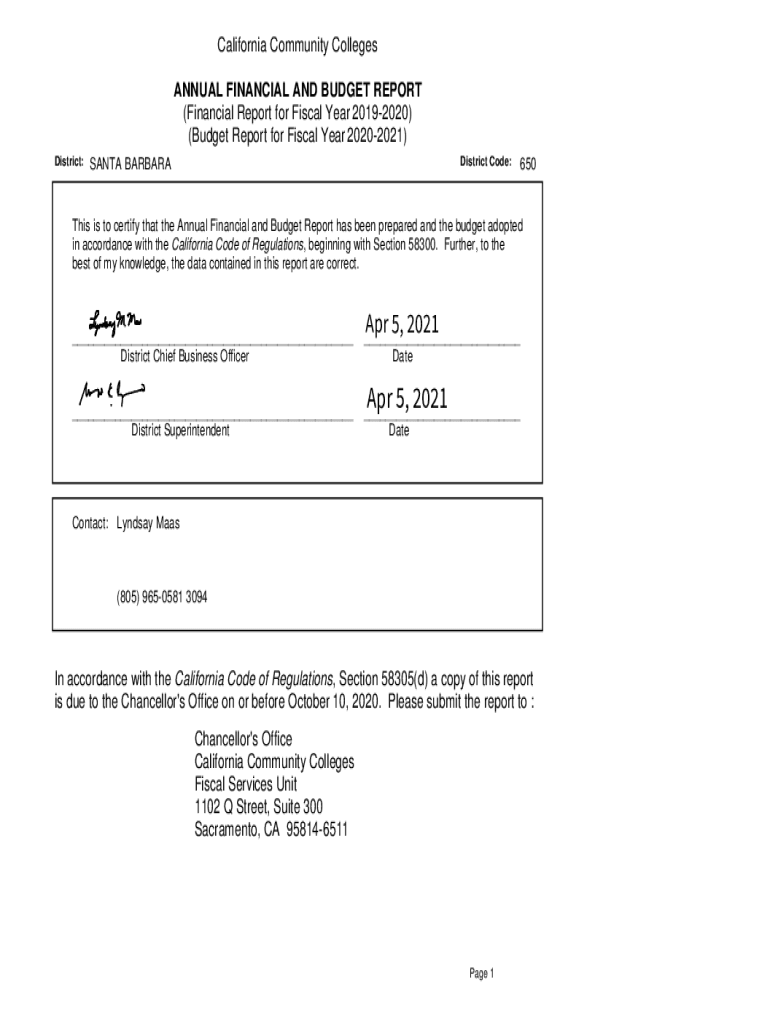

California Community Colleges ANNUAL FINANCIAL AND BUDGET REPORT (Financial Report for Fiscal Year 20192020) (Budget Report for Fiscal Year 20202021) District:District Code:SANTA BARBARA650This is

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiscal reports

Edit your fiscal reports form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiscal reports form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fiscal reports online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fiscal reports. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fiscal reports

How to fill out fiscal reports

01

To fill out fiscal reports, follow these steps:

02

Gather all necessary financial documents, such as income statements, balance sheets, and cash flow statements.

03

Start by filling out the basic information section, which includes the name of the company, the reporting period, and the fiscal year.

04

Proceed to fill out the income statement, detailing the company's revenues and expenses over the reporting period.

05

Fill out the balance sheet, listing the company's assets, liabilities, and shareholders' equity at a specific point in time.

06

Complete the cash flow statement, which shows the inflow and outflow of cash during the reporting period.

07

Review the completed fiscal reports for accuracy and make any necessary adjustments.

08

Submit the fiscal reports to the appropriate authorities or stakeholders as required by law or organizational policies.

09

Note: It is recommended to consult with a financial professional or accountant for specific guidance and to ensure compliance with relevant regulations.

Who needs fiscal reports?

01

Various individuals and entities need fiscal reports, including:

02

- Business owners and managers: To assess the financial health of the company and make informed decisions.

03

- Shareholders and investors: To evaluate the company's performance and potential profitability.

04

- Lenders and creditors: To determine the borrower's creditworthiness and make lending decisions.

05

- Regulatory authorities: To monitor compliance with financial regulations and assess economic stability.

06

- Government agencies: To collect tax revenues and track economic activity.

07

- Stakeholders and analysts: To analyze the company's financial standing and predict future trends.

08

In general, fiscal reports serve as a crucial tool for financial transparency, accountability, and decision-making in both public and private sector organizations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my fiscal reports in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your fiscal reports and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I modify fiscal reports without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including fiscal reports, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit fiscal reports on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share fiscal reports on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is fiscal reports?

Fiscal reports are formal financial statements that provide an overview of a company's financial performance and position over a specific period.

Who is required to file fiscal reports?

Generally, corporations, partnerships, and certain nonprofits are required to file fiscal reports, often depending on jurisdiction and revenue thresholds.

How to fill out fiscal reports?

To fill out fiscal reports, gather relevant financial data, understand the reporting requirements, and use standardized formats or software to complete the reports accurately.

What is the purpose of fiscal reports?

The purpose of fiscal reports is to provide stakeholders with transparent information about a company’s financial health, assist in decision-making, and comply with legal requirements.

What information must be reported on fiscal reports?

Fiscal reports typically include revenue, expenses, profits, assets, liabilities, and equity details, as well as cash flow statements and notes on significant accounting policies.

Fill out your fiscal reports online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiscal Reports is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.