Get the free Schedule I Montana Additions to Federal Adjusted Gross Income - revenue mt

Show details

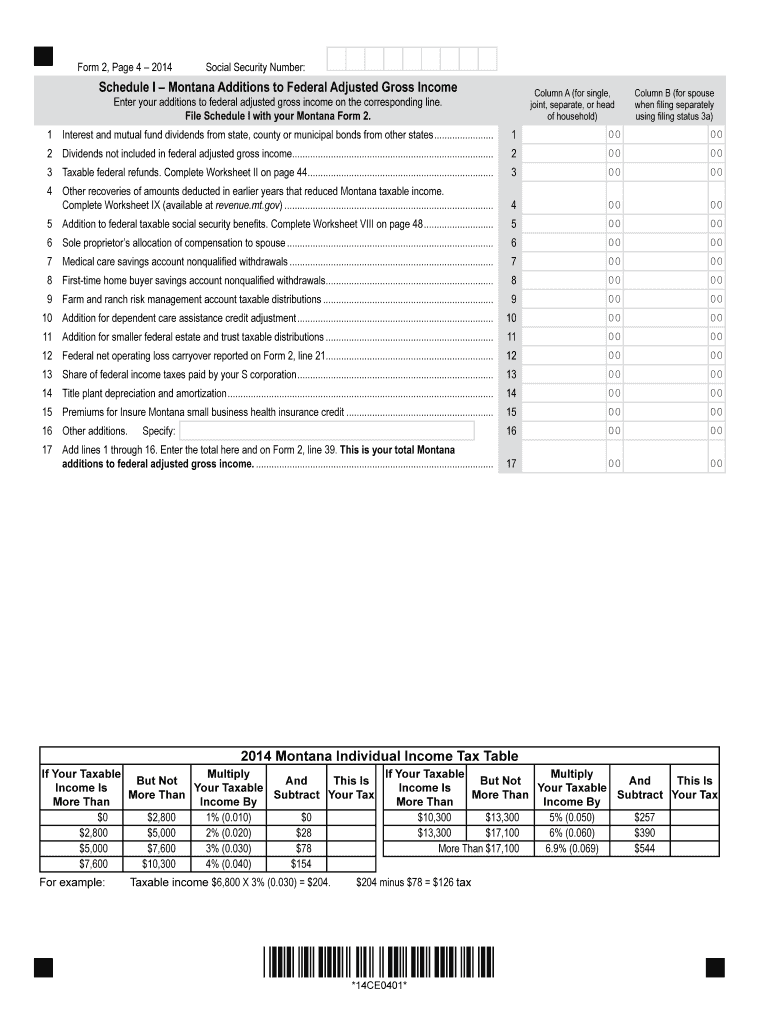

Form 2, Page 4 2014 Reset Form Social Security Number: Schedule I Montana Additions to Federal Adjusted Gross Income Column A (for single, joint, separate, or head of household) Enter your additions

We are not affiliated with any brand or entity on this form

Instructions and Help about schedule i montana additions

How to edit schedule i montana additions

How to fill out schedule i montana additions

Instructions and Help about schedule i montana additions

How to edit schedule i montana additions

To edit the Schedule I Montana Additions form, open the PDF file in an editor that supports form filling. Utilize the text editing tools to update or modify information as necessary. Once edits are made, save the changes and ensure they reflect accurately before submission.

How to fill out schedule i montana additions

Filling out the Schedule I Montana Additions form requires accurate reporting of additional income. Begin by gathering all necessary financial documentation. Enter the required information into the designated fields clearly, following the instructions provided on the form. After completing the form, review it for accuracy before submission.

Latest updates to schedule i montana additions

Latest updates to schedule i montana additions

Be sure to check the Montana Department of Revenue website for any recent updates to the Schedule I Montana Additions form. New amendments may impact which additions are reportable or change filing procedures.

All You Need to Know About schedule i montana additions

What is schedule i montana additions?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About schedule i montana additions

What is schedule i montana additions?

Schedule I Montana Additions is a tax form used by residents of Montana to report certain types of additions to their income for state tax purposes. This form allows taxpayers to report income that is not subject to federal taxation but must be included in the state tax calculation.

What is the purpose of this form?

The primary purpose of the Schedule I Montana Additions form is to ensure that taxpayers accurately report all income that is subject to Montana state taxes. This form outlines specific types of income that require reporting, even if such income is exempt from federal tax.

Who needs the form?

Individuals who have specific types of income that are not federally taxable but are subject to Montana taxes must complete the Schedule I Montana Additions form. Taxpayers who receive income from sources such as state tax refunds or certain retirement income may need this form to properly report their financial status.

When am I exempt from filling out this form?

Filers are exempt from filling out the Schedule I Montana Additions form if they do not have any income that needs to be reported on the form. Additionally, if an individual has a simple income situation with no Montana-specific tax additions, they may not be required to submit this form.

Components of the form

The Schedule I Montana Additions form includes sections for various types of income additions, such as personal exemptions, adjustments for certain retirement accounts, and other miscellaneous income. Each section needs to be filled out in detail, providing the necessary figures and calculations to ensure compliance with state regulations.

What are the penalties for not issuing the form?

Failure to complete and submit the Schedule I Montana Additions form when required can result in penalties imposed by the state of Montana. These penalties may include fines and interest on any underpaid taxes. Continuous failure to file may also lead to more severe enforcement actions.

What information do you need when you file the form?

When filing the Schedule I Montana Additions form, you will need information about your total income, specific types of income that require reporting, and any applicable deductions or adjustments. Having accurate records, such as W-2s, 1099s, and prior tax returns, will streamline the filing process.

Is the form accompanied by other forms?

The Schedule I Montana Additions form may be submitted alongside the Montana Individual Income Tax Return. It is essential to verify if additional schedules or forms must be included based on your individual tax situation.

Where do I send the form?

The completed Schedule I Montana Additions form should be sent to the Montana Department of Revenue. Depending on your residency and specific tax obligations, you can mail your form to the designated address outlined on the Montana Department of Revenue’s official website.

See what our users say