Get the free IRS Tax Exempt and Govemment Entities

Show details

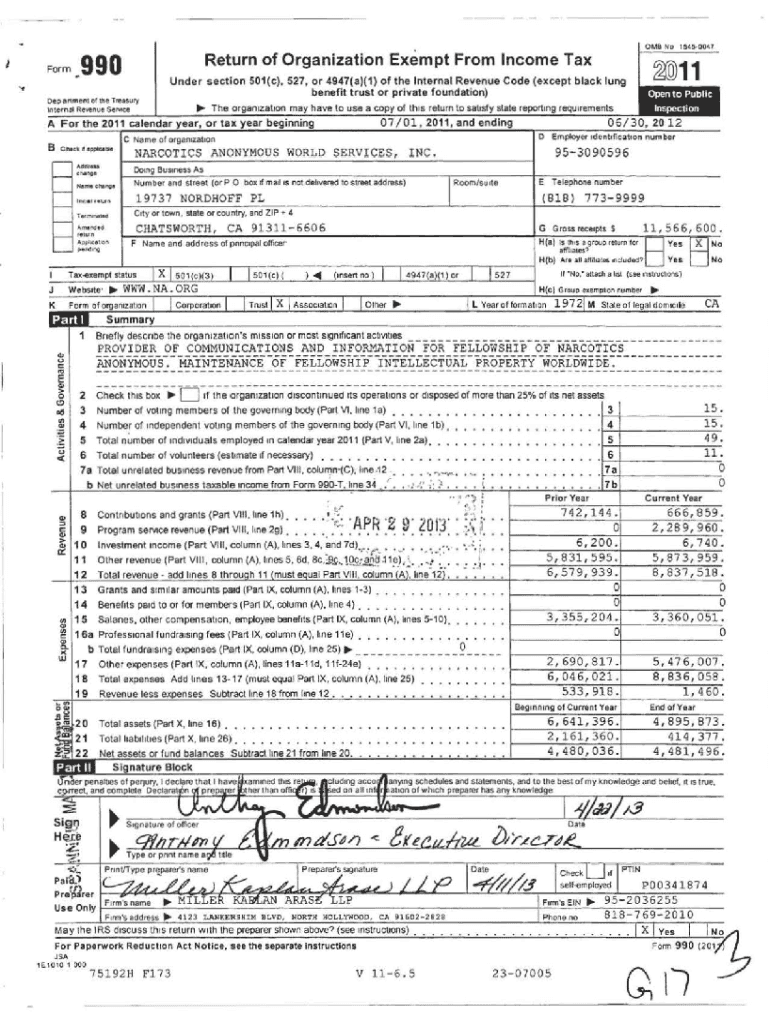

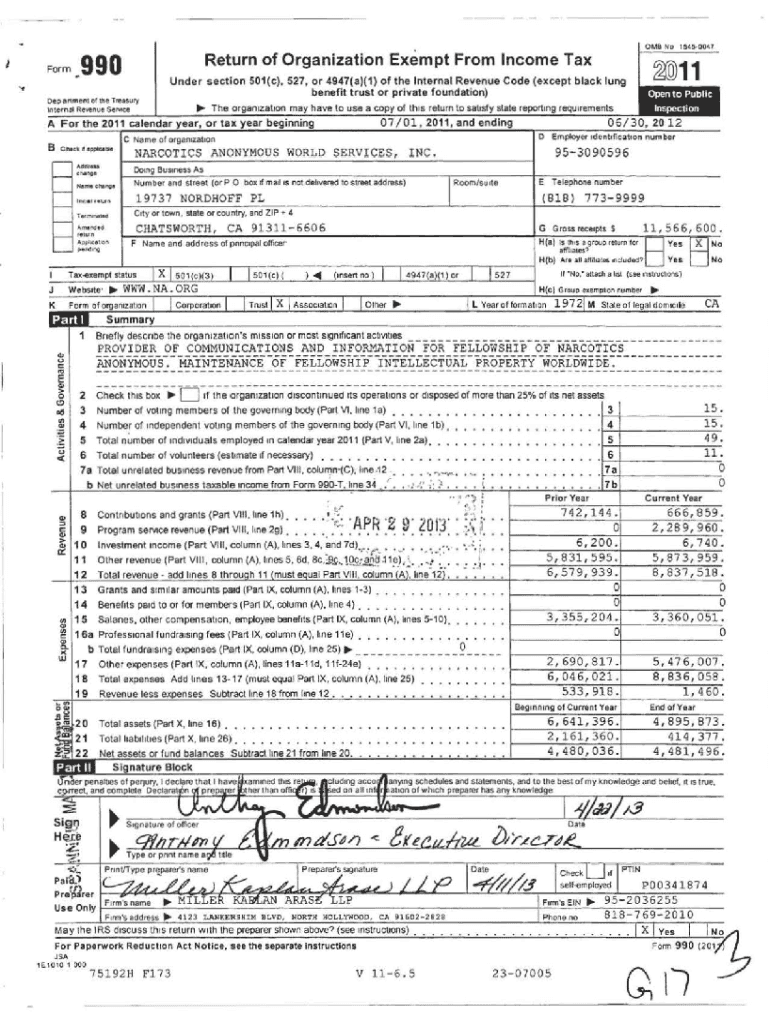

OMB No IS4507IFormReturn of Organization Exempt From Income Tax990Oepanment of the Tr usury 1ntem111 RM1nue SE_.07 /01, 2011, and endingAddru. C:h11119953090596INC.Room Bus;less As Number and street

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs tax exempt and

Edit your irs tax exempt and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs tax exempt and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs tax exempt and online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit irs tax exempt and. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs tax exempt and

How to fill out irs tax exempt and

01

To fill out IRS tax exempt form, follow these steps:

02

Obtain the correct form: The IRS offers different forms for tax-exempt organizations depending on their type and purpose. Make sure to choose the appropriate form for your organization.

03

Provide basic information: Fill out your organization's name, address, employer identification number (EIN), and other identifying details as requested on the form.

04

Describe your organization: Articulate your organization's mission, activities, and goals in a clear and concise manner.

05

Provide supporting documents: Attach any necessary supporting documents such as financial statements, articles of incorporation, and bylaws.

06

Fill out the financial section: Provide information about your organization's income, expenses, assets, and liabilities.

07

Complete the compliance section: Answer questions related to your organization's compliance with tax laws, political activities, and other relevant regulations.

08

Review and sign: Double-check all the information provided and make sure it is accurate. Sign and date the form.

09

Submit the form: Send the completed form, along with any required attachments, to the address specified on the form or the IRS website.

10

Follow up: After submitting the form, keep track of any communication from the IRS and respond promptly to any requests for additional information or clarification.

Who needs irs tax exempt and?

01

Various organizations may need IRS tax exempt status, including:

02

- Nonprofit organizations: Charities, religious organizations, educational institutions, scientific organizations, and other nonprofit entities may seek tax exemption to receive certain benefits and attract tax-deductible donations.

03

- Social welfare organizations: Some organizations that primarily focus on promoting social welfare may also qualify for tax-exempt status.

