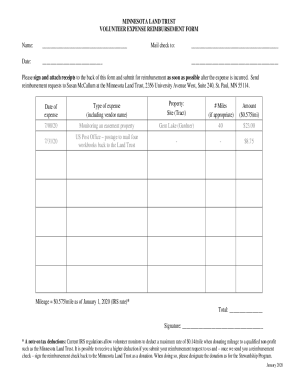

Get the free Information on Donated Property If you need more space, attach a statement

Show details

Groups of similar items) for which you claimed a deduction of $5,000 or less. Also, list publicly traded securities even if the deduction is more than $5,000 (see ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign information on donated property

Edit your information on donated property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your information on donated property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit information on donated property online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit information on donated property. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

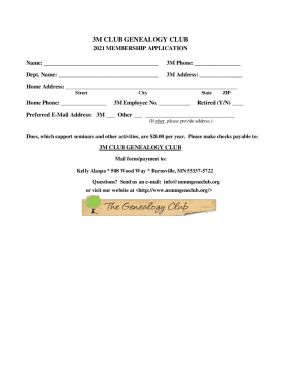

How to fill out information on donated property

How to fill out information on donated property:

Obtain all relevant documentation:

01

Gather any title deeds or ownership documents related to the donated property.

02

Obtain a copy of the appraisal or valuation report for the property.

Identify the donor and recipient:

01

Clearly state the full name and contact information of the donor, including their mailing address, phone number, and email address.

02

Provide the same information for the recipient, who may be an individual or an organization.

Describe the property:

01

Include a detailed description of the donated property, such as the address, size, type of property (residential, commercial, etc.), and any unique features or characteristics.

02

If applicable, mention any restrictions or conditions associated with the property, such as zoning regulations or conservation easements.

Estimate the fair market value:

01

Determine the fair market value of the donated property at the time of the donation. This may require the assistance of a qualified appraiser, especially for larger or more complex properties.

02

Include the appraiser's name, contact information, and their qualifications.

Calculate the charitable deduction:

Based on the fair market value, calculate the amount of the charitable deduction that the donor may be eligible for. This is typically calculated according to the guidelines set by the tax authorities in your country.

Provide additional details:

Depending on the requirements of the organization or entity receiving the donation, you may need to provide additional information, such as the intended use of the property or any future plans for development or conservation.

Who needs information on donated property?

01

The donor: The donor needs the information on the donated property to properly report the donation to the tax authorities and claim any applicable tax deductions or benefits.

02

The recipient organization or entity: The organization or entity receiving the donated property requires the information to assess the value and relevance of the donation, and to fulfill any reporting or legal requirements associated with accepting and utilizing the donated property.

03

Financial advisors or tax professionals: Financial advisors or tax professionals involved in the donor's estate planning or tax advice may also need the information to provide guidance on the implications and benefits of the property donation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my information on donated property directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your information on donated property and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I modify information on donated property without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your information on donated property into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I create an eSignature for the information on donated property in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your information on donated property and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is information on donated property?

Information on donated property includes details about property that has been donated, such as its value, description, and the date it was donated.

Who is required to file information on donated property?

Individuals or organizations who receive donated property and claim a tax deduction are required to file information on donated property.

How to fill out information on donated property?

Information on donated property can be filled out on IRS Form 8283 and attached to the tax return.

What is the purpose of information on donated property?

The purpose of information on donated property is to report the value of donated property accurately for tax purposes and to support any deductions claimed.

What information must be reported on information on donated property?

Information on donated property must include a description of the property, its fair market value, the donor's information, and the date of donation.

Fill out your information on donated property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Information On Donated Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.