Get the free Giving a Gift of Securities - Victoria Hospice

Show details

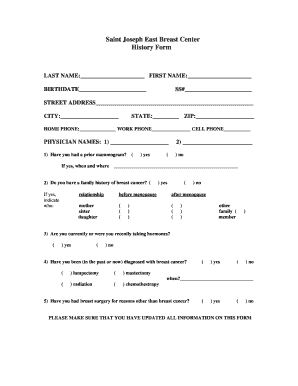

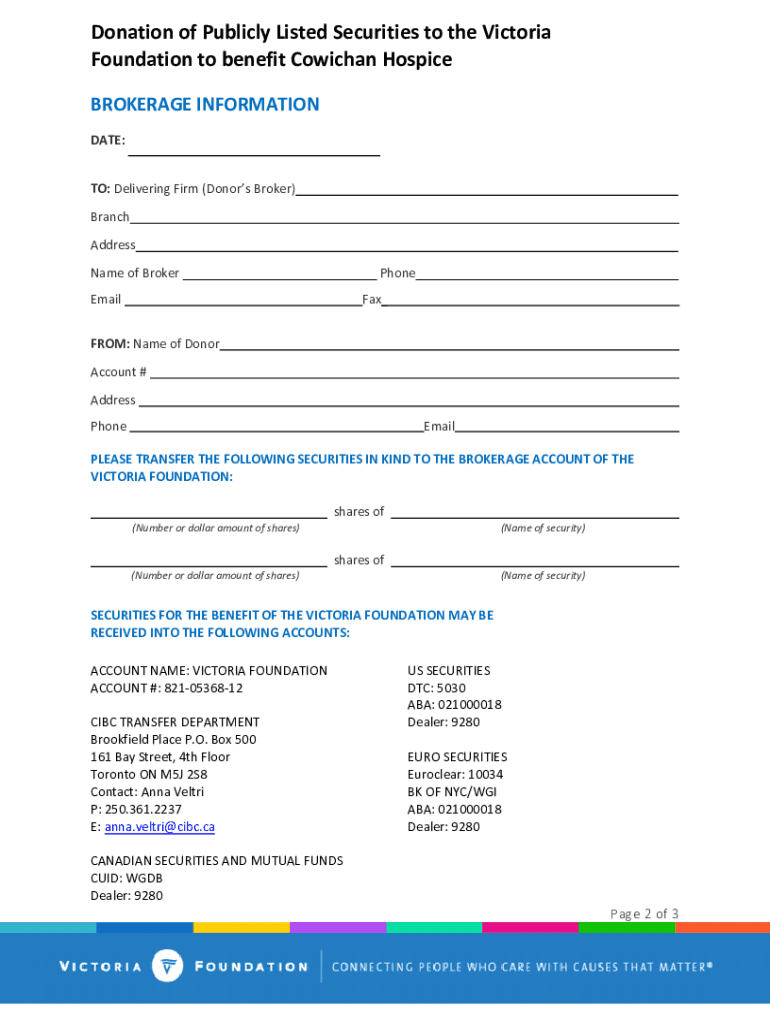

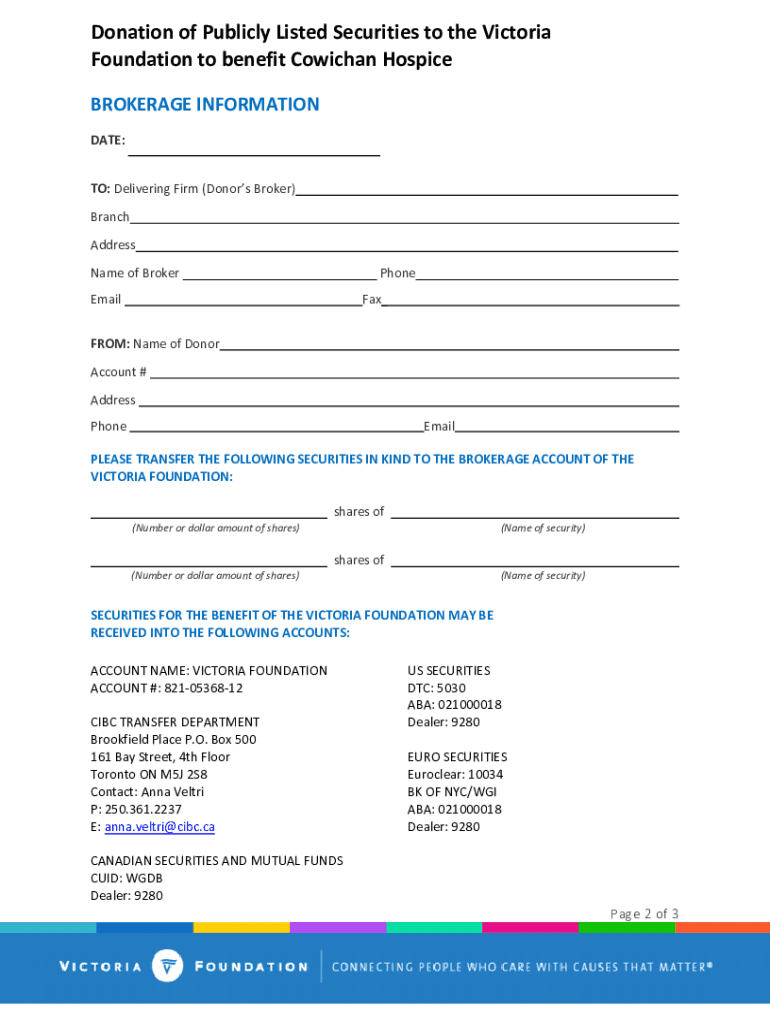

Donation of Publicly Listed Securities to the Victoria Foundation for the benefit of Conical Hospice Thank you for your interest in donating securities to the Victoria Foundation for the benefit of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign giving a gift of

Edit your giving a gift of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your giving a gift of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing giving a gift of online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit giving a gift of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out giving a gift of

How to fill out giving a gift of

01

Start by selecting a suitable gift for the recipient, taking into consideration their interests, hobbies, and preferences.

02

Wrap the gift neatly and consider adding a personalized touch such as a handwritten note or a special message.

03

If required, include any necessary documentation or instructions along with the gift.

04

Consider the occasion and choose an appropriate time to present the gift to the recipient.

05

Offer the gift with a sincere and thoughtful attitude, expressing your intention and appreciation for the recipient.

06

In case the gift needs to be shipped, use appropriate packaging and ensure it is securely packed to avoid any damage during transit.

07

Follow up with the recipient after they have received the gift to ensure its successful delivery and express your hope that they enjoy it.

Who needs giving a gift of?

01

Anyone who wants to show their appreciation, love, or gratitude towards someone else.

02

People who want to celebrate a special occasion or milestone in someone's life.

03

Individuals who want to strengthen personal or professional relationships.

04

Those who want to surprise and bring joy to someone's life.

05

Individuals who want to fulfill cultural or social expectations of gift-giving.

06

People who want to contribute to a positive and giving society.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit giving a gift of from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your giving a gift of into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make changes in giving a gift of?

The editing procedure is simple with pdfFiller. Open your giving a gift of in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I complete giving a gift of on an Android device?

Use the pdfFiller mobile app to complete your giving a gift of on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is giving a gift of?

Giving a gift of refers to the act of transferring property or money to another person without expecting anything in return, typically for their personal enjoyment or benefit.

Who is required to file giving a gift of?

Individuals who gift more than the annual exclusion amount set by the IRS, which is $16,000 for the tax year 2022, must file a gift tax return.

How to fill out giving a gift of?

To fill out a gift tax return, use IRS Form 709, providing information about the donor, recipient, and details of the gifts given, including their fair market value.

What is the purpose of giving a gift of?

The purpose of giving a gift is to show appreciation, love, or support to another individual, and it can also help reduce the taxable estate of the donor.

What information must be reported on giving a gift of?

The reported information includes the donor's and recipient's names and addresses, the date of the gift, a description of the gift, and its fair market value.

Fill out your giving a gift of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Giving A Gift Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.