Get the free Property taxes likely rising in Fargo, West Fargo and Grand ...

Show details

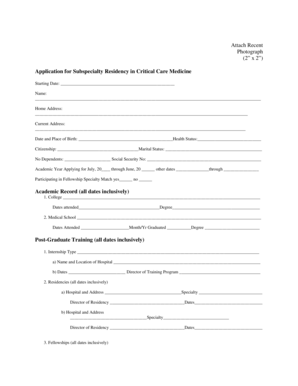

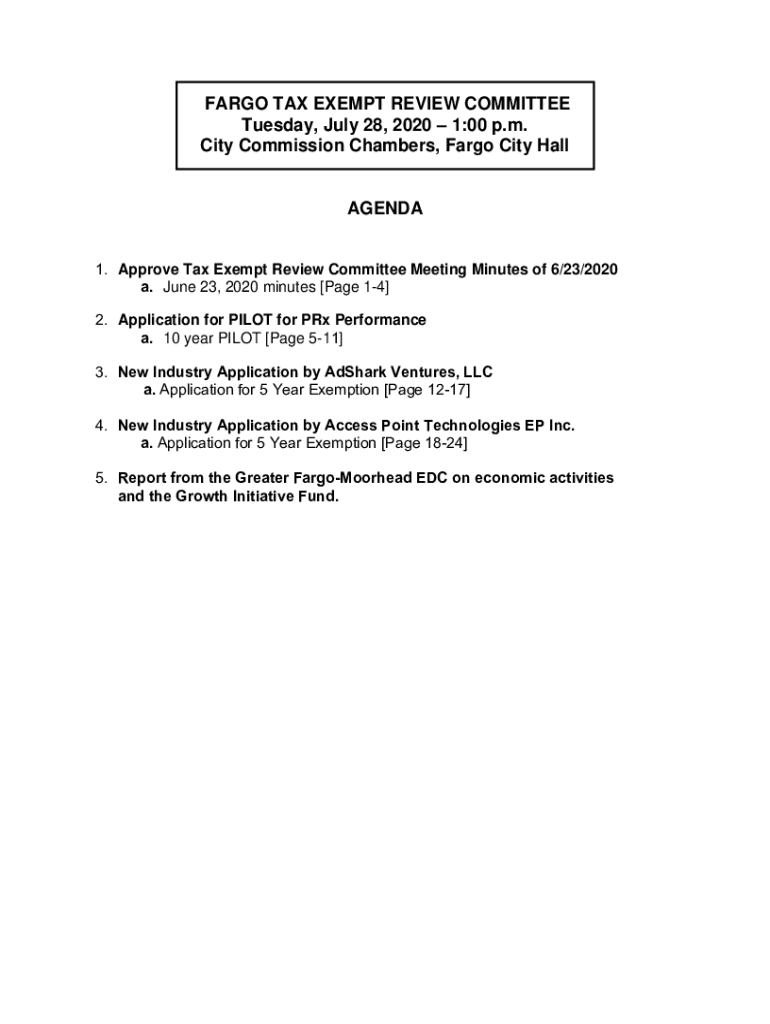

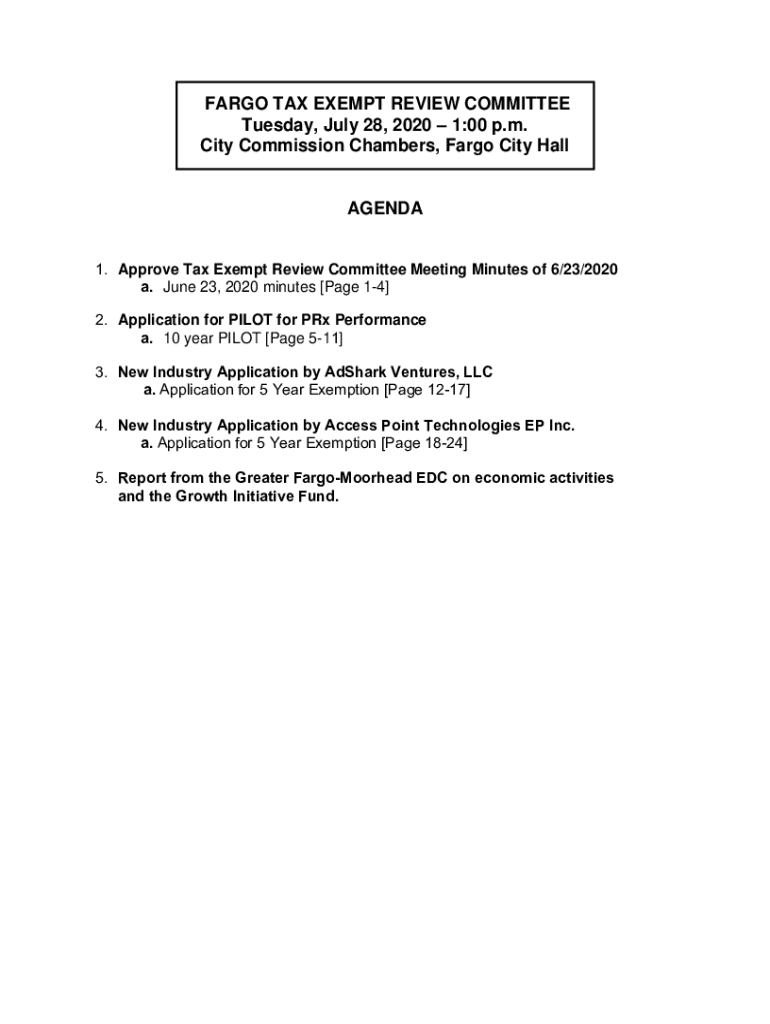

FARGO TAX EXEMPT REVIEW COMMITTEE Tuesday, July 28, 2020 1:00 p.m. City Commission Chambers, Fargo City HallAGENDA 1. Approve Tax Exempt Review Committee Meeting Minutes of 6/23/2020 a. June 23, 2020

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property taxes likely rising

Edit your property taxes likely rising form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property taxes likely rising form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing property taxes likely rising online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit property taxes likely rising. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property taxes likely rising

How to fill out property taxes likely rising

01

Collect all the necessary documents related to your property, such as property assessment notices and previous year's tax returns.

02

Review the property tax form provided by your local government or tax authority.

03

Fill in your personal information accurately, including your name, address, and contact details.

04

Provide the required information about your property, such as its location, size, and any improvements or renovations made.

05

Calculate the value of your property based on the guidelines provided by your local government or tax authority.

06

Determine the applicable tax rate for your property based on your jurisdiction's regulations.

07

Calculate the estimated property tax liability by multiplying the assessed value of your property by the tax rate.

08

Provide any additional information or documentation required by your local government or tax authority.

09

Review the completed property tax form to ensure accuracy and completeness.

10

Submit the filled-out property tax form along with any supporting documents to the appropriate government or tax authority before the designated deadline.

Who needs property taxes likely rising?

01

Property owners who are legally required to pay property taxes need to be aware of any potential increase in taxes.

02

Individuals or businesses that own real estate properties and are subject to property tax regulations should consider the possibility of rising property taxes.

