Get the free Donors may transfer gifts of publicly traded appreciated ...

Show details

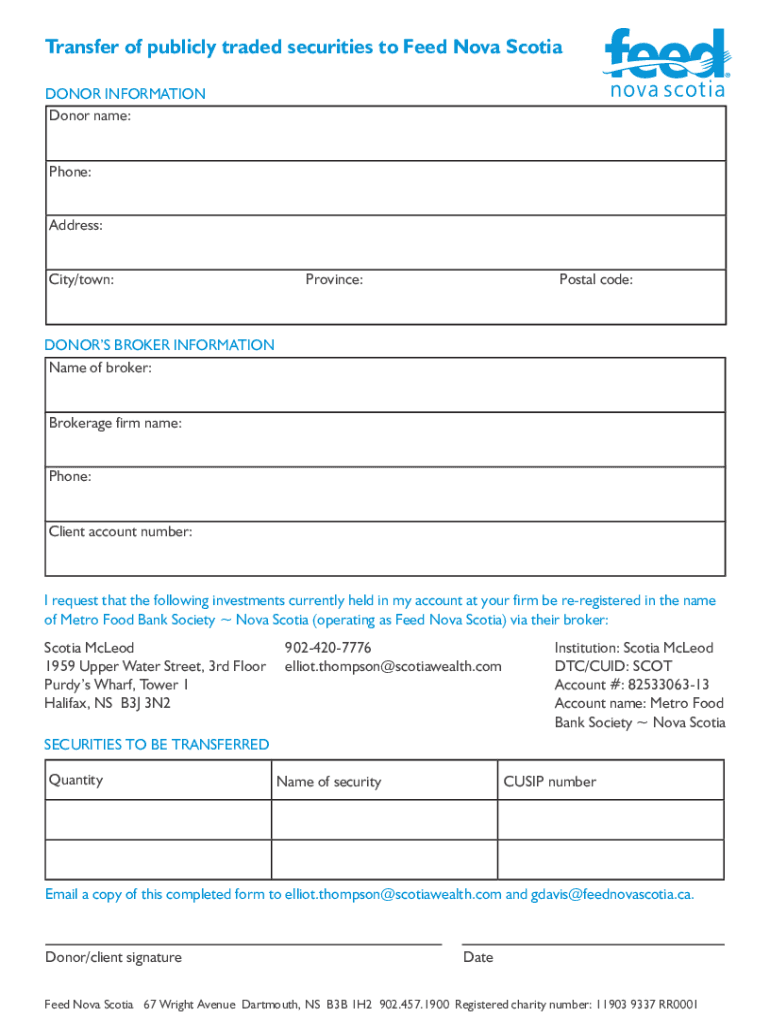

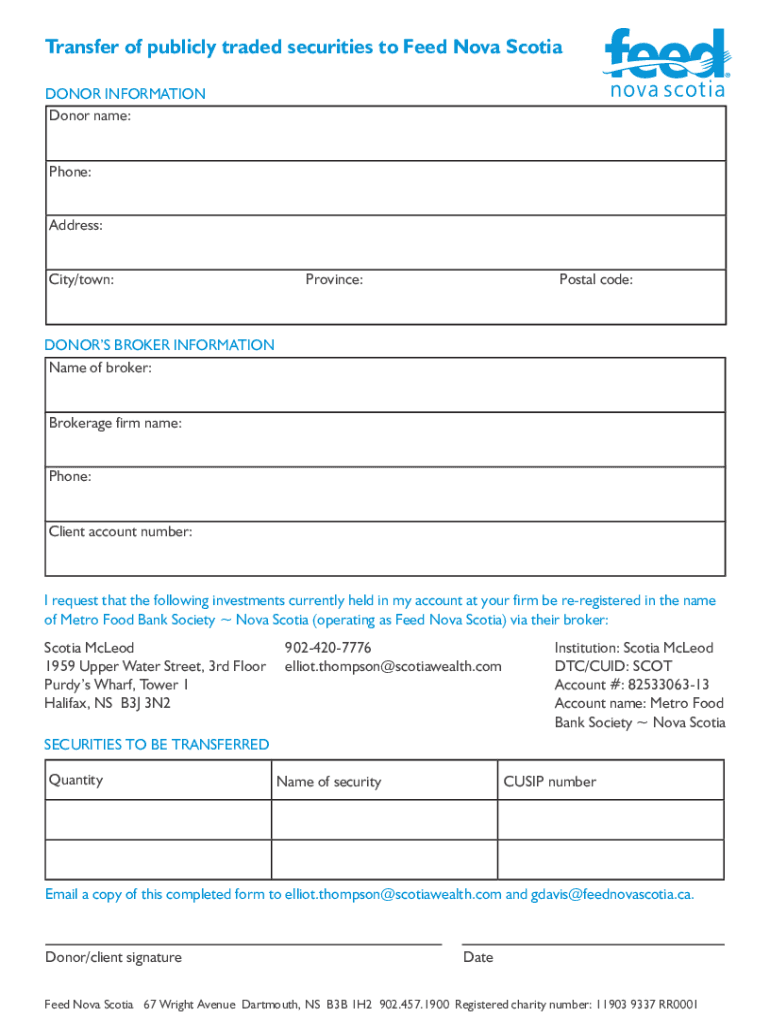

Transfer of publicly traded securities to Feed Nova Scotia DONOR INFORMATION Donor name: Phone: Address: City/town:Province:Postal code:DONORS BROKER INFORMATION Name of broker: Brokerage firm name:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donors may transfer gifts

Edit your donors may transfer gifts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donors may transfer gifts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit donors may transfer gifts online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit donors may transfer gifts. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donors may transfer gifts

How to fill out donors may transfer gifts

01

To fill out donors may transfer gifts, follow these steps:

1. Gather all the necessary information about the donor, including their name, contact information, and any specific requirements for the gift transfer.

02

Prepare the necessary legal documents such as a gift agreement or a donation contract. These documents will outline the terms and conditions of the gift transfer.

03

Make sure to comply with any legal regulations or tax requirements related to gift transfers. Consult with a legal professional or tax advisor if needed.

04

Communicate with the donor to ensure their wishes are fully understood and that all parties are in agreement regarding the gift transfer.

05

Complete the paperwork for the gift transfer, including any necessary signatures and witnessed documentation.

06

Keep a copy of all the relevant documents and ensure they are filed appropriately for future reference.

07

If applicable, provide the donor with a receipt or acknowledgment of their gift transfer for their records and tax purposes.

Who needs donors may transfer gifts?

01

Various organizations and individuals may benefit from donors may transfer gifts, including:

02

- Non-profit organizations that rely on donations to support their cause or provide services to the community.

03

- Educational institutions such as schools or universities that can use the gifts for scholarships, research funding, or facility improvements.

04

- Hospitals and healthcare organizations that may use the gifts to enhance patient care, invest in medical research, or purchase necessary equipment.