04

- Political organizations: Certain political organizations may be eligible for tax-exempt status under specific conditions.

05

- Employee benefit plans: Organizations that offer qualified employee benefit plans, such as pension or health plans, may need tax-exempt status to maintain favorable tax treatment.

06

- Business leagues and trade associations: These organizations, which primarily work for the common business interests of their members, may seek tax exemption.

07

- Amateur sports organizations: Certain sports organizations that promote amateur competition may qualify for tax-exempt status.

08

It is important to consult with a tax professional or refer to the IRS guidelines to determine if your organization qualifies for tax exemption.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my irs tax exempt and directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign irs tax exempt and and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send irs tax exempt and to be eSigned by others?

Once your irs tax exempt and is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I complete irs tax exempt and on an Android device?

Complete your irs tax exempt and and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is IRS tax exempt?

IRS tax exempt status refers to organizations that are not required to pay federal income tax due to their nature, such as charities, religious institutions, and certain non-profits.

Who is required to file IRS tax exempt?

Organizations seeking tax-exempt status, such as charitable groups, religious entities, and other non-profit organizations, must file with the IRS to obtain this designation.

How to fill out IRS tax exempt?

To fill out IRS tax exempt forms, organizations typically use Form 1023 or Form 1023-EZ, providing details about structure, purpose, finances, and operations, accompanied by necessary documentation.

What is the purpose of IRS tax exempt?

The purpose of IRS tax exempt status is to encourage philanthropic activities by allowing organizations to operate without the burden of federal income tax, thus allocating more resources to their causes.

What information must be reported on IRS tax exempt?

Organizations must report information on their structure, governance, financial activities, and purpose, including a detailed description of their programs and financial statements.

Fill out your irs tax exempt and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Tax Exempt And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.