03

Taxpayers who want to ensure compliance with the tax laws and avoid any penalties or complications related to unpaid property taxes should be concerned about potential increases.

04

Municipalities, counties, or other local government entities that rely on property tax revenues for funding public services and infrastructure might be interested in the likelihood of rising property taxes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete property taxes likely rising online?

Filling out and eSigning property taxes likely rising is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit property taxes likely rising online?

With pdfFiller, it's easy to make changes. Open your property taxes likely rising in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I sign the property taxes likely rising electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your property taxes likely rising in minutes.

What is property taxes likely rising?

Property taxes are likely rising due to increased property values, inflation, and the need for local governments to fund public services such as schools, roads, and emergency services.

Who is required to file property taxes likely rising?

Property owners are required to file property taxes for any real estate they own, including residential, commercial, and industrial properties.

How to fill out property taxes likely rising?

To fill out property taxes, property owners should gather relevant information including the property's assessed value, any exemptions, and complete the tax forms provided by their local tax authority, ensuring all required documentation is included.

What is the purpose of property taxes likely rising?

The purpose of property taxes is to provide funding for local services, infrastructure, and development, as well as to support essential public services like education, sanitation, and public safety.

What information must be reported on property taxes likely rising?

Property owners must report their property's assessed value, any exemptions they believe they qualify for, improvements made to the property, and any changes in ownership during the tax year.

Fill out your property taxes likely rising online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Taxes Likely Rising is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.