05

- Cultural institutions such as museums, art galleries, or theaters that depend on donations to preserve and promote arts and culture.

06

- Religious organizations that receive gifts from donors for the maintenance of their places of worship, community outreach programs, or charitable initiatives.

07

- Individuals or families facing financial hardship or in need of support, who may benefit from monetary or material gifts donated by generous individuals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send donors may transfer gifts to be eSigned by others?

When you're ready to share your donors may transfer gifts, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make changes in donors may transfer gifts?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your donors may transfer gifts to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit donors may transfer gifts straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing donors may transfer gifts.

What is donors may transfer gifts?

Donors may transfer gifts refers to the process in which individuals or organizations can give valuable items or monetary gifts to other individuals or charitable organizations.

Who is required to file donors may transfer gifts?

Individuals or organizations that make significant gifts to others, which may fall under tax reporting requirements, are required to file donors may transfer gifts.

How to fill out donors may transfer gifts?

To fill out donors may transfer gifts, gather all relevant information about the gifts, the recipients, and the value of the gifts, then use the appropriate tax forms provided by the Internal Revenue Service (IRS) or relevant tax authorities to report the gifts.

What is the purpose of donors may transfer gifts?

The purpose of donors may transfer gifts is to ensure transparency and compliance with tax regulations regarding the transfer of wealth, and to keep track of large gifts that could impact tax liabilities.

What information must be reported on donors may transfer gifts?

Information that must be reported includes the donor's name and address, the recipient's name and address, a description of the gifts, the date of transfer, and the fair market value of the gifts.

Fill out your donors may transfer gifts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donors May Transfer Gifts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.