Get the free What is an annuity and when is it a smart investment?

Show details

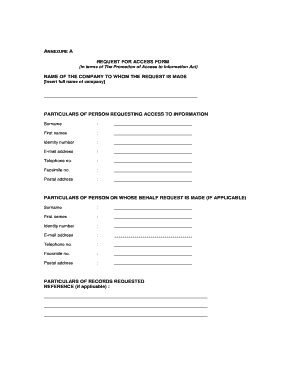

Expression of wishes Pension Annuities (including Enhanced Pension Annuities) What is this form for? If youve selected value protection on your policy, and your terms and conditions allow you to nominate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign what is an annuity

Edit your what is an annuity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your what is an annuity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit what is an annuity online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit what is an annuity. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out what is an annuity

How to fill out what is an annuity

01

To fill out what is an annuity, you need to follow these steps:

02

Begin by understanding the concept of an annuity, which is a financial product that provides a series of regular payments over a specified period of time.

03

Research different types of annuities, such as fixed annuities, variable annuities, and indexed annuities, to determine which one suits your needs.

04

Gather all necessary financial information, including your income, expenses, and any existing assets or investments.

05

Consult with a financial advisor or insurance agent who specializes in annuities to get expert guidance on selecting the right annuity for your financial goals.

06

Compare annuity products from different providers and carefully review the terms and conditions, including fees, surrender charges, and payout options.

07

Once you have chosen an annuity, complete the application form provided by the annuity provider. Provide accurate and complete information to avoid delays or complications.

08

Understand the implications and tax consequences of purchasing an annuity. Consult with a tax professional if needed.

09

Review the annuity contract before signing it. Make sure you understand all the terms, including the payment schedule, death benefit options, and any potential penalties for early withdrawals.

10

Submit the completed application form along with any required documents to the annuity provider.

11

Monitor your annuity's performance and periodically review your financial goals to ensure the annuity continues to align with your needs.

Who needs what is an annuity?

01

Many individuals can benefit from having an understanding of what an annuity is and how it can fit into their financial plans. Some common examples of who needs an annuity include:

02

- Individuals approaching retirement who want a steady income stream during their retirement years.

03

- People who have received a large sum of money, such as an inheritance, and want to ensure it lasts long-term.

04

- Individuals who want to supplement their existing retirement savings and diversify their investment portfolio.

05

- Parents and grandparents who want to set up a reliable source of income for their children or grandchildren's education expenses.

06

- Business owners or self-employed individuals who want to create a tax-advantaged retirement savings plan.

07

- Those who want to transfer the risk of outliving their savings to an insurance company.

08

- Individuals who prioritize guaranteed income over potential market fluctuations.

09

- Anyone seeking a long-term financial strategy that provides stability and a predictable cash flow.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify what is an annuity without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including what is an annuity, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I edit what is an annuity online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your what is an annuity and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an eSignature for the what is an annuity in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your what is an annuity and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is an annuity?

An annuity is a financial product that provides a series of payments made at defined intervals, typically used as a means of income during retirement.

Who is required to file what is an annuity?

Individuals or entities receiving annuity payments may be required to report these payments for tax purposes on their income tax returns.

How to fill out what is an annuity?

Filling out annuity-related forms typically involves providing information about the annuity policy, the amount of payouts received, and personal identification details.

What is the purpose of what is an annuity?

The purpose of an annuity is to provide a steady stream of income, often used for retirement funding, and to manage the risks of outliving one's savings.

What information must be reported on what is an annuity?

Information that must be reported includes the amount of annuity payments received, the tax identification number, and details about the annuity contract or policy.

Fill out your what is an annuity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Is An Annuity